Looking back on productivity software stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including Dropbox (NASDAQ: DBX) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

Dropbox (NASDAQ: DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ: DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $624.7 million, down 1% year on year. This print exceeded analysts’ expectations by 0.7%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but decelerating customer growth.

Unsurprisingly, the stock is down 6.7% since reporting and currently trades at $27.70.

Is now the time to buy Dropbox? Access our full analysis of the earnings results here, it’s free.

Best Q1: Pegasystems (NASDAQ: PEGA)

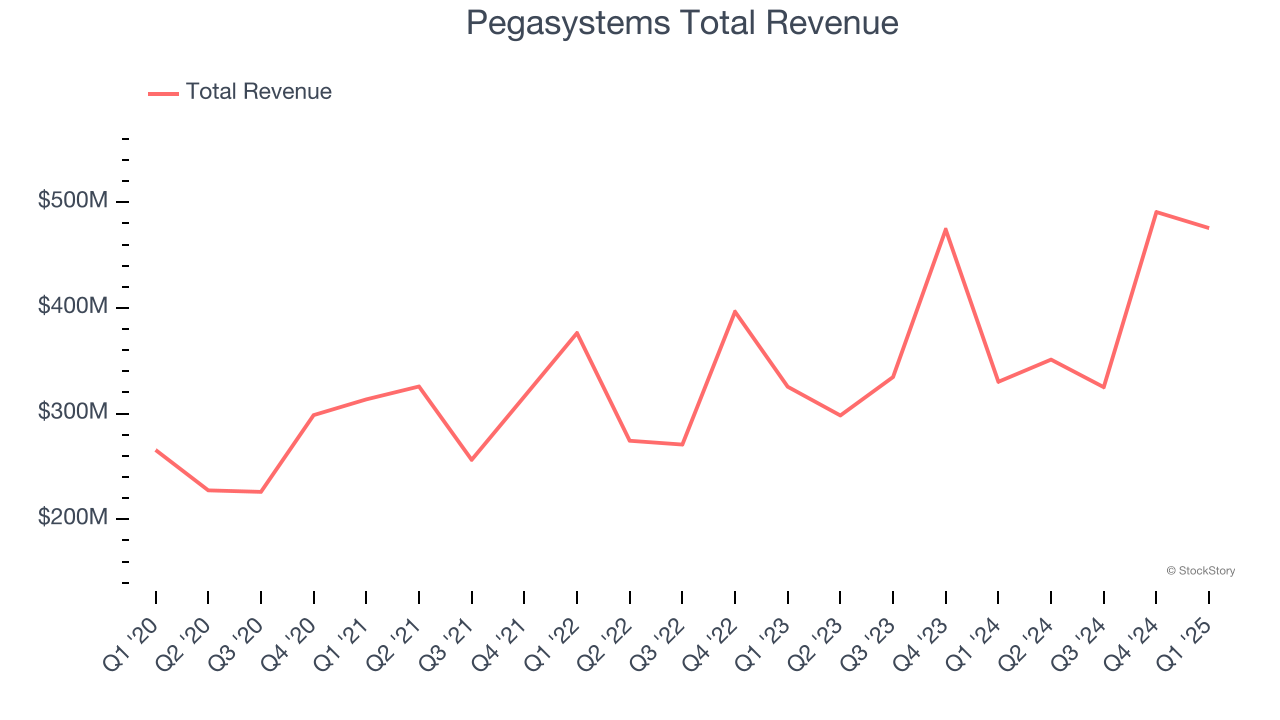

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ: PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $475.6 million, up 44.1% year on year, outperforming analysts’ expectations by 33.1%. The business had an incredible quarter with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

Pegasystems pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 56.2% since reporting. It currently trades at $53.75.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SoundHound AI (NASDAQ: SOUN)

Founded in 2005, SoundHound AI (NASDAQ: SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $29.13 million, up 151% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

SoundHound AI delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 10.5% since the results and currently trades at $10.75.

Read our full analysis of SoundHound AI’s results here.

RingCentral (NYSE: RNG)

Founded in 1999 during the dot-com era, RingCentral (NYSE: RNG) provides software as a service that unifies phone, text, fax, video calls and chat in one platform.

RingCentral reported revenues of $612.1 million, up 4.8% year on year. This number was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also recorded a decent beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

The stock is up 6.2% since reporting and currently trades at $28.35.

Read our full, actionable report on RingCentral here, it’s free.

Box (NYSE: BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE: BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $276.3 million, up 4.4% year on year. This print beat analysts’ expectations by 0.6%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

The stock is up 8.6% since reporting and currently trades at $34.17.

Read our full, actionable report on Box here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.