Private label food company TreeHouse Foods (NYSE: THS) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $840.3 million. Its non-GAAP profit of $0.43 per share was 23.9% below analysts’ consensus estimates.

Is now the time to buy TreeHouse Foods? Find out by accessing our full research report, it’s free for active Edge members.

TreeHouse Foods (THS) Q3 CY2025 Highlights:

- TreeHouse Foods announced it will be acquired by Investindustrial for a total of $2.9 billion. In light of the pending transaction, TreeHouse Foods will not host its conference call previously scheduled for today, and the Company is withdrawing guidance, which it will no longer provide moving forward.

- Revenue: $840.3 million vs analyst estimates of $849.3 million (flat year on year, 1.1% miss)

- Adjusted EPS: $0.43 vs analyst expectations of $0.56 (23.9% miss)

- Adjusted EBITDA: -$202.1 million vs analyst estimates of $98.83 million (-24.1% margin, significant miss due to $298 million non-recurring impairment charge)

- Operating Margin: -30.2%, down from 3.8% in the same quarter last year due to $298 million non-recurring impairment charge

- Free Cash Flow Margin: 0.3%, similar to the same quarter last year

- Sales Volumes fell 11.6% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $962 million

Company Overview

Whether it be packaged crackers, broths, or beverages, Treehouse Foods (NYSE: THS) produces a wide range of private-label foods for grocery and food service customers.

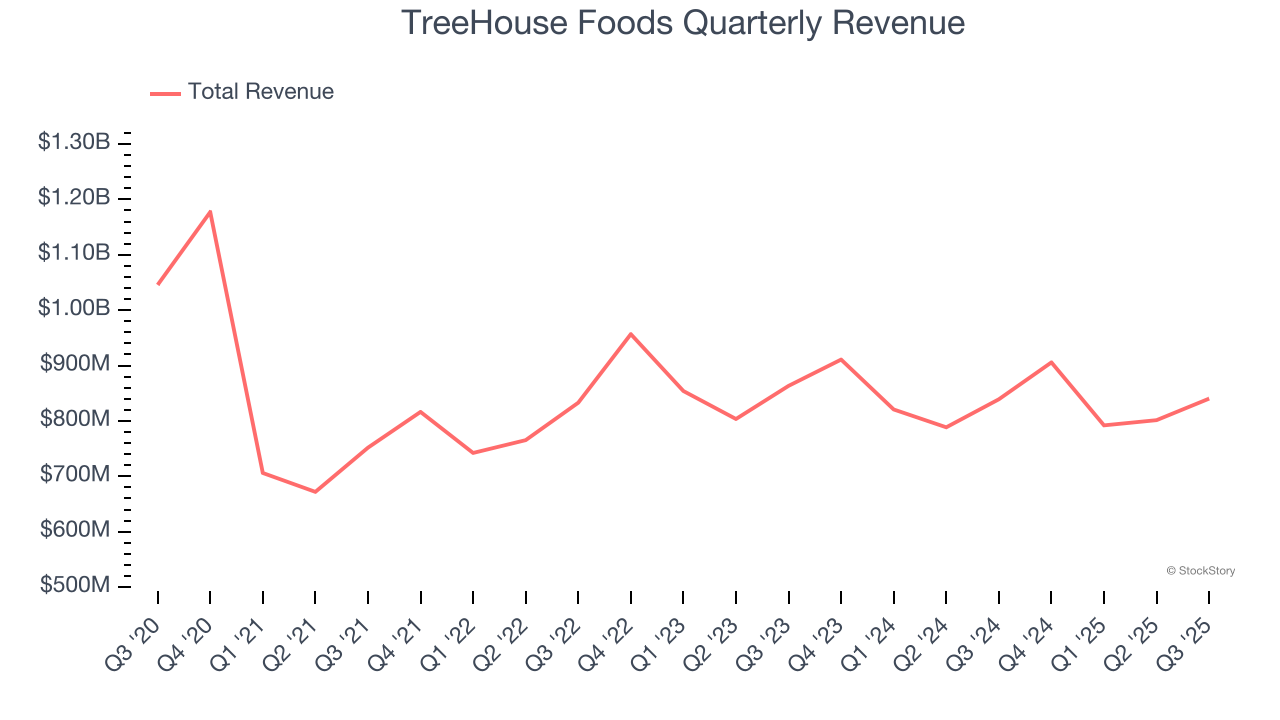

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.34 billion in revenue over the past 12 months, TreeHouse Foods carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, TreeHouse Foods grew its sales at a sluggish 1.9% compounded annual growth rate over the last three years as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, TreeHouse Foods’s $840.3 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and indicates its newer products will not lead to better top-line performance yet.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

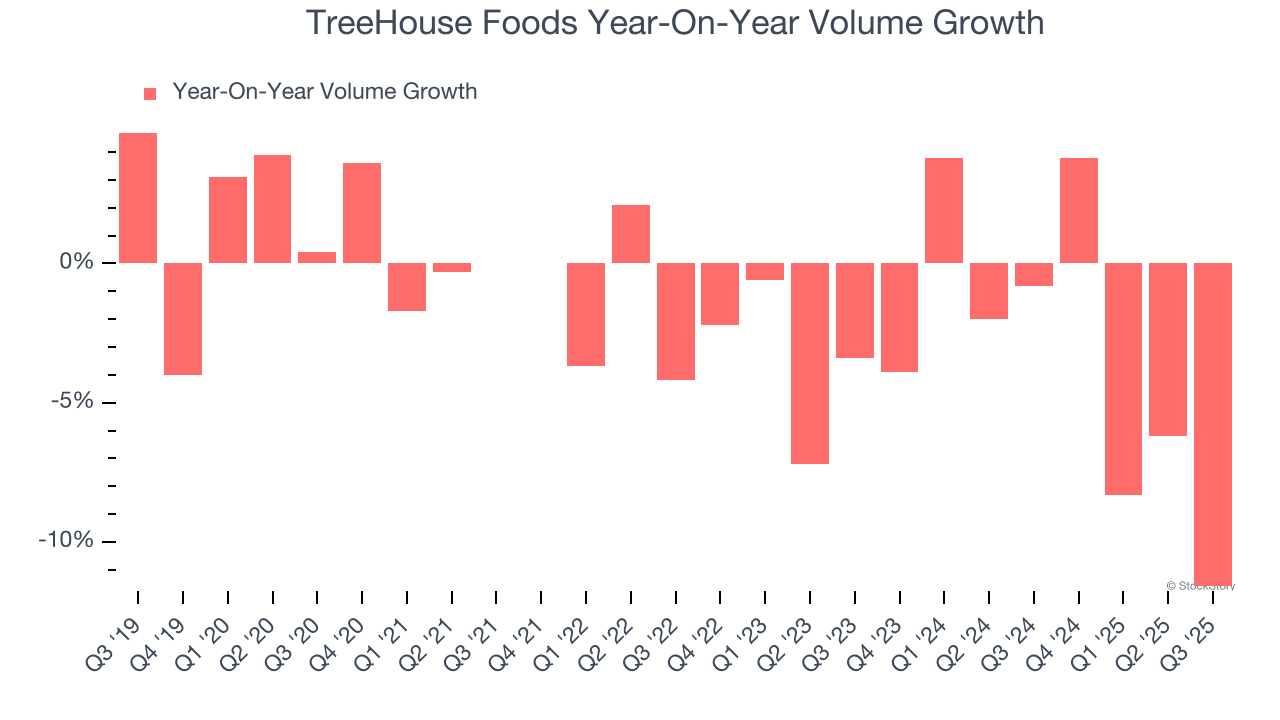

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

TreeHouse Foods’s average quarterly sales volumes have shrunk by 3.2% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In TreeHouse Foods’s Q3 2025, sales volumes dropped 11.6% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from TreeHouse Foods’s Q3 Results

The stock traded up 20.4% to $22.92 immediately following the results largely due to the announcement that TreeHouse Foods will be acquired by Investindustrial for a total of $2.9 billion.

Is TreeHouse Foods an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.