Regional banking company Prosperity Bancshares (NYSE: PB) missed Wall Street’s revenue expectations in Q2 CY2025 as sales only rose 1.9% year on year to $310.7 million. Its GAAP profit of $1.42 per share was in line with analysts’ consensus estimates.

Is now the time to buy Prosperity Bancshares? Find out by accessing our full research report, it’s free.

Prosperity Bancshares (PB) Q2 CY2025 Highlights:

- Net Interest Income: $267.7 million vs analyst estimates of $275.1 million (3.5% year-on-year growth, 2.7% miss)

- Net Interest Margin: 3.2% vs analyst estimates of 3.2% (24 basis point year-on-year increase, 5.1 bps miss)

- Revenue: $310.7 million vs analyst estimates of $314.4 million (1.9% year-on-year growth, 1.2% miss)

- Efficiency Ratio: 44.8% vs analyst estimates of 45.4% (0.6 percentage point beat)

- EPS (GAAP): $1.42 vs analyst estimates of $1.42 (in line)

- Market Capitalization: $6.95 billion

“I am excited to share that our bank continues to grow, with double digit increases in net income and earnings per share compared with the second quarter of 2024. Our net interest margin also improved to 3.28%, a 24 basis point increase compared with the second quarter of 2024 as our interest-bearing assets continue to reprice. Loans grew $219.8 million during the second quarter of 2025, and we continue to see cautious enthusiasm from our customers. As mentioned in my previous comments, these are the results we expected, and these tailwinds should continue to be positive over the next 12 and 24 months,” said David Zalman, Prosperity’s Senior Chairman and Chief Executive Officer.

Company Overview

With a network of banking centers spanning the Lone Star State and beyond, Prosperity Bancshares (NYSE: PB) operates full-service banking locations throughout Texas and Oklahoma, offering a wide range of financial products and services to businesses and consumers.

Sales Growth

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

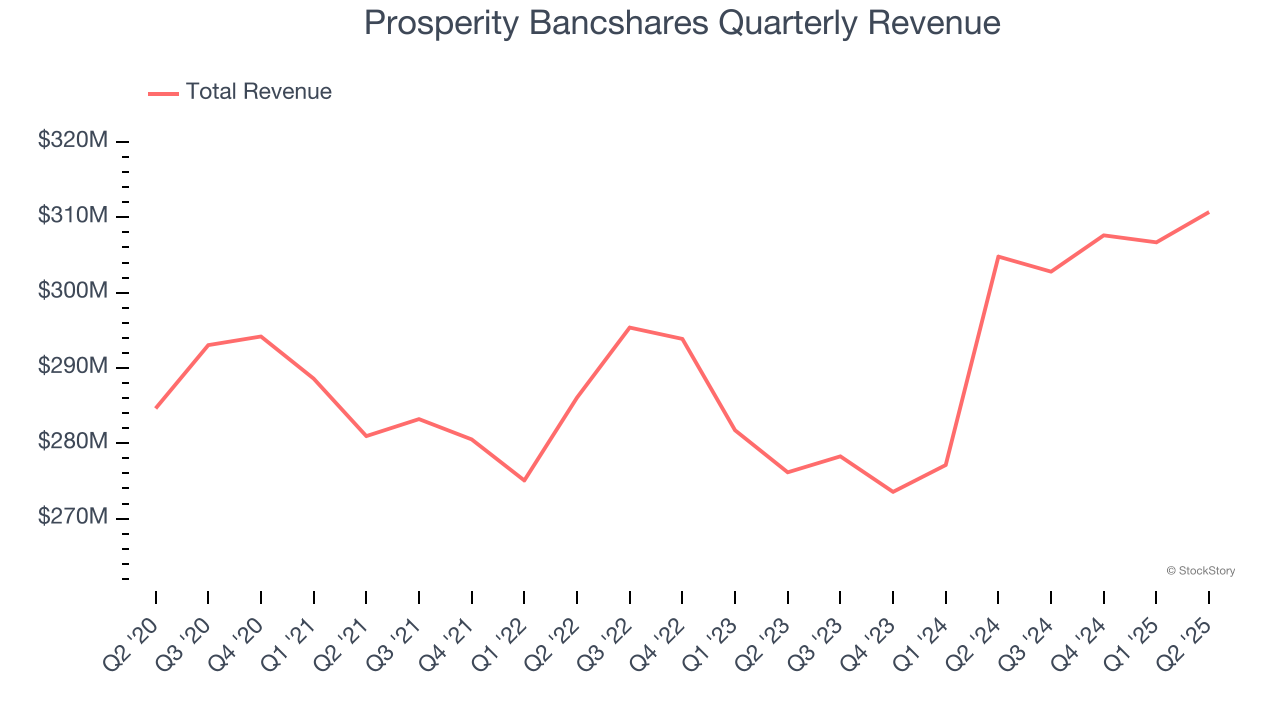

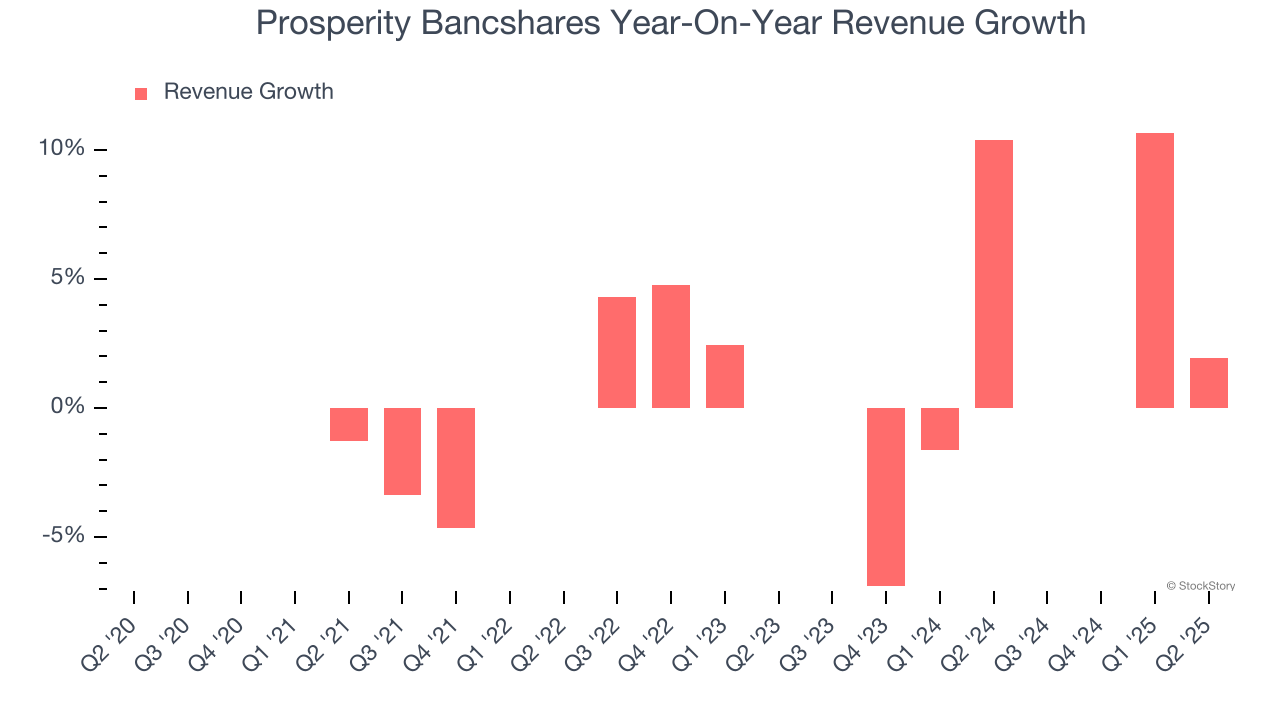

Unfortunately, Prosperity Bancshares’s 3.6% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the bank sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Prosperity Bancshares’s annualized revenue growth of 3.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Prosperity Bancshares’s revenue grew by 1.9% year on year to $310.7 million, falling short of Wall Street’s estimates.

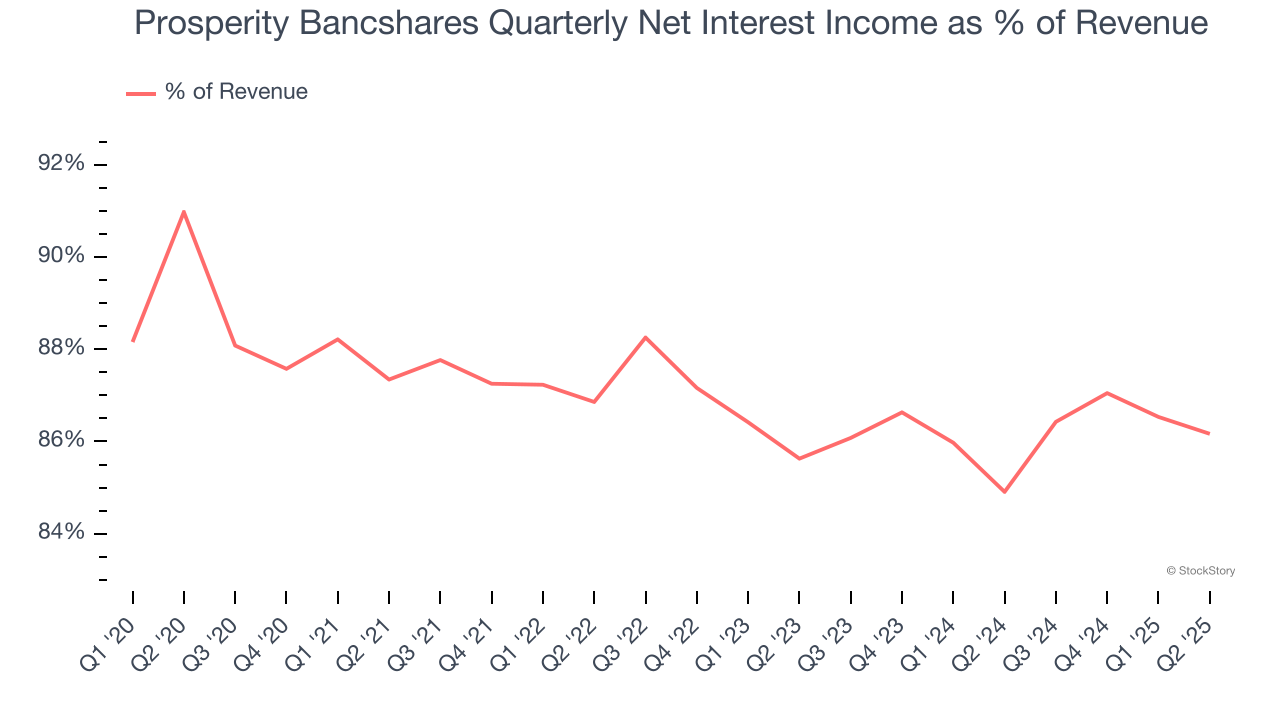

Net interest income made up 86.9% of the company’s total revenue during the last five years, meaning Prosperity Bancshares barely relies on non-interest income to drive its overall growth.

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Tangible Book Value Per Share (TBVPS)

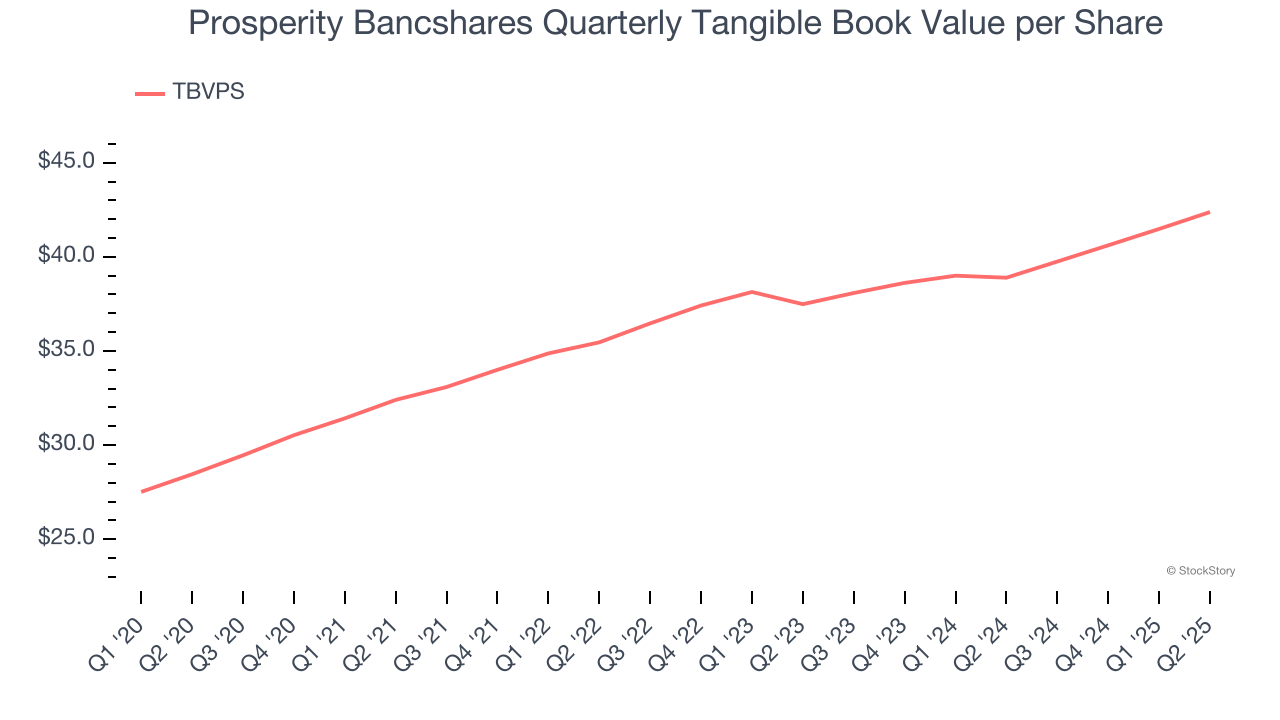

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

Prosperity Bancshares’s TBVPS grew at an excellent 8.3% annual clip over the last five years. However, TBVPS growth has recently decelerated a bit to 6.3% annual growth over the last two years (from $37.49 to $42.38 per share).

Over the next 12 months, Consensus estimates call for Prosperity Bancshares’s TBVPS to grow by 8.1% to $45.81, decent growth rate.

Key Takeaways from Prosperity Bancshares’s Q2 Results

We struggled to find many positives in these results. Its net interest income missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $73.29 immediately following the results.

So should you invest in Prosperity Bancshares right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.