Let’s dig into the relative performance of Nike (NYSE: NKE) and its peers as we unravel the now-completed Q2 consumer discretionary earnings season.

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The 7 consumer discretionary stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was 0.9% above.

Luckily, consumer discretionary stocks have performed well with share prices up 12.7% on average since the latest earnings results.

Nike (NYSE: NKE)

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE: NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

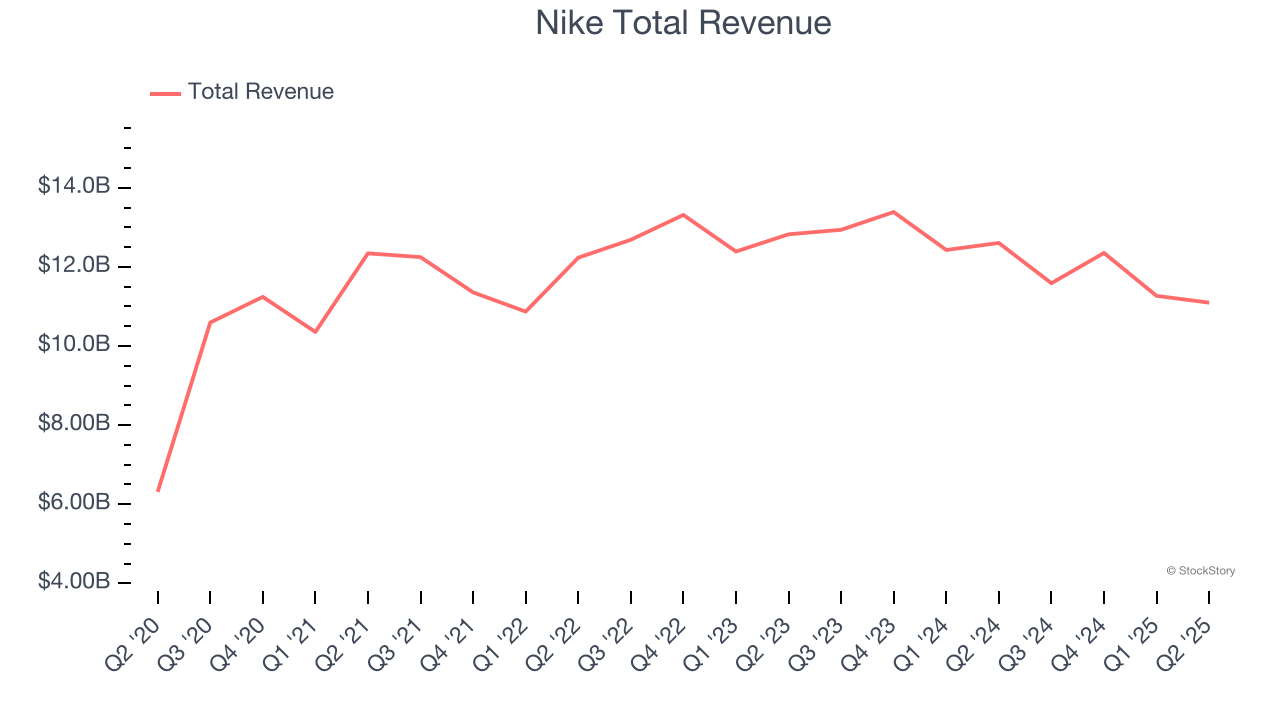

Nike reported revenues of $11.1 billion, down 12% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ constant currency revenue and EBITDA estimates.

"While our financial results are in-line with our expectations, they are not where we want them to be. Moving forward, we expect our business to improve as a result of the progress we're making through our Win Now actions," said Elliott Hill, President & CEO, NIKE,

Nike delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 18.6% since reporting and currently trades at $74.18.

Is now the time to buy Nike? Access our full analysis of the earnings results here, it’s free.

Best Q2: Levi's (NYSE: LEVI)

Credited for inventing the first pair of blue jeans in 1873, Levi's (NYSE: LEVI) is an apparel company renowned for its iconic denim products and classic American style.

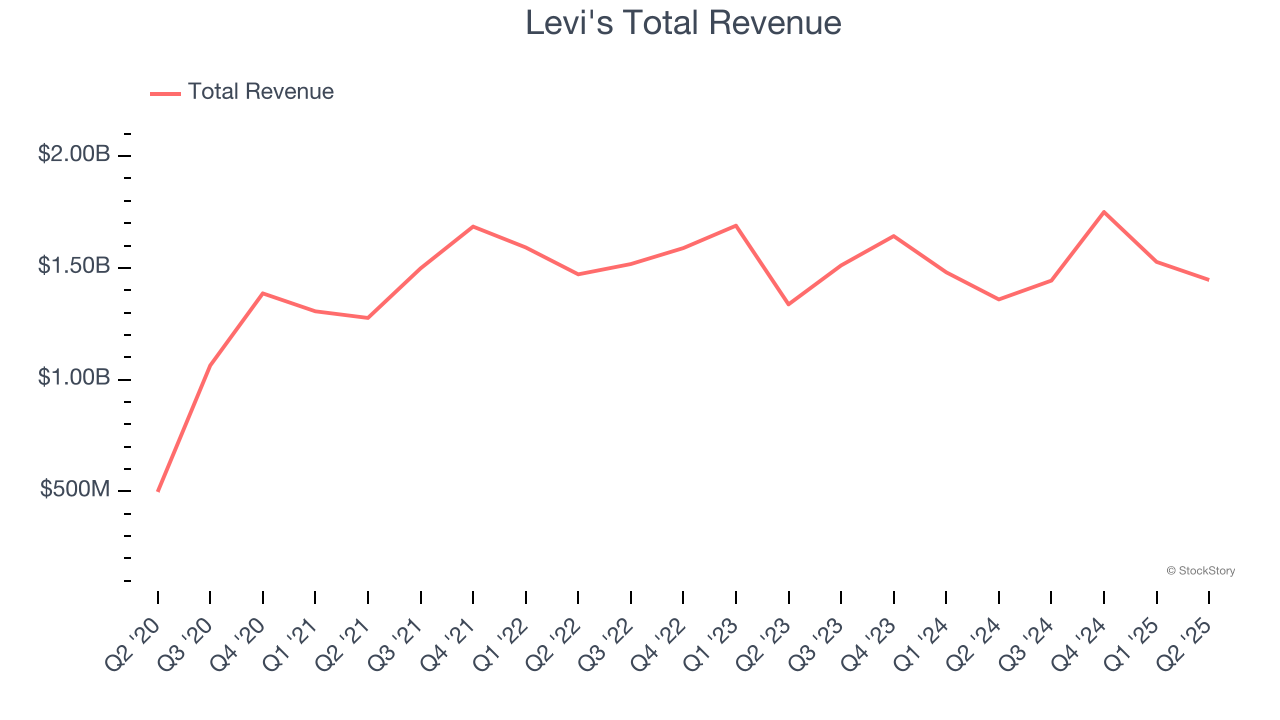

Levi's reported revenues of $1.45 billion, up 6.4% year on year, outperforming analysts’ expectations by 5.8%. The business had an exceptional quarter with an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ EPS estimates.

Levi's scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 5.1% since reporting. It currently trades at $20.75.

Is now the time to buy Levi's? Access our full analysis of the earnings results here, it’s free.

United Airlines (NASDAQ: UAL)

Founded in 1926, United Airlines Holdings (NASDAQ: UAL) operates a global airline network, providing passenger and cargo air transportation services across domestic and international routes.

United Airlines reported revenues of $15.24 billion, up 1.7% year on year, falling short of analysts’ expectations by 0.9%. It was a mixed quarter as it posted a narrow beat of analysts’ EPS estimates but a miss of analysts’ EBITDA estimates.

United Airlines delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 4.2% since the results and currently trades at $92.20.

Read our full analysis of United Airlines’s results here.

Monarch (NASDAQ: MCRI)

Established in 1993, Monarch (NASDAQ: MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Monarch reported revenues of $136.9 million, up 6.8% year on year. This result topped analysts’ expectations by 5.4%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 21.5% since reporting and currently trades at $106.

Read our full, actionable report on Monarch here, it’s free.

Carnival (NYSE: CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE: CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Carnival reported revenues of $6.33 billion, up 9.5% year on year. This print beat analysts’ expectations by 1.7%. It was a very strong quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Carnival delivered the fastest revenue growth among its peers. The stock is up 24.7% since reporting and currently trades at $29.97.

Read our full, actionable report on Carnival here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.