Membership-only discount retailer Costco (NASDAQ: COST) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 8.1% year on year to $86.16 billion. Its GAAP profit of $5.87 per share was 1.1% above analysts’ consensus estimates.

Is now the time to buy Costco? Find out by accessing our full research report, it’s free.

Costco (COST) Q3 CY2025 Highlights:

- Revenue: $86.16 billion vs analyst estimates of $85.91 billion (8.1% year-on-year growth, in line)

- EPS (GAAP): $5.87 vs analyst estimates of $5.81 (1.1% beat)

- Adjusted EBITDA: $4.98 billion vs analyst estimates of $4.17 billion (5.8% margin, 19.4% beat)

- Operating Margin: 3.9%, in line with the same quarter last year

- Free Cash Flow Margin: 2.2%, similar to the same quarter last year

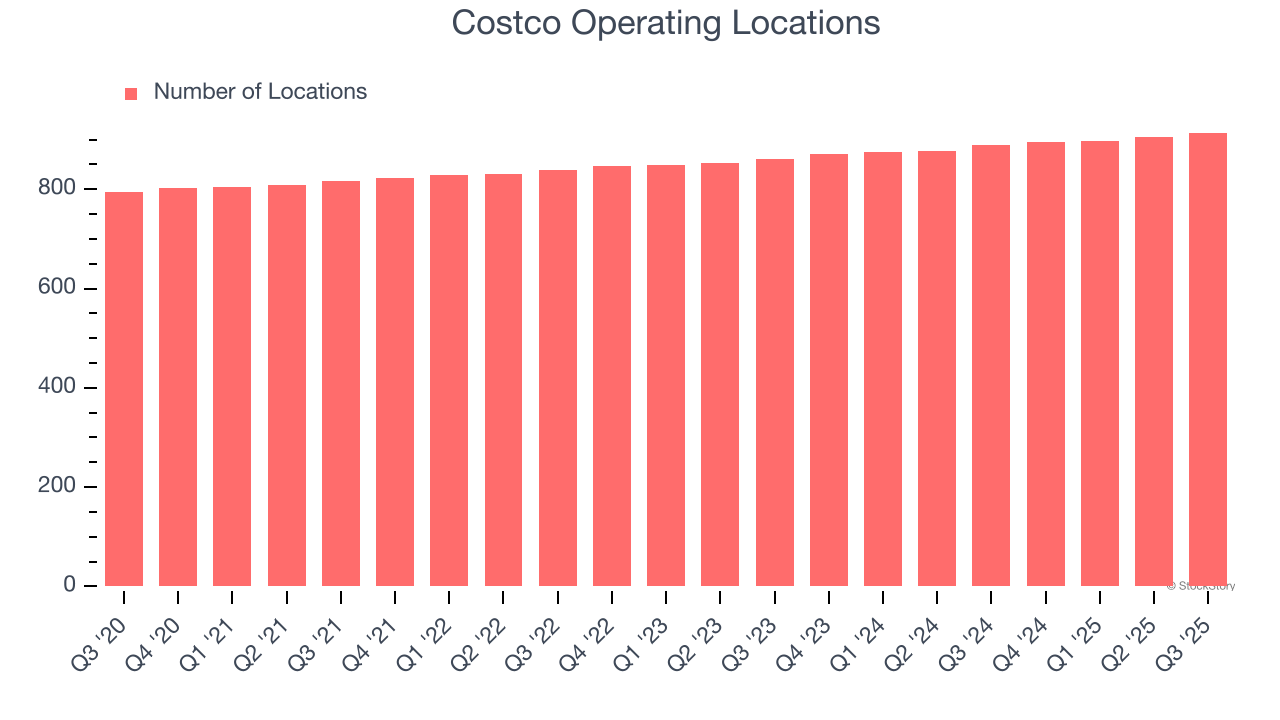

- Locations: 914 at quarter end, up from 890 in the same quarter last year

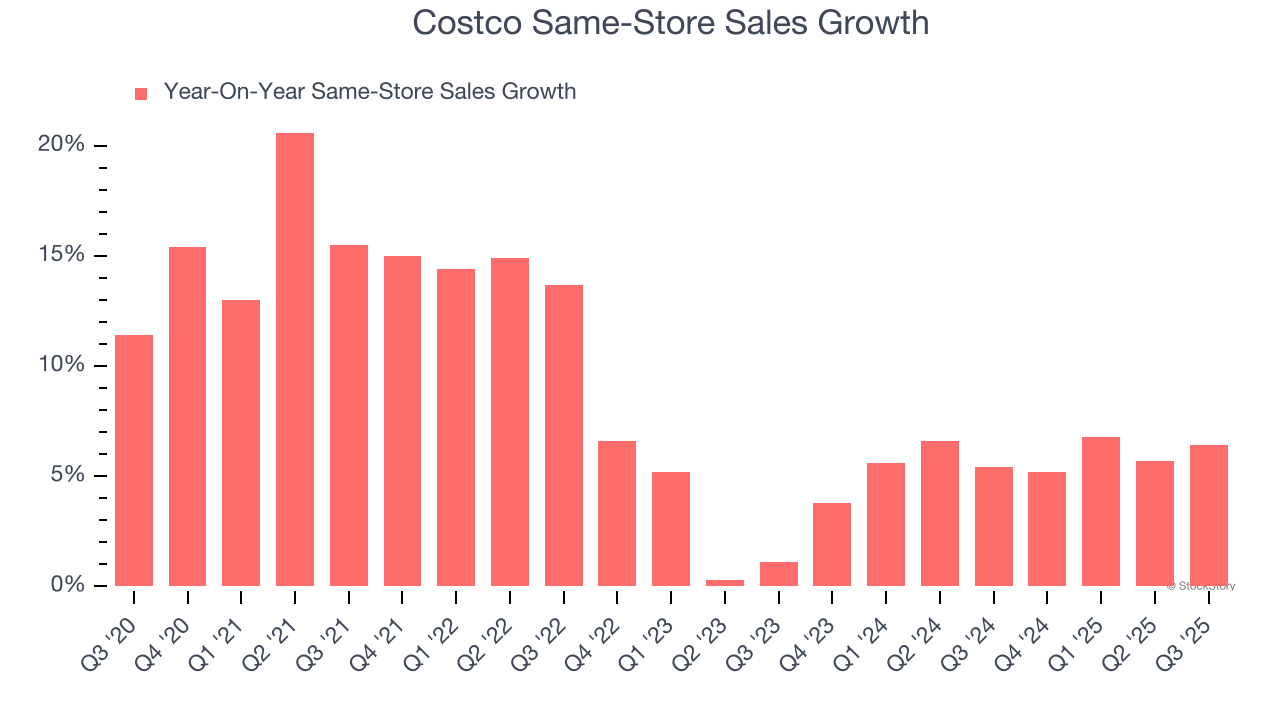

- Same-Store Sales rose 6.4% year on year (5.4% in the same quarter last year)

- Market Capitalization: $419.2 billion

Company Overview

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ: COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $275.2 billion in revenue over the past 12 months, Costco is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices.

As you can see below, Costco’s 10.3% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and increased sales at existing, established locations.

This quarter, Costco grew its revenue by 8.1% year on year, and its $86.16 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a deceleration versus the last six years. We still think its growth trajectory is attractive given its scale and implies the market is baking in success for its products.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

Costco operated 914 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 2.9% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Costco has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.7%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Costco multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Costco’s same-store sales rose 6.4% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Costco’s Q3 Results

Despite in-line revenue, we were impressed that Costco beat analysts’ gross margin and EPS expectations this quarter. Overall, we think this was still a solid quarter with some key areas of upside. The stock remained flat at $937.15 immediately after reporting.

So do we think Costco is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.