Shareholders of Atlassian would probably like to forget the past six months even happened. The stock dropped 29.3% and now trades at $165.82. This might have investors contemplating their next move.

Following the drawdown, is this a buying opportunity for TEAM? Find out in our full research report, it’s free.

Why Does TEAM Stock Spark Debate?

Started by two Australian university friends who funded their startup with credit cards, Atlassian (NASDAQ: TEAM) provides software tools that help teams plan, track, collaborate, and share knowledge across organizations.

Two Things to Like:

1. Long-Term Revenue Growth Shows Strong Momentum

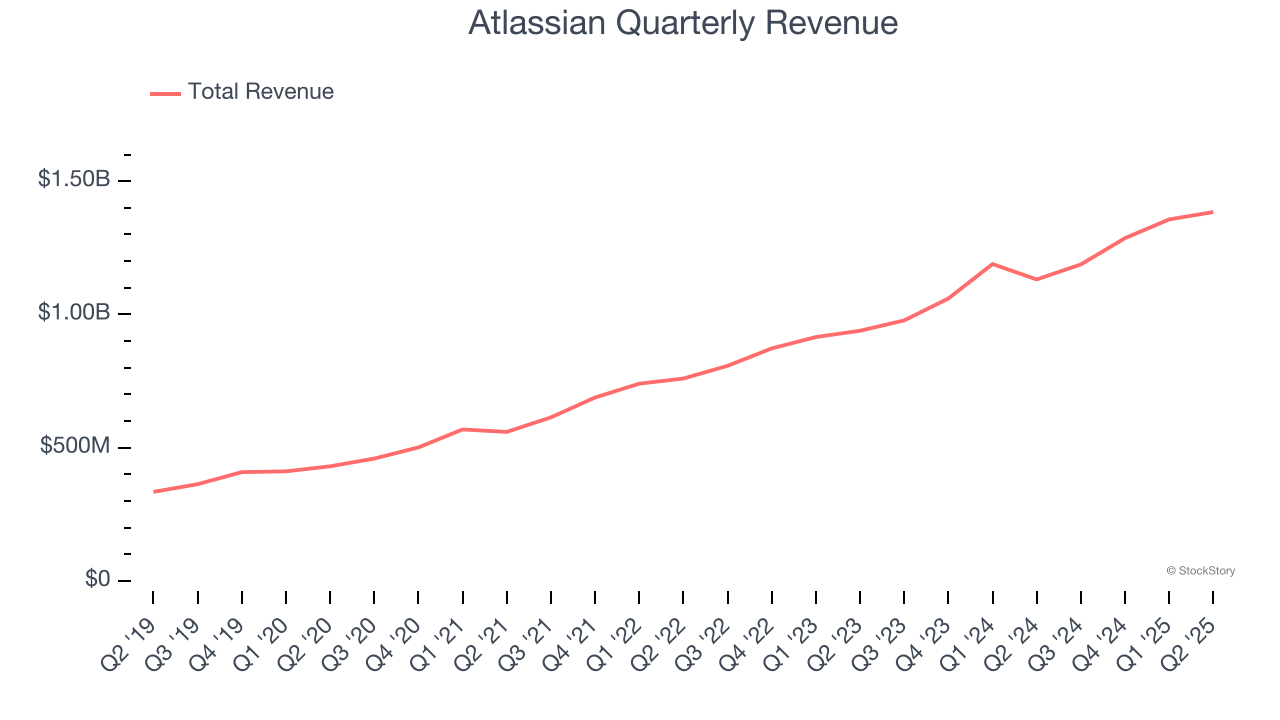

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Atlassian’s sales grew at a solid 26.4% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Atlassian is extremely efficient at acquiring new customers, and its CAC payback period checked in at 19.4 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

One Reason to be Careful:

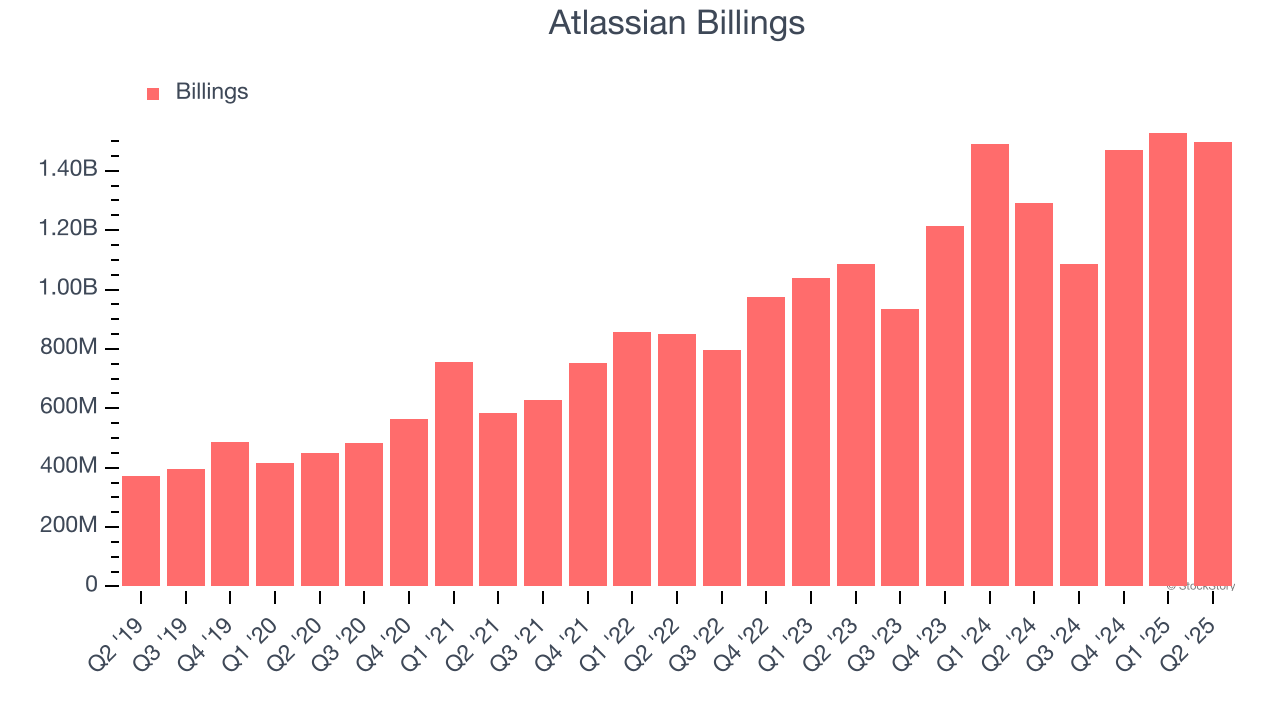

Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Atlassian’s billings came in at $1.50 billion in Q2, and over the last four quarters, its year-on-year growth averaged 14%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Atlassian has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 7.1× forward price-to-sales (or $165.82 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Atlassian

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.