Live events and entertainment company Live Nation (NYSE: LYV) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 16.3% year on year to $7.01 billion. Its GAAP profit of $0.41 per share was 60.6% below analysts’ consensus estimates.

Is now the time to buy Live Nation? Find out by accessing our full research report, it’s free.

Live Nation (LYV) Q2 CY2025 Highlights:

- Revenue: $7.01 billion vs analyst estimates of $6.78 billion (16.3% year-on-year growth, 3.4% beat)

- EPS (GAAP): $0.41 vs analyst expectations of $1.04 (60.6% miss)

- Adjusted EBITDA: $978.2 million vs analyst estimates of $755.8 million (14% margin, 29.4% beat)

- Operating Margin: 6.9%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, down from 9.9% in the same quarter last year

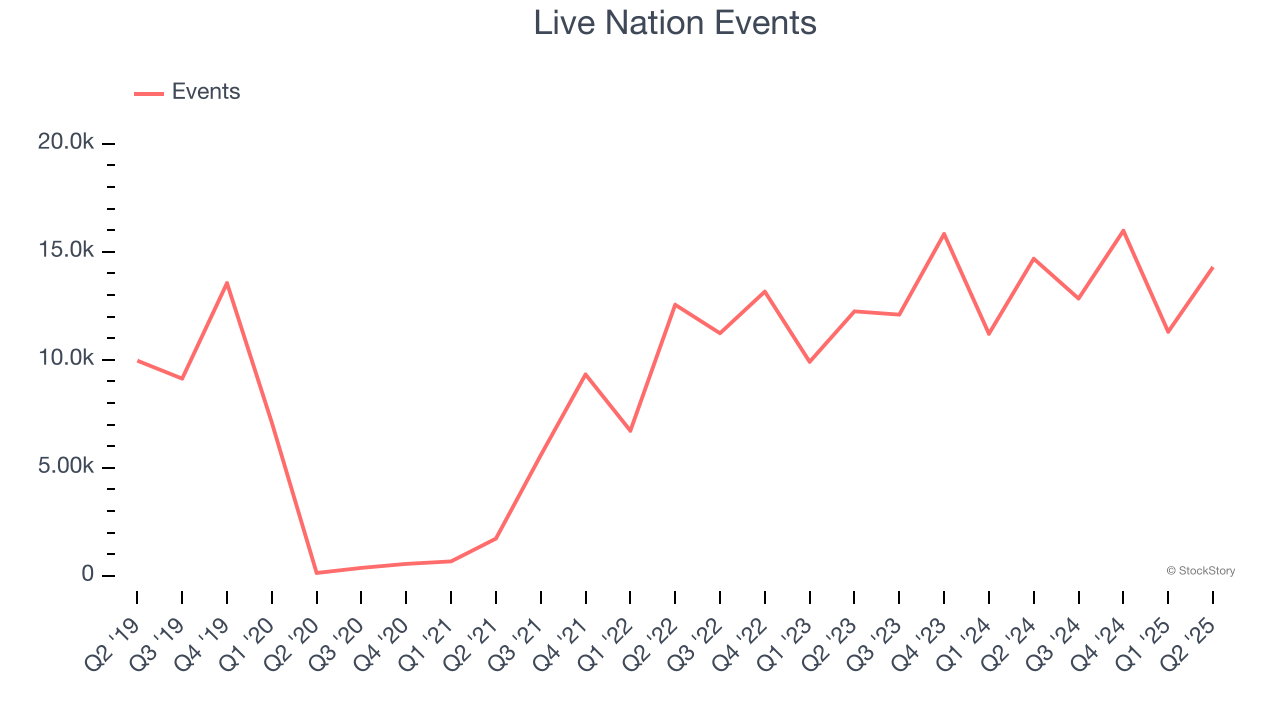

- Events: 14,292, down 386 year on year

- Market Capitalization: $34.36 billion

Company Overview

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Revenue Growth

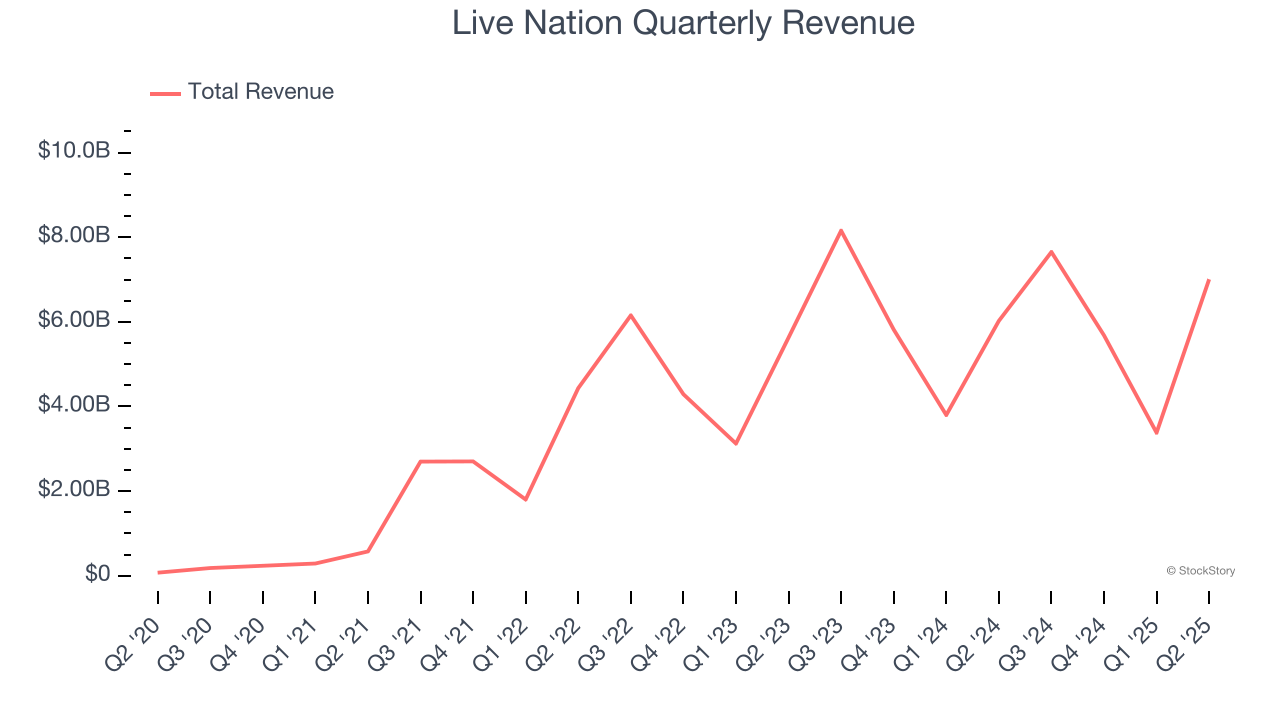

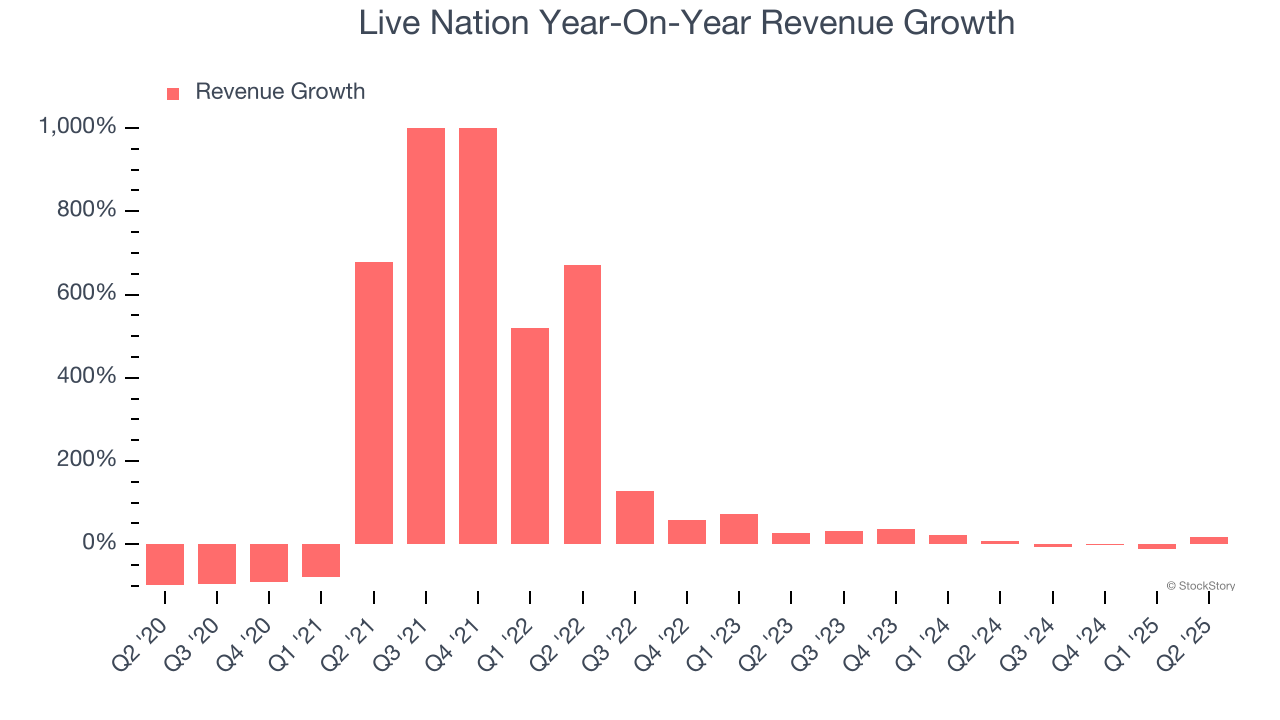

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Live Nation’s 24% annualized revenue growth over the last five years was impressive. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Live Nation’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 11.2% over the last two years was well below its five-year trend. Note that COVID hurt Live Nation’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its number of events and fans per event, which clocked in at 14,292 and 3,089 in the latest quarter. Over the last two years, Live Nation’s events averaged 8.3% year-on-year growth while its fans per event averaged 1% year-on-year growth.

This quarter, Live Nation reported year-on-year revenue growth of 16.3%, and its $7.01 billion of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 15% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and indicates its newer products and services will fuel better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

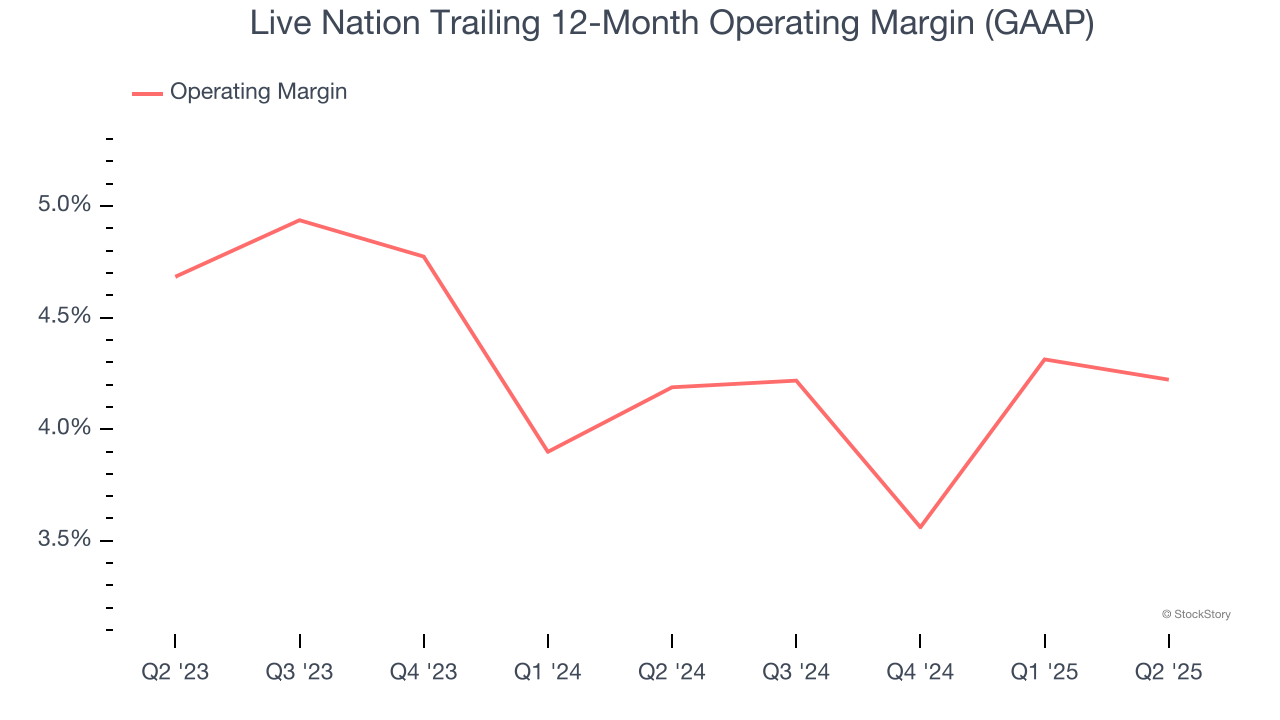

Live Nation’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.2% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q2, Live Nation generated an operating margin profit margin of 6.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

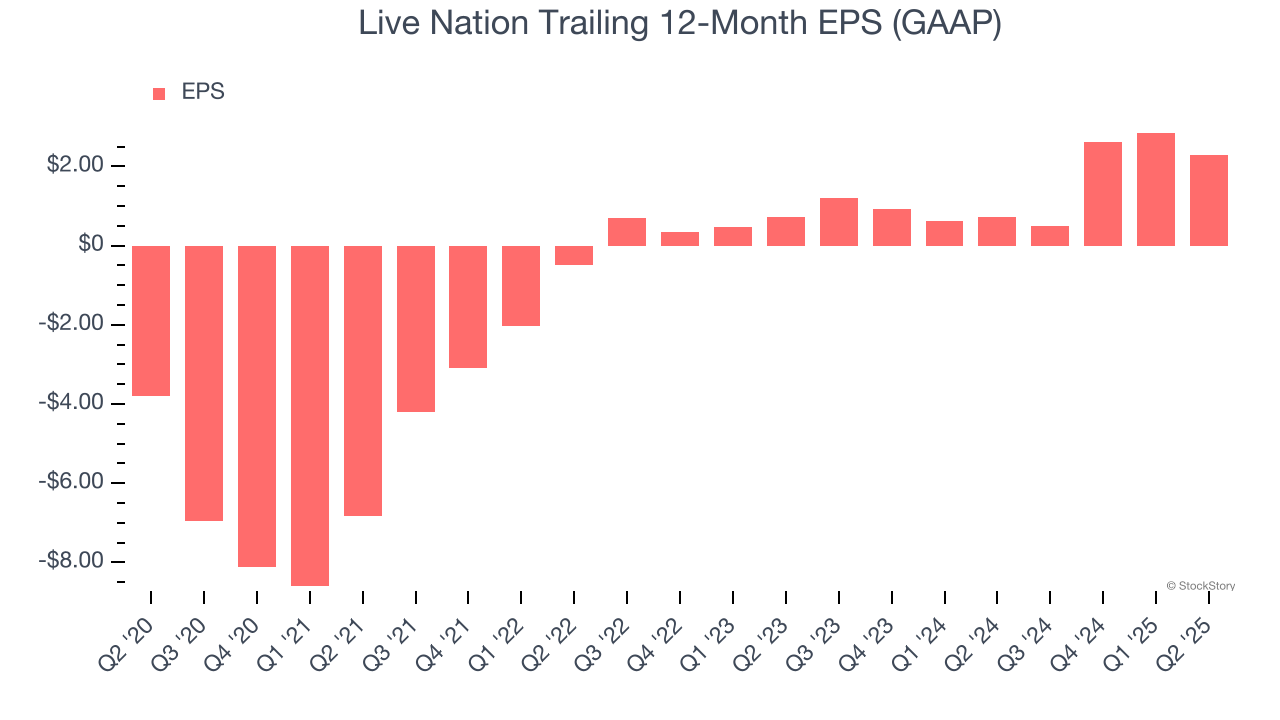

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Live Nation’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q2, Live Nation reported EPS at $0.41, down from $0.98 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Live Nation’s Q2 Results

We were impressed by how significantly Live Nation blew past analysts’ EBITDA expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS missed and its number of fans per event fell short of Wall Street’s estimates. Overall, we think this was still a decent quarter with some key metrics above expectations. The market seemed to be hoping for more, and the stock traded down 1.6% to $146.27 immediately following the results.

So should you invest in Live Nation right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.