As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at perishable food stocks, starting with Fresh Del Monte Produce (NYSE: FDP).

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

The 11 perishable food stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.6% while next quarter’s revenue guidance was 2.7% above.

While some perishable food stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.7% since the latest earnings results.

Fresh Del Monte Produce (NYSE: FDP)

Translating to "of the mountain" in Spanish, Fresh Del Monte (NYSE: FDP) is a leader in providing high-quality, sustainably grown fresh fruits and vegetables.

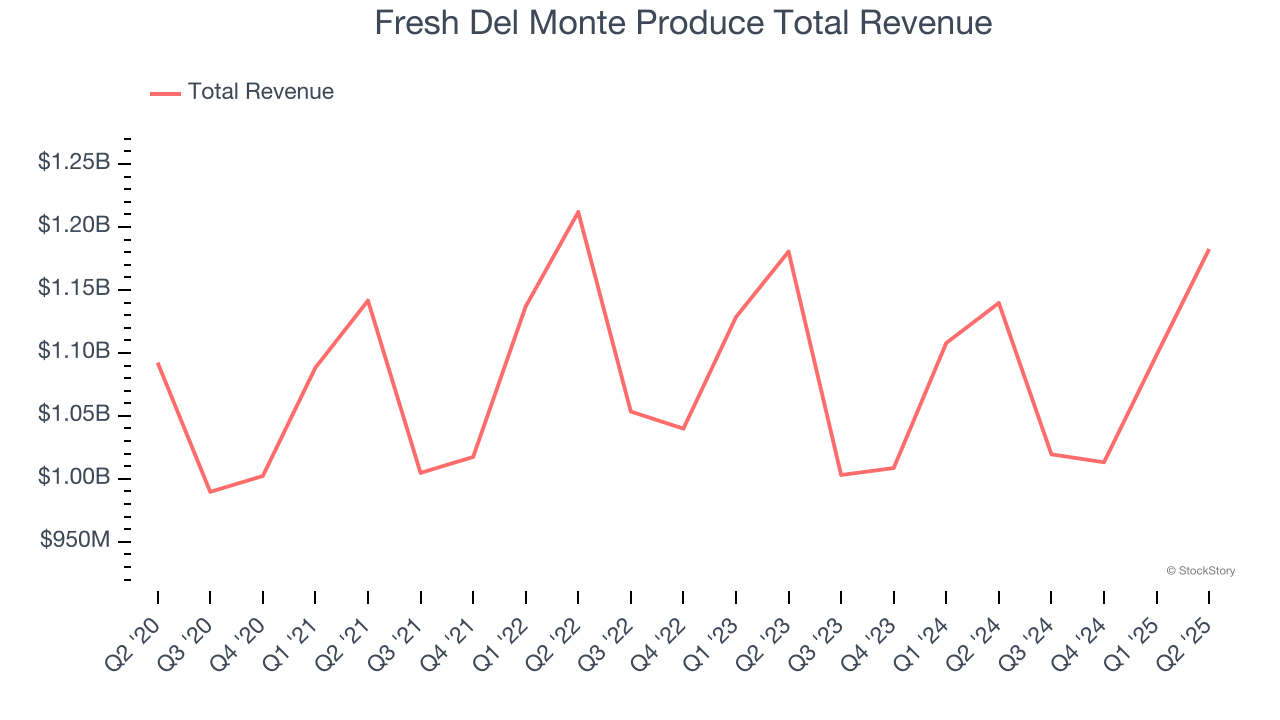

Fresh Del Monte Produce reported revenues of $1.18 billion, up 3.8% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EBITDA estimates and a beat of analysts’ EPS estimates.

“Fresh Del Monte’s second quarter 2025 results reflect the strength of a strategy rooted in consistency, discipline, and long-term vision. Sales growth was fueled by continued demand for our core products, including our proprietary pineapple varieties, and strong momentum across our fresh-cut business—an area where we’re seeing encouraging progress and expanding margins,” said Mohammad Abu-Ghazaleh, Fresh Del Monte’s Chairman and CEO.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $35.80.

Is now the time to buy Fresh Del Monte Produce? Access our full analysis of the earnings results here, it’s free.

Best Q2: Mission Produce (NASDAQ: AVO)

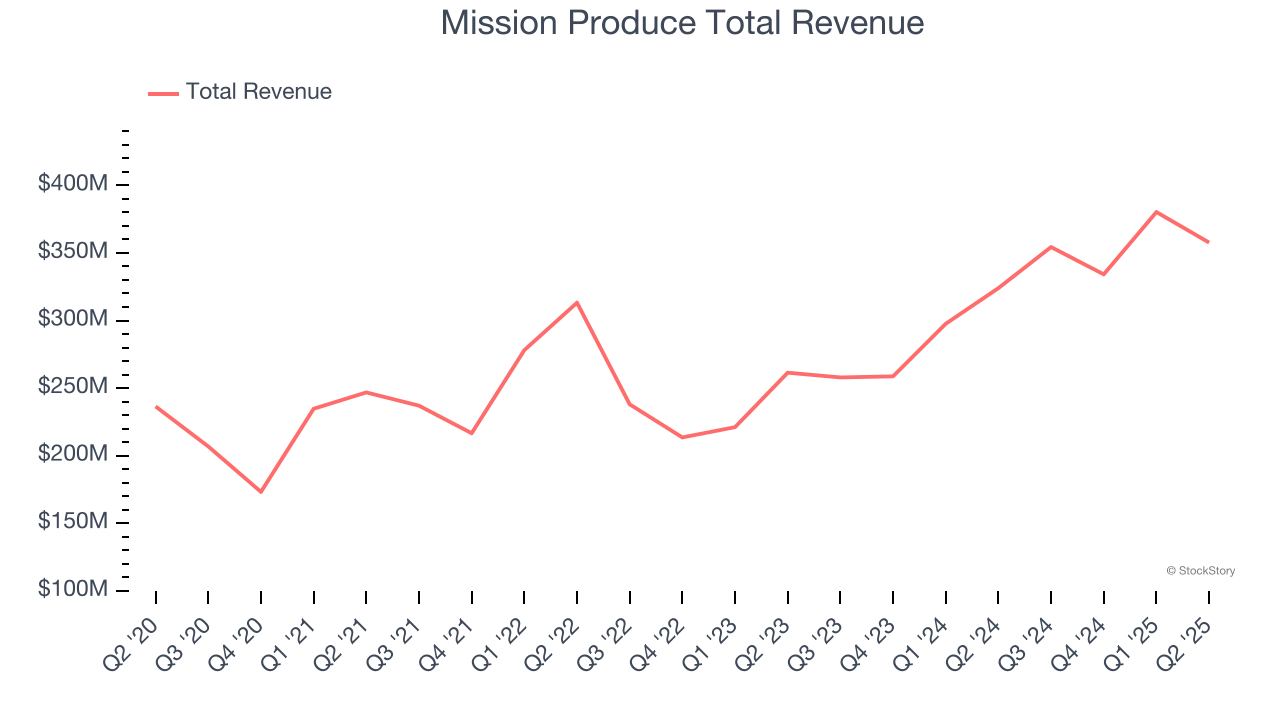

Founded in 1983 in California, Mission Produce (NASDAQ: AVO) grows, packages, and distributes avocados.

Mission Produce reported revenues of $357.7 million, up 10.4% year on year, outperforming analysts’ expectations by 11.7%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ gross margin estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.1% since reporting. It currently trades at $12.34.

Is now the time to buy Mission Produce? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Calavo (NASDAQ: CVGW)

A trailblazer in the avocado industry, Calavo Growers (NASDAQ: CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

Calavo reported revenues of $178.8 million, flat year on year, falling short of analysts’ expectations by 8.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA and gross margin estimates.

Interestingly, the stock is up 1.5% since the results and currently trades at $27.88.

Read our full analysis of Calavo’s results here.

Beyond Meat (NASDAQ: BYND)

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ: BYND) is a food company specializing in alternatives to traditional meat products.

Beyond Meat reported revenues of $74.96 million, down 19.6% year on year. This result missed analysts’ expectations by 8.6%. It was a softer quarter as it also logged a significant miss of analysts’ EBITDA estimates and a significant miss of analysts’ gross margin estimates.

Beyond Meat had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 11.1% since reporting and currently trades at $2.60.

Read our full, actionable report on Beyond Meat here, it’s free.

Pilgrim's Pride (NASDAQ: PPC)

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ: PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Pilgrim's Pride reported revenues of $4.76 billion, up 4.3% year on year. This number surpassed analysts’ expectations by 2.9%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ gross margin estimates.

The stock is down 7.7% since reporting and currently trades at $44.05.

Read our full, actionable report on Pilgrim's Pride here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.