Over the past six months, Waste Connections’s stock price fell to $173.69. Shareholders have lost 10% of their capital, which is disappointing considering the S&P 500 has climbed by 22.7%. This might have investors contemplating their next move.

Is now the time to buy Waste Connections, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Waste Connections Not Exciting?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons you should be careful with WCN and a stock we'd rather own.

1. Slow Organic Growth Suggests Waning Demand In Core Business

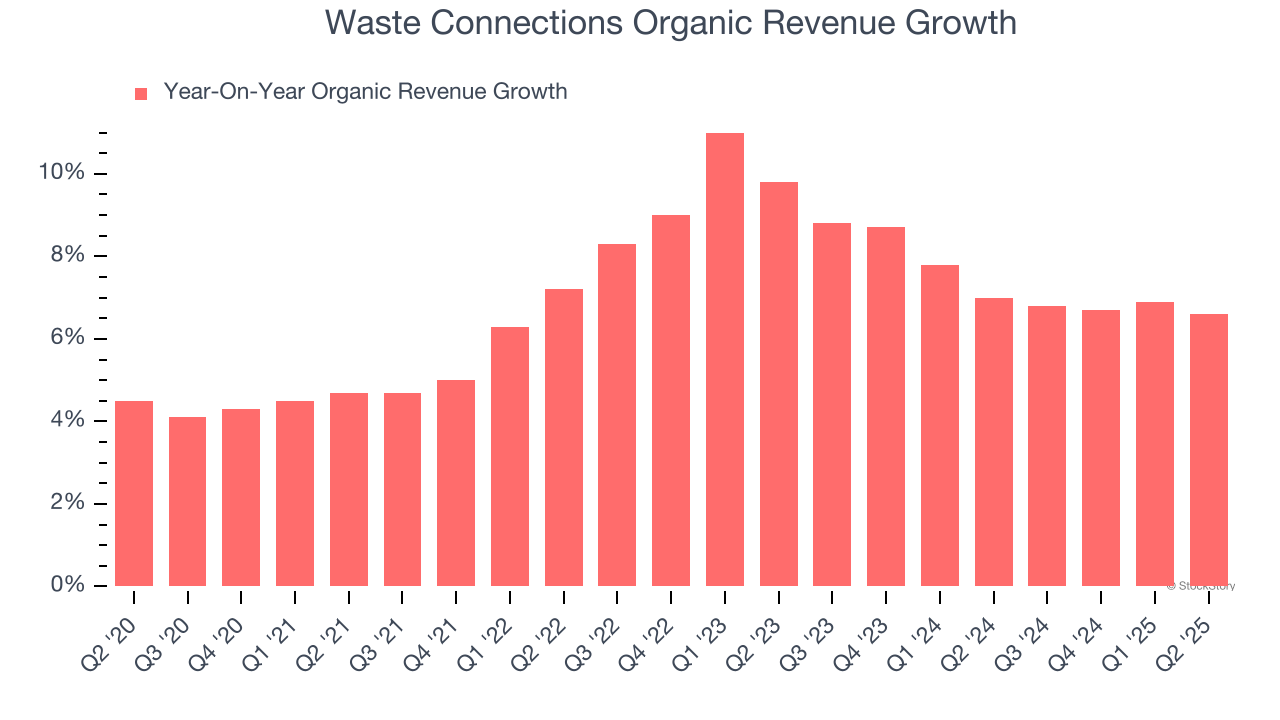

We can better understand Waste Management companies by analyzing their organic revenue. This metric gives visibility into Waste Connections’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Waste Connections’s organic revenue averaged 7.4% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Shrinking Operating Margin

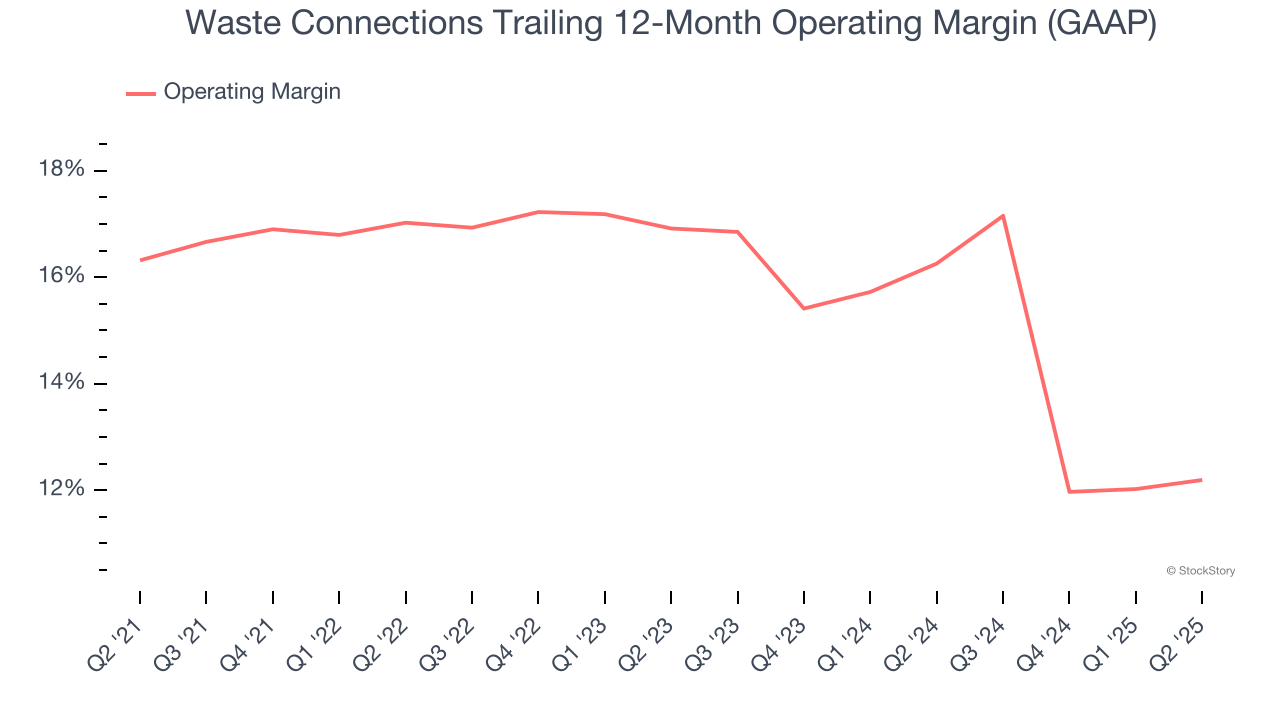

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Waste Connections’s operating margin decreased by 4.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 12.2%.

3. Previous Growth Initiatives Haven’t Impressed

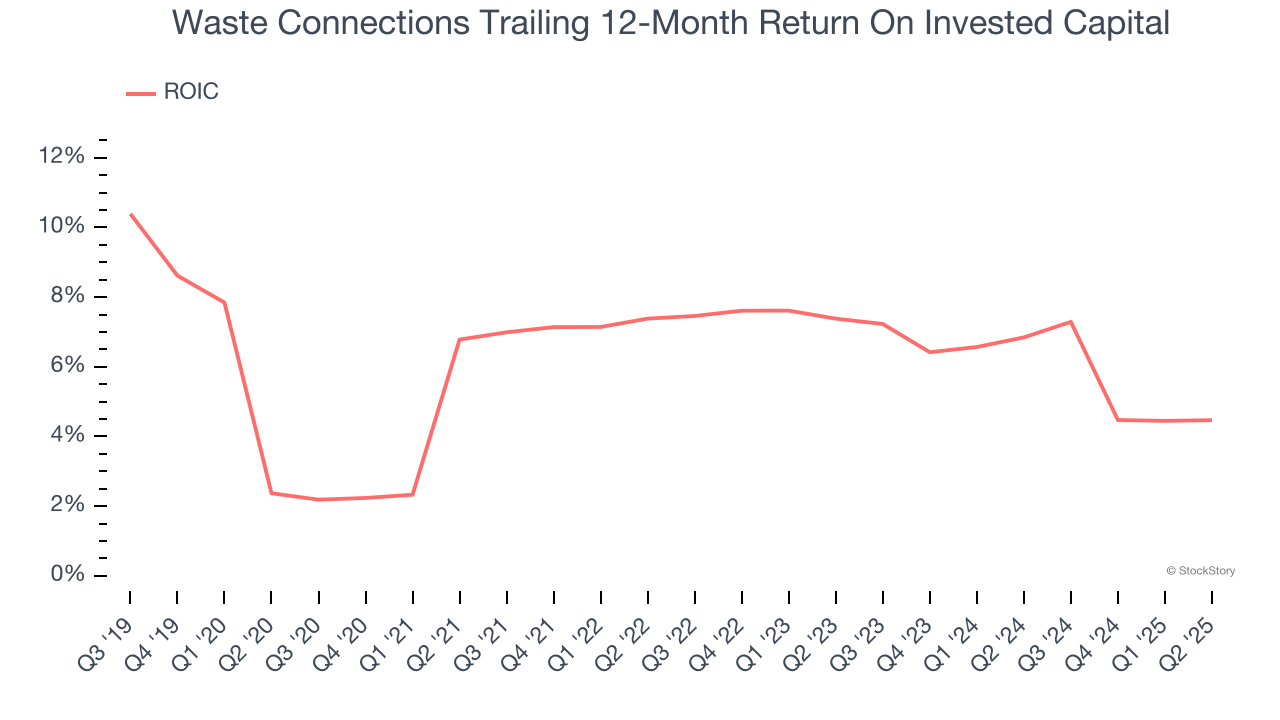

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Waste Connections historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.6%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

Waste Connections isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 32.4× forward P/E (or $173.69 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Waste Connections

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.