Commercial real estate lender Starwood Property Trust (NYSE: STWD) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 11.2% year on year to $165.5 million. Its GAAP profit of $0.38 per share was in line with analysts’ consensus estimates.

Is now the time to buy Starwood Property Trust? Find out by accessing our full research report, it’s free.

Starwood Property Trust (STWD) Q2 CY2025 Highlights:

- Revenue: $165.5 million vs analyst estimates of $208 million (11.2% year-on-year decline, 20.4% miss)

- EPS (GAAP): $0.38 vs analyst estimates of $0.38 (in line)

- Market Capitalization: $7.12 billion

"We have continued to demonstrate the strength and flexibility of our multi-cylinder platform," said Barry Sternlicht, Chairman and CEO of Starwood Property Trust.

Company Overview

With a diverse portfolio spanning commercial properties, residential mortgages, infrastructure loans, and real estate servicing, Starwood Property Trust (NYSE: STWD) is a real estate investment trust that originates, acquires, and manages commercial mortgages, residential loans, and other real estate investments.

Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees.

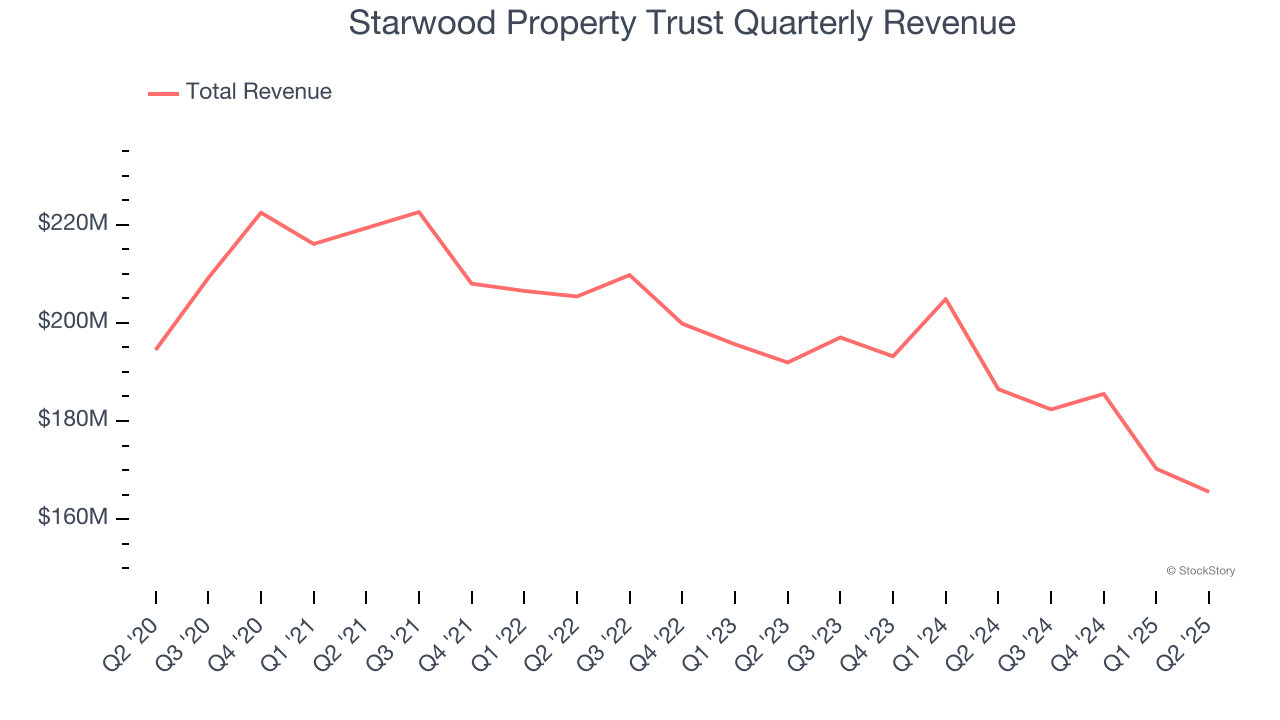

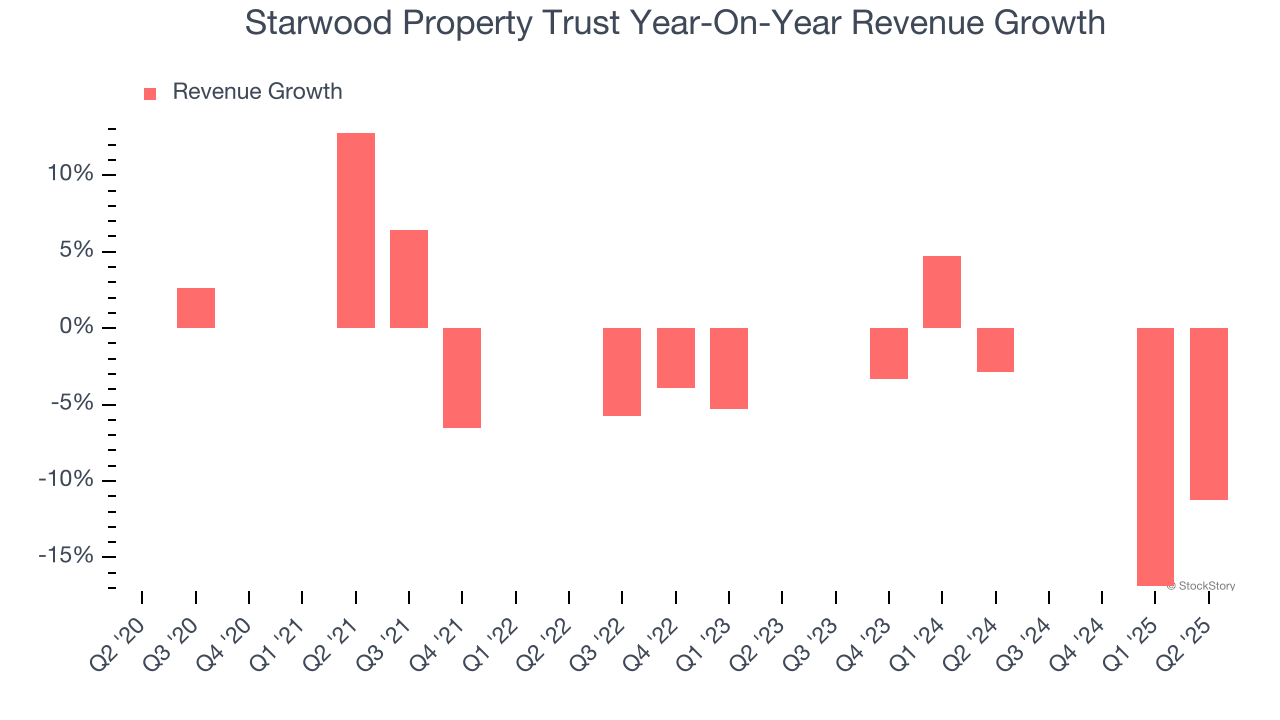

Starwood Property Trust struggled to consistently generate demand over the last five years as its revenue dropped at a 3% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Starwood Property Trust’s recent performance shows its demand remained suppressed as its revenue has declined by 6% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Starwood Property Trust missed Wall Street’s estimates and reported a rather uninspiring 11.2% year-on-year revenue decline, generating $165.5 million of revenue.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Starwood Property Trust’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its EPS was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 1.3% to $19.67 immediately following the results.

So do we think Starwood Property Trust is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.