Genomics company Pacific Biosciences of California (NASDAQ: PACB) reported Q1 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 4.3% year on year to $37.15 million. Its non-GAAP loss of $0.15 per share was 20.5% above analysts’ consensus estimates.

Is now the time to buy PacBio? Find out by accessing our full research report, it’s free.

PacBio (PACB) Q1 CY2025 Highlights:

- Revenue: $37.15 million vs analyst estimates of $35.3 million (4.3% year-on-year decline, 5.2% beat)

- Adjusted EPS: -$0.15 vs analyst estimates of -$0.19 (20.5% beat)

- Operating Margin: -1,155%, down from -210% in the same quarter last year

- Market Capitalization: $339 million

“We are off to a solid start to the year, highlighted by a full quarter of shipments of the Vega platform, record consumables revenue and improved non-GAAP gross margin,” said Christian Henry, President and Chief Executive Officer.

Company Overview

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ: PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

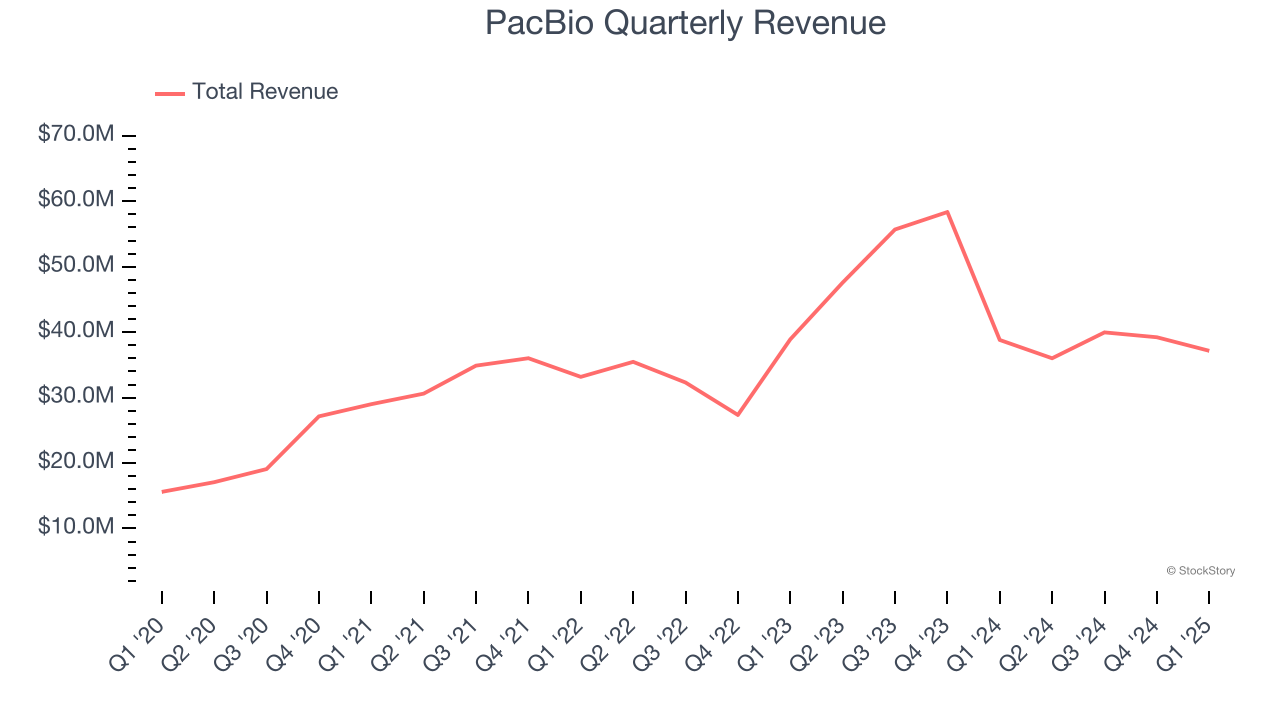

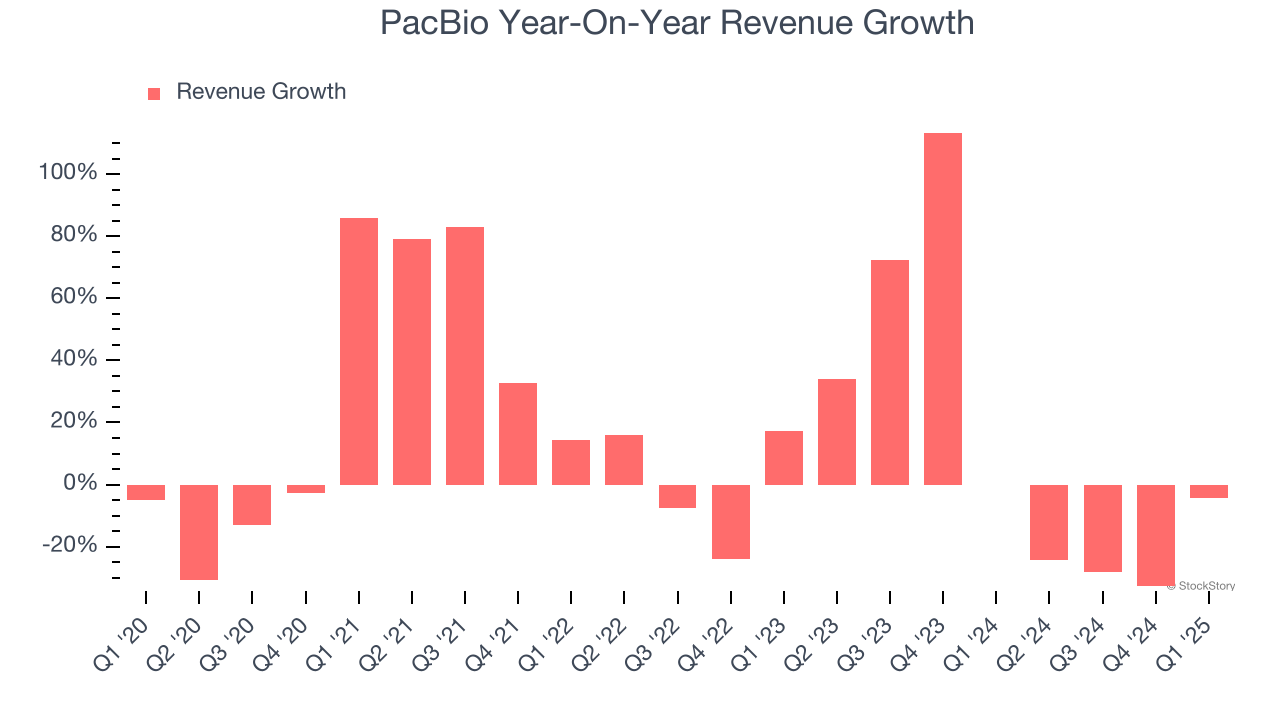

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, PacBio’s sales grew at a decent 11.1% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. PacBio’s recent performance shows its demand has slowed as its annualized revenue growth of 6.6% over the last two years was below its five-year trend.

This quarter, PacBio’s revenue fell by 4.3% year on year to $37.15 million but beat Wall Street’s estimates by 5.2%.

Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and implies its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

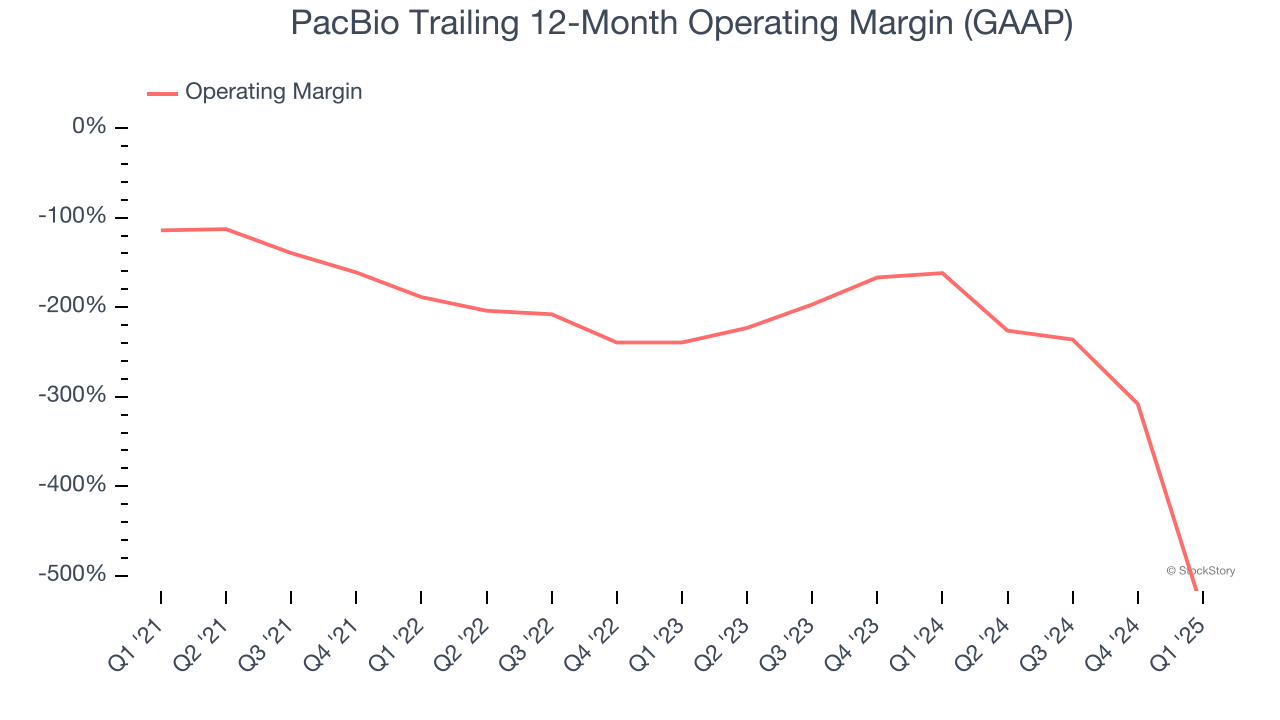

Operating Margin

PacBio’s high expenses have contributed to an average operating margin of negative 256% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, PacBio’s operating margin decreased significantly over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 300 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

PacBio’s operating margin was negative 1,155% this quarter. The company's consistent lack of profits raise a flag.

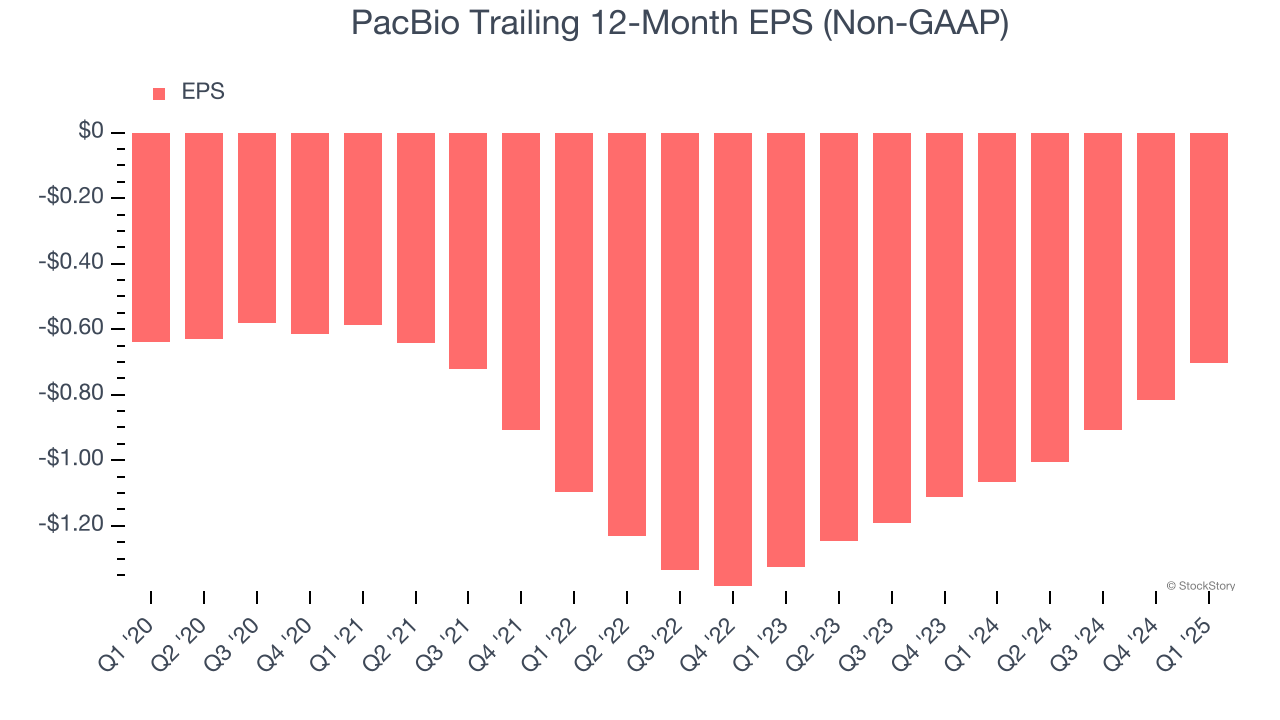

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

PacBio’s earnings losses deepened over the last five years as its EPS dropped 1.8% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, PacBio’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, PacBio reported EPS at negative $0.15, up from negative $0.26 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects PacBio to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.70 will advance to negative $0.69.

Key Takeaways from PacBio’s Q1 Results

We were impressed by how significantly PacBio blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. Investors were likely hoping for more, and shares traded down 2.5% to $1.16 immediately following the results.

So do we think PacBio is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.