Global credit card network provider Mastercard Inc. (NYSE: MA) stock a cup and handle breakout, but the upside may be limited with the news of the White House's proposed Junk Fee Prevention Act. Mastercard is the world's second-largest credit card network, with an estimated 23.7% market share behind Visa Inc. (NYSE: V) at 52.6%. American Express Co. (NYSE: AXP) comes in third at 19.6%, and Discover Financial Services (NYSE: DFS) comes in fourth with a 4% market share.

One of Mastercard’s growth strategies has been to partner with regional and community banks to issue their private-label credit cards under the Mastercard network.

Mastercard CEO Michael Miebach stated that consumer spending has been "remarkably resilient" despite macroeconomic headwinds. The rebound in cross-border travel and the reopening of Asia drove this. However, the quarter-over-quarter (QoQ) drop from 44% to 31% cross-border volume growth may be showing signs of normalization.

Mastercard Earning Growth Eases QoQ

On Jan. 26, 2023, Mastercard reported its fiscal Q4 2022 earnings for the quarter that ended December 2022. The Company reported earnings-per-share (EPS) profits of $2.65, beating consensus analyst estimates of $2.58 by $0.07. Earnings declined sequentially quarter-over-quarter (QoQ) as cross-border volume growth normalized. Revenues grew 11.5% year-over-year (YoY) to $5.82 billion beating $5.79 billion consensus analyst estimates.

Its gross dollar volume rose 8% to $2.1 trillion on a local currency basis. Cross-border volume grew 31%. Switched transactions grew by 8%. Switched transactions are credit card transactions processed through a network switch rather than directly by the credit card issuer. This results in a fee for Mastercard for facilitating the transaction.

Consumer Spending is Still Resilient

CEO Michael Miebach commented, “We closed out the year with strong financial results and notable wins which will help us capitalize on the tremendous secular shift to digital payments. As we look at the broader economy, we see the continued recovery of cross-border travel, with volumes up 59% versus a year ago. We’re encouraged by Asia opening up further. While macroeconomic and geopolitical uncertainty persists, consumer spending has been remarkably resilient. We are well prepared to adjust our investment profile quickly if needed.”

The Junk Fee Protection Act

On Feb. 1, 2023, the White House issued a press release detailing actions the Biden-Harris Administration will take to eliminate “junk fees” under its Junk Fee Prevention Act. It's proposing a rule to slash excessive late fees according to the Credit CARD Act of 2009. This will affect credit card issuers. It's expected to reduce typical late fees from $30 to $8, saving Americans nearly $9 billion annually.

Excessive Event Fees

It also cracks down on four types of junk fees, hitting the American consumer for billions of dollars annually. These include "excessive online concert, sporting events, and other entertainment ticket fees, " which directly aim at Live Nation Entertainment Inc. (NYSE: LYV). These fees, including delivery, processing, and facility fees, average more than 20% of a ticket's face value, with many reaching up to half the cost of an event ticket.

They point out that many Americans only have one online option for making an initial ticket purchase. One company, in particular, has exclusive partnerships with 80 top 100 areas. This allows them to charge high fees without any fear of competition. They are referring to Live Nation.

Excessive Early Termination Fees

The administration wants to eliminate early elimination fees for TV, phone, and internet service. These are fees that customers have to pay in the event they wish to switch to another provider, where penalties can exceed $200. This will impact cable and broadband providers like Comcast Co. (NASDAQ: CMCSA) and Verizon Communications Inc. (NYSE: VZ).

Surprise Resort and Destination Fees

These fees pop up on hotel bills surpassing $50 or more. Over a third of hotel guests have reported having to pay these fees. This makes comparison shopping misleading as these fees and surcharges tend to appear upon checkout or a lengthy online reservation process. This will impact the hotel chains like Marriott International Inc. (NYSE: MAR) and Hilton Worldwide Holdings Inc. (NYSE: HLT).

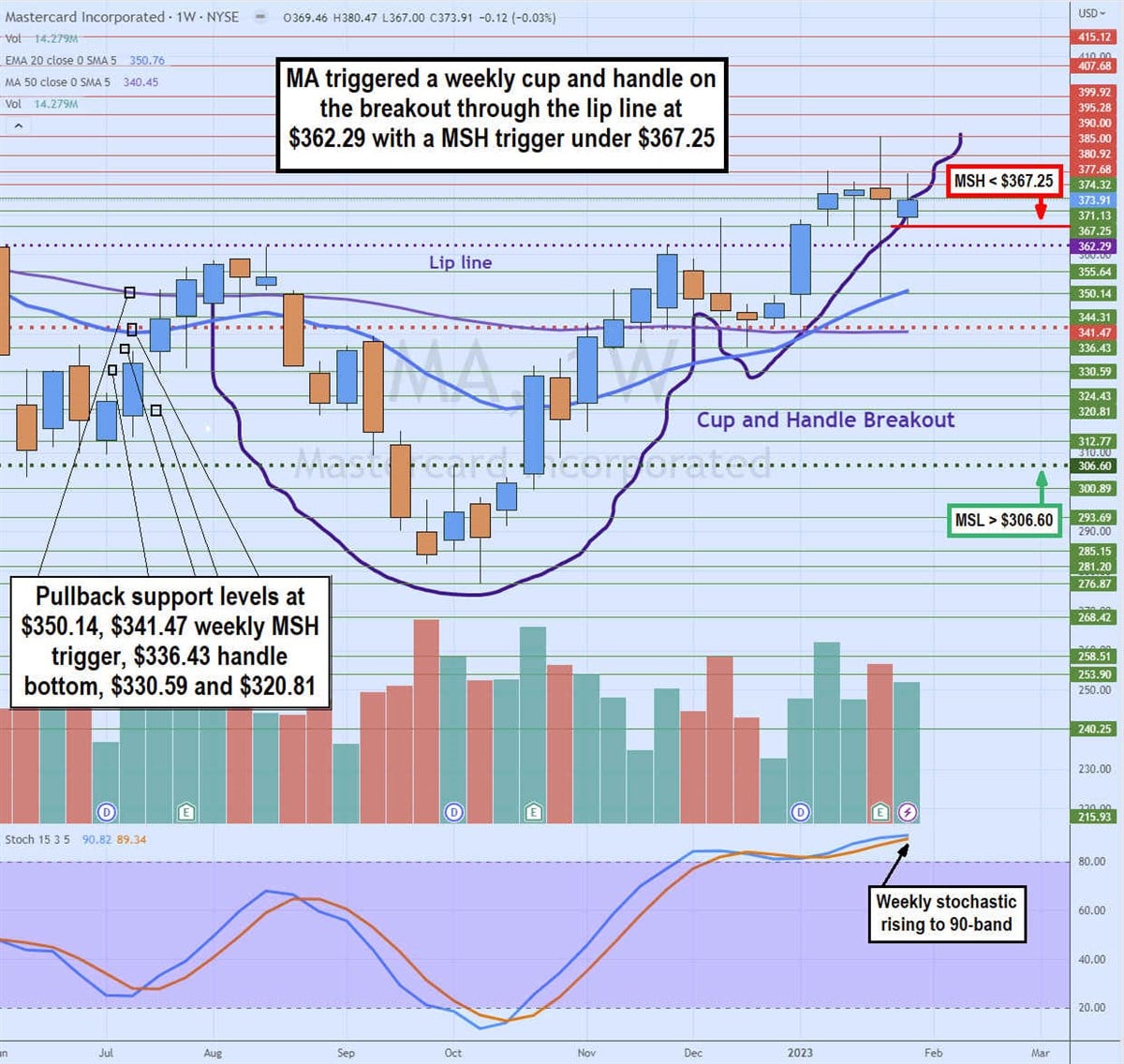

Weekly Cup and Handle Breakout

The weekly candlestick chart on MA depicts a classic cup and handle breakout. The cup lip line formed in August 2022 at $362.29 before shares fell to a swing low of $275.87 in October 2022. Shares staged a rally upon triggering the weekly market structure low (MSL) breakout through $306.60.

For six weeks, MA shares climbed to retest the cup line at $362.29 in November 2022 before falling back down to $336.43 in a flag pattern before bouncing back up through the $362.29 lip line.

This handle formation triggered a cup and handle breakout as the stochastic bounced off the 80-band sending shares to a swing high of $385 before setting a weekly market structure high (MSH) sell trigger on a breakdown under $367.25. Pullback support levels are $350.14, $341.47 weekly MSH trigger, $336.43 handle bottom, $330.59, and $320.81.