The platinum market has been on a tear lately, mirroring the broader frenzy in precious metals that has gotten everyone from day traders to institutional investors buzzing. Right now, these markets look seriously overextended, with prices surging way past their fundamentals in a classic case of momentum chasing. Take platinum itself—its nearby futures continuous chart price traded at $2,128.0, which is comfortably above the 50-day simple moving average (blue) and approaching its all-time high in 2008 of $2,308.8.

Source: Barchart.com

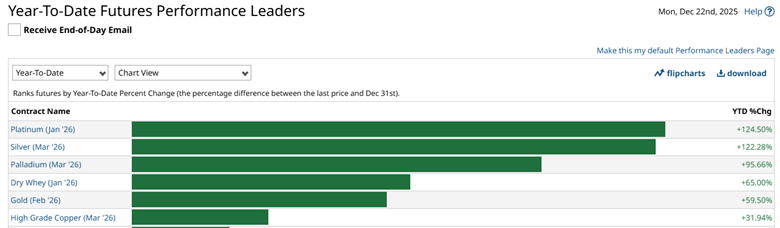

Gold and silver aren't far behind, both trading well north of their 50-day averages, too, suggesting the whole sector's stretched thin after months of upward pressure from economic uncertainty (tariffs) and interest rate jitters. That said, these metals have delivered some impressive runs, turning early buyers into happy campers with gains that'd make anyone's portfolio shine. Barchart's Year-To-Date Performance Leaders shows that 5 of the top 6 markets are metals.

Source: Barchart.com

If you haven't jumped in yet, it might be smart to hit pause and take a breather. We're not calling a top here by any means; the overall trend is still firmly upward, fueled by ongoing industrial demand and geopolitical tensions. But beginning new core positions at these elevated levels calls for caution, as pullbacks are inevitable in any hot market. Those dips will likely hand value hunters a sweeter entry point without the risk of buying at the peak of the hype.

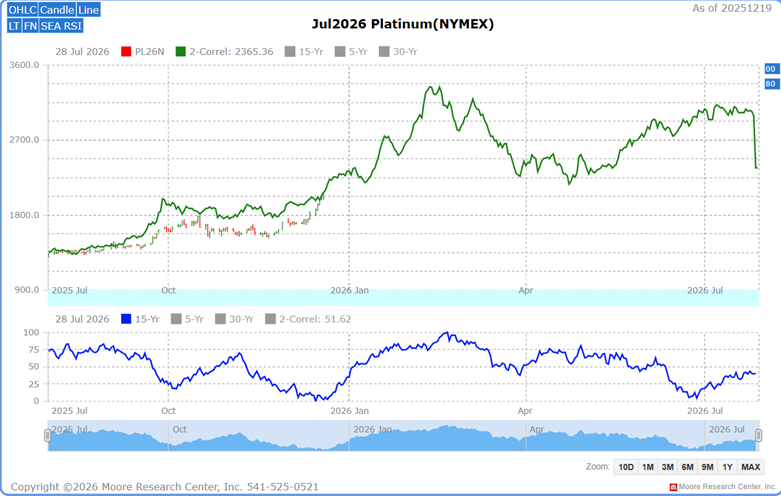

Seasonal Patterns and Correlated Market Years Research

Source: Moore Research Center, Inc. (MRCI)

For many traders, the latter part of December is a time to recap the current year and plan for the upcoming year. If 2026 is anything like 2025, one thing we can count on is uncertainty. To navigate these volatile periods, traders need a plan. And the discipline to follow it.

As of this writing, the Federal Reserve will continue to lower the Fed Funds rate at least twice in 2026, according to the Fed Funds futures contract traders' positions. Lower rates have been a significant tailwind for higher gold prices in 2025.

MRCI research has shown that significant lows have formed over the past 15 years (blue) in the latter portion of December. And prices have typically rallied from these lows until about mid-February. When we add the current bullish macro fundamentals across many metals markets, this seasonal pattern seems timely this year.

Currently, platinum is trading similarly to the two previous years, 1980:90% and 2000:84% (green). The current uptrend is breaking out to the upside, as did the correlated years. What's interesting is that the peak of these correlated years occurred in mid-February. For traders looking for a window to identify value in the platinum market, early and late January have seen a measurable price pullback.

As a crucial reminder, while seasonal patterns can provide valuable insights, they should not be the basis for trading decisions. Traders must consider technical and fundamental indicators, risk management strategies, and market conditions to make informed, balanced trading decisions.

Assets Traders Can Use to Participate in the Platinum Market

Traders looking to gain exposure to the platinum market have several practical options, depending on their goals, risk tolerance, and whether they prefer cash price or leveraged speculation. The most straightforward way for many retail investors is through physically backed exchange-traded funds (ETFs), which hold actual platinum bullion in secure vaults and closely mirror the spot price minus a small expense ratio. Popular choices include the abrdn Physical Platinum Shares ETF (PPLT), the largest ETF for platinum with over $2.06 billion in assets, trading like stocks on major exchanges and offering easy liquidity without the hassles of storing physical metal.

For more active traders, futures contracts on the CME Group (PL) provide direct access. Each contract represents 50 troy ounces of platinum, with high leverage and physical delivery options if held to expiration.

Other avenues include:

- Buying physical platinum bars or coins from dealers (best for long-term holders)

- Options on futures

- Shares in platinum mining companies, such as those focused on South African or Russian operations, provide indirect exposure tied to production and company performance.

In closing…

As we wrap up another whirlwind year in the precious metals arena, platinum and its counterparts have certainly rewarded those who rode the wave early, but the current stretch above key moving averages and the sheer momentum behind the rally scream for a measure of caution before piling in at these heights. With seasonal patterns hinting at potential December lows followed by a push into mid-February, much like the correlated breakout years of old, and the Fed likely easing rates further into 2026, the longer-term backdrop remains constructive. Yet, those inevitable January pullbacks could offer far better entry points for new core positions. Whether you lean toward the simplicity of ETFs like PPLT, the leverage of futures, or even physical bars for the long haul, the real edge comes from having a solid plan, respecting risk, and resisting the urge to chase highs in a market that's already delivered plenty of shine. Successful traders know that discipline and patience almost always outlast hype.

On the date of publication, Don Dawson did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Platinum Hits $2,128! Time to Chase or Wait for the Dip?

- The Nasdaq-100 ETF Just Flashed a Bearish Chart Signal. Here’s What Happens Next.

- Silver Prices Are Flying. Should You Try to Catch the Rally, or Bet Against It?

- Chip Stocks Are No Longer an Automatic Path to Profits. What the Numbers Say About This Key Semi ETF Now.