![]()

Semiconductor manufacturer Magnachip Semiconductor (NYSE: MX) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 30.9% year on year to $45.95 million. On the other hand, next quarter’s revenue guidance of $40.5 million was less impressive, coming in 14.9% below analysts’ estimates. Its non-GAAP loss of $0.01 per share was 91.7% above analysts’ consensus estimates.

Is now the time to buy Magnachip? Find out by accessing our full research report, it’s free for active Edge members.

Magnachip (MX) Q3 CY2025 Highlights:

- Revenue: $45.95 million vs analyst estimates of $46 million (30.9% year-on-year decline, in line)

- Adjusted EPS: -$0.01 vs analyst estimates of -$0.12 (91.7% beat)

- Adjusted EBITDA: -$3.96 million vs analyst estimates of -$3 million (-8.6% margin, relatively in line)

- Revenue Guidance for Q4 CY2025 is $40.5 million at the midpoint, below analyst estimates of $47.6 million

- Operating Margin: -25.1%, down from -16.6% in the same quarter last year

- Free Cash Flow was -$7.49 million compared to -$15.51 million in the same quarter last year

- Inventory Days Outstanding: 91, in line with the previous quarter

- Market Capitalization: $111.4 million

Camillo Martino, Magnachip’s CEO said, “Our top priority is to stabilize our financial position and establish a solid foundation for business recovery. At the same time, we have restructured our go-to-market organization and we are revitalizing our product portfolio to enhance our competitiveness, particularly in China. In the first three quarters of 2025, we launched 30 new-generation products, compared to only two in the first three quarters of 2024. We currently plan to launch at least another 20 new-generation products in the fourth quarter of 2025, bringing the total for 2025 to at least 50 new-generation products, in comparison to only four in all of 2024.”

Company Overview

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE: MX) is a provider of analog and mixed-signal semiconductors.

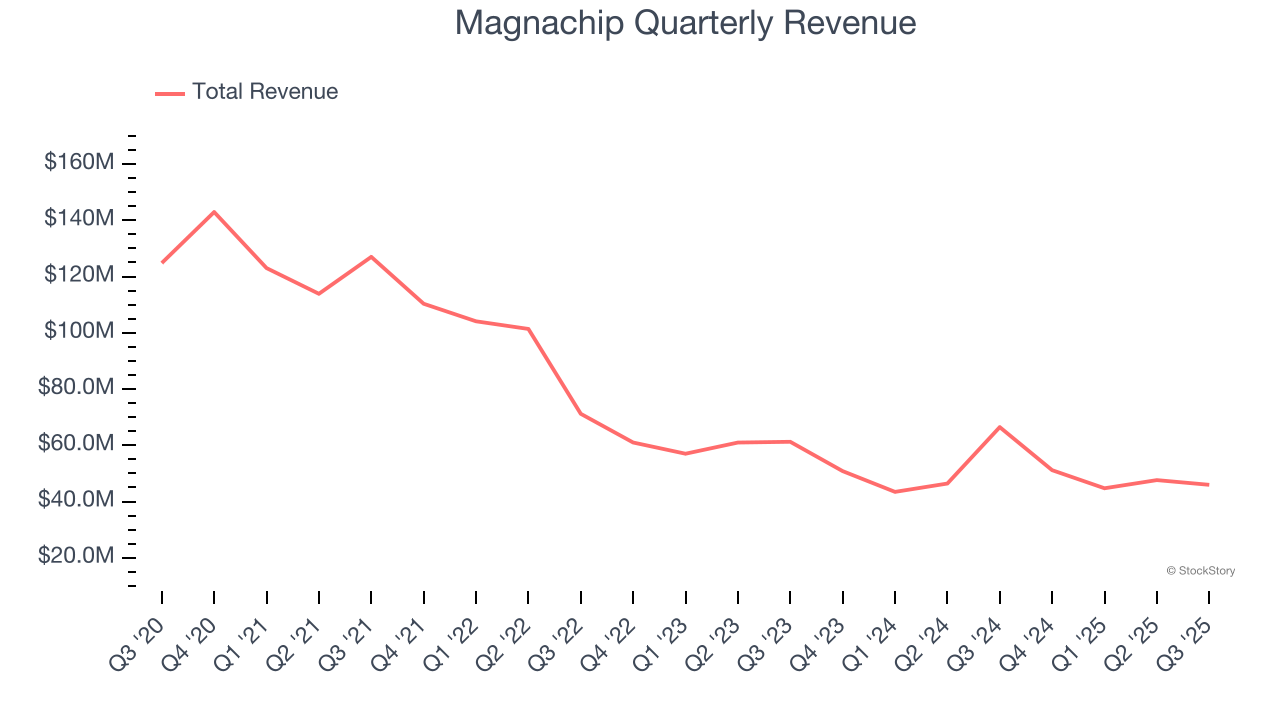

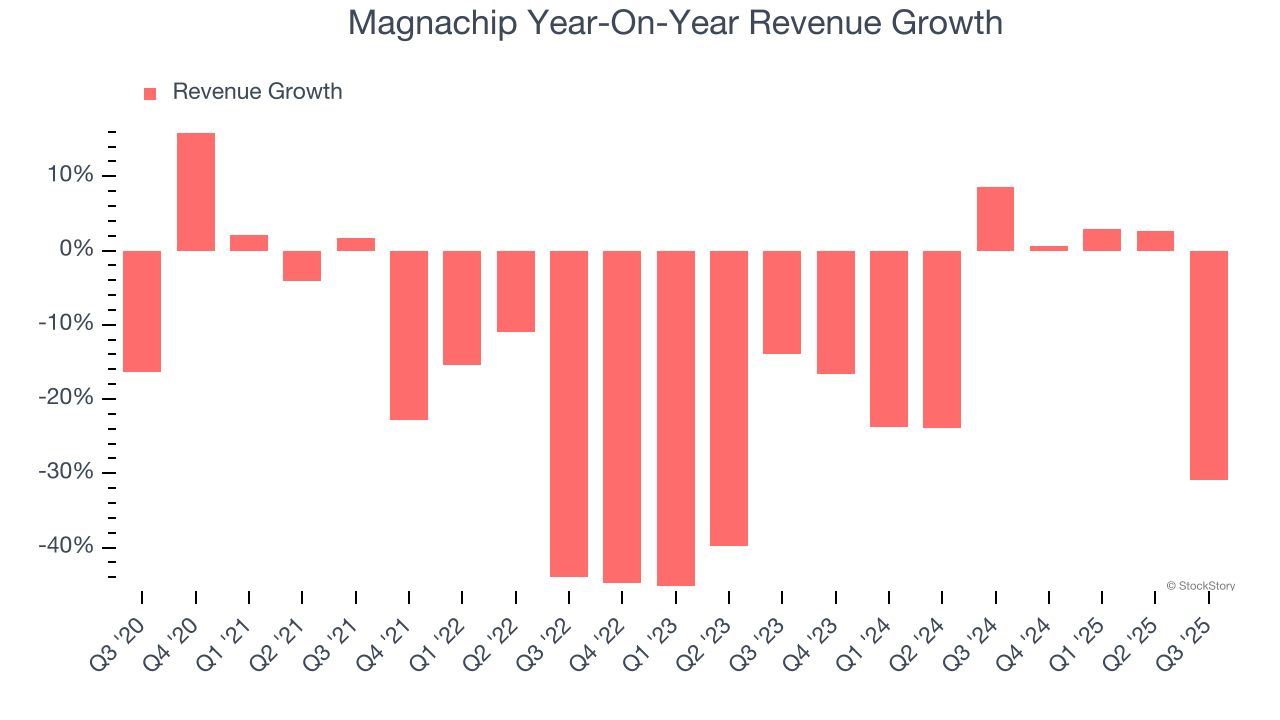

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Magnachip’s demand was weak over the last five years as its sales fell at a 17.2% annual rate. This wasn’t a great result and suggests it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Magnachip’s annualized revenue declines of 11.2% over the last two years suggest its demand continued shrinking.

This quarter, Magnachip reported a rather uninspiring 30.9% year-on-year revenue decline to $45.95 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 20.8% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

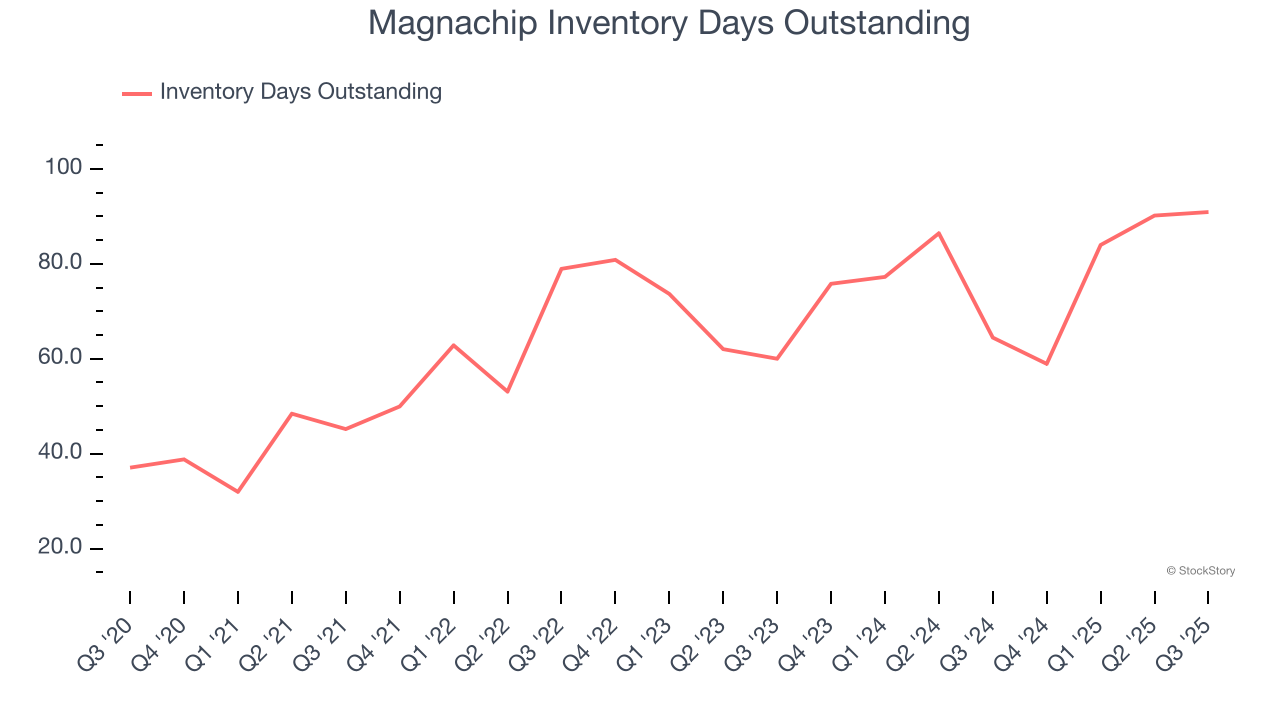

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Magnachip’s DIO came in at 91, which is 25 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

Key Takeaways from Magnachip’s Q3 Results

It was good to see Magnachip beat analysts’ EPS expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its adjusted operating income fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $3.14 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.