All News about 20+ Year Treas Bond Ishares ETF

US Consumer Sentiment Rises More Than Predicted To 6-Month Highs, Inflation Expectations Hit 4-Year Low

Today 10:41 EST

Via Benzinga

Topics

Economy

Exposures

Interest Rates

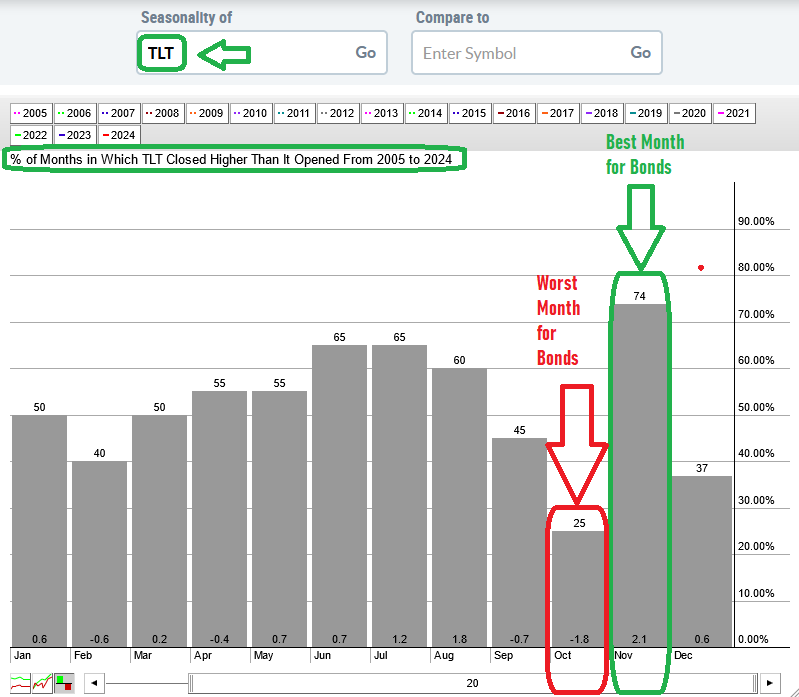

A Second Trump Term Stokes The Inflation Narrative

November 07, 2024

Via Talk Markets

Bears Misjudged These 3 ETFs: Where Investors Can Find Upside

November 06, 2024

Via MarketBeat

Gold Hits Record Highs, Defies Market Gravity: Why The Precious Metal Is Decoupling From Treasury Yields

October 29, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

Inflation Trades Gain Momentum: What Investors Should Watch

October 29, 2024

Via MarketBeat

Inflation Risk Rising, Key Trades Investors Are Making Now

October 28, 2024

Via MarketBeat

“Tale Of Two Cities” Stock Market (And Sentiment Results)

October 24, 2024

Via Talk Markets

Topics

Workforce

Mortgage Applications Fall For Fourth Straight Week As High Rates Squeeze Homebuyers

October 23, 2024

Via Benzinga

Topics

Economy

Exposures

Interest Rates

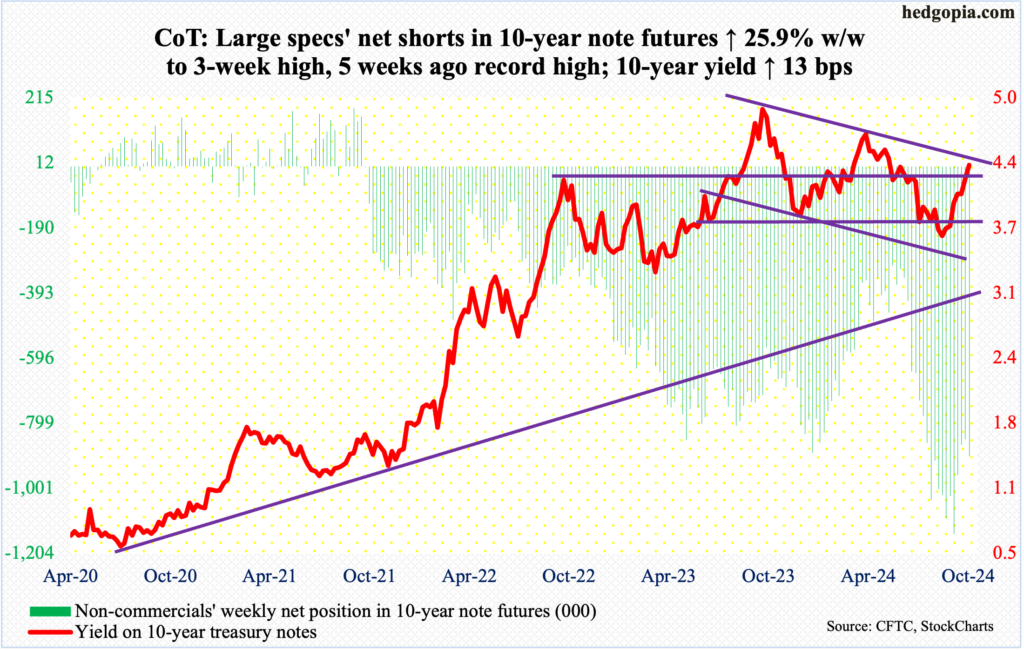

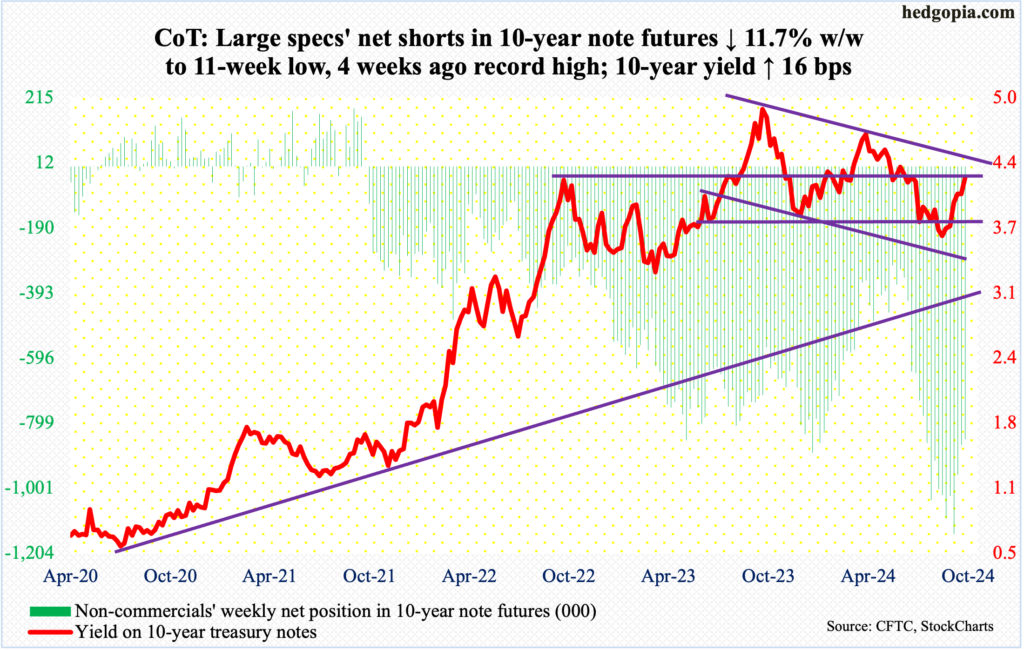

More Treasury Bonds Selling Ahead? Watch The Japanese Yen

October 23, 2024

Via Talk Markets

Topics

Bonds

Exposures

Debt Markets

Data & News supplied by www.cloudquote.io

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Stock quotes supplied by Barchart

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the following

Privacy Policy and Terms and Conditions.

Free News Feed

Get our RSS Feed!

© Copyright 2008 StreetInsider.com

Custom Website Design by Active Media Architects

Custom Website Design by Active Media Architects