SoFi Technologies (SOFI) stock went higher on Thursday after the company introduced its first-ever stablecoin named SoFiUSD. This is a major development in its overall blockchain strategy. This development comes on the heels of SoFi Technologies launching SoFi Crypto. It seems like SoFi Technologies has embarked on accelerating its expansion plan in the crypto space.

Although stablecoins are not uncommon in today's crypto community, this announcement is remarkable because SoFi is launching with the distinct advantage and competitive edge of being a regulated national bank. In fact, as announced by management, they are not launching a product for speculative purposes but to address true inefficiencies in payment flows, settlement, and movement of liquidity. The market has reacted favorably to this announcement as merely an extension of SoFi's increasing fee-based and technology-driven business lines.

About SoFi Technologies Stock

SoFi Technologies is a digital financial services company, and its headquarters are in San Francisco, California. This company has an extensive ecosystem that encompasses lending, banking, investing, credit cards, and financial planning, all in one mobile platform. With SoFi Bank, the company additionally holds a national banking charter, which provides the company with some advantages in regulation over its fintech rivals. Its market capitalization of $32 billion falls into the large-cap fintech space.

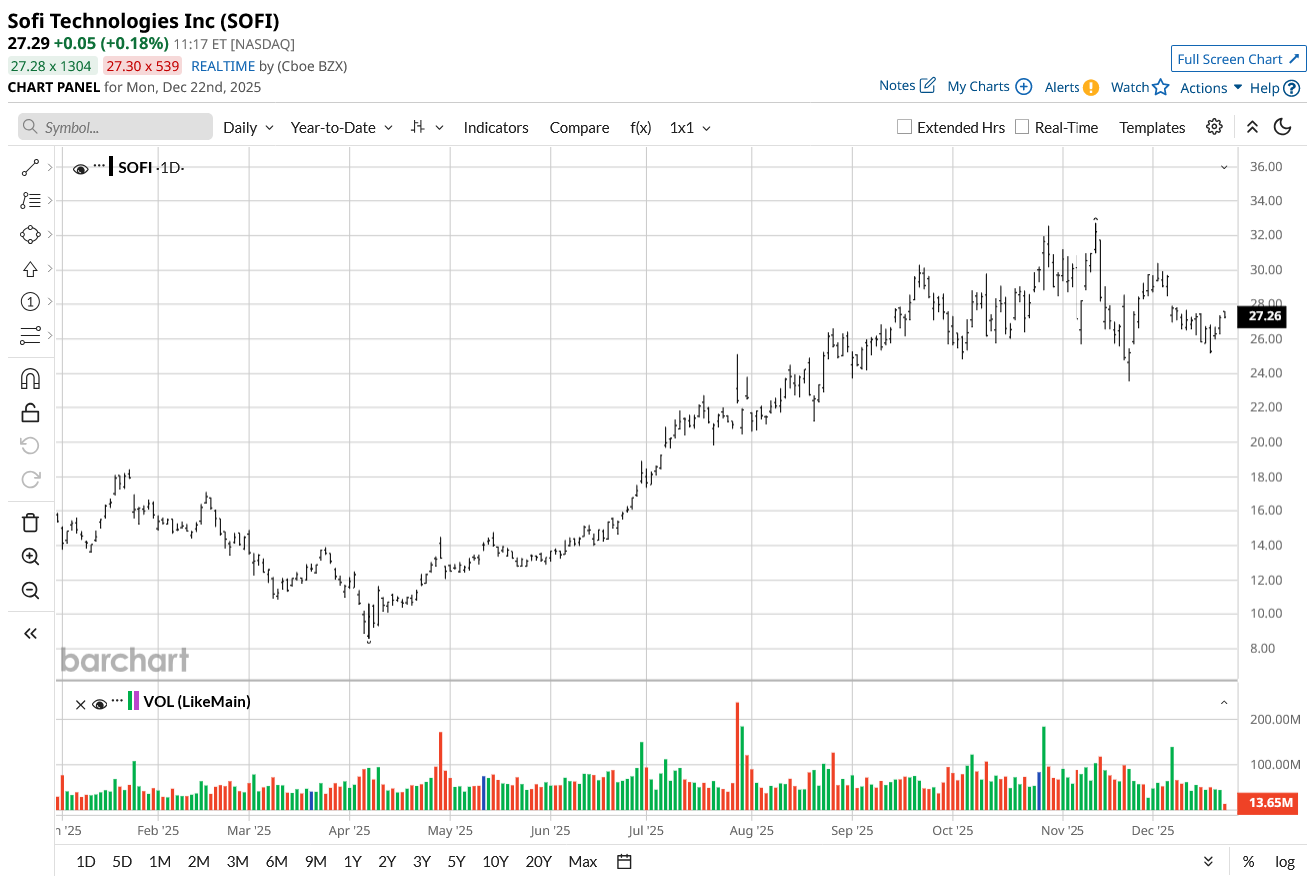

SOFI stock has remained quite volatile throughout the past year and has ranged from a low of $8.60 to a high of $32.73 over the 52-week period. Although the stock has registered a strong appreciation over the past year, it has not yet touched its recent peak. Currently trading at approximately $27 per stock, the stock has nonetheless beaten the overall market for the past 12 months.

Valuation-wise, SoFi stands out with high multiples. In terms of trailing and forward P/E multiples, it stands at 84x and 68x, respectively, which indicate that the market continues to expect a certain level of earnings growth. A P/S multiple of 11.4x indicates that it is a premium compared to traditional banks. However, it is not significantly different compared to fintech companies that are infrastructure-driven.

SoFi Delivers Strong Q3 Earnings and Expands Its Crypto Vision

SoFi has most recently reported results on Oct. 28, with its EPS for Q3 2025 at $0.11, a sharp doubling of results from a year ago. Net revenue increased by 38% to $961.6 million, while net income surged 129% from a year ago. In addition, SoFi posted its eighth consecutive profitable quarter on a GAAP basis.

Adjusted EBITDA increased to $276.9 million, an adjusted margin of 29%, with adjusted net revenue hitting an all-time high of $949.6 million. Notably, the company emphasized accelerated membership growth with the addition of 905,000 members in the quarter, bringing the membership base to 12.6 million. In addition, product adoption rates continued at high levels, with 40% of new product accounts represented by existing members.

In this light, the introduction of the SoFiUSD stands out against the broader strategy aimed at fee-driven growth and infrastructure monetization. Specifically, the management clarified that the stablecoin is not only going to benefit its customers but will also provide the infrastructure on a white-label basis for other banks and fintech companies. The CEO, Anthony Noto, claimed that blockchain technology is in the midst of a supercycle, with the SoFiUSD being one of the instruments useful for overcoming slow settlement times, regionalization, and transparency of reserves.

SoFi has not yet offered revenue guidance on the stablecoin business. However, the fact that it has been noted together with other high-margin revenue sources such as the Loan Platform Business and Financial Services operating segment indicates it will be a source of revenue growth in the long run.

What Do Analysts Expect for SOFI Stock?

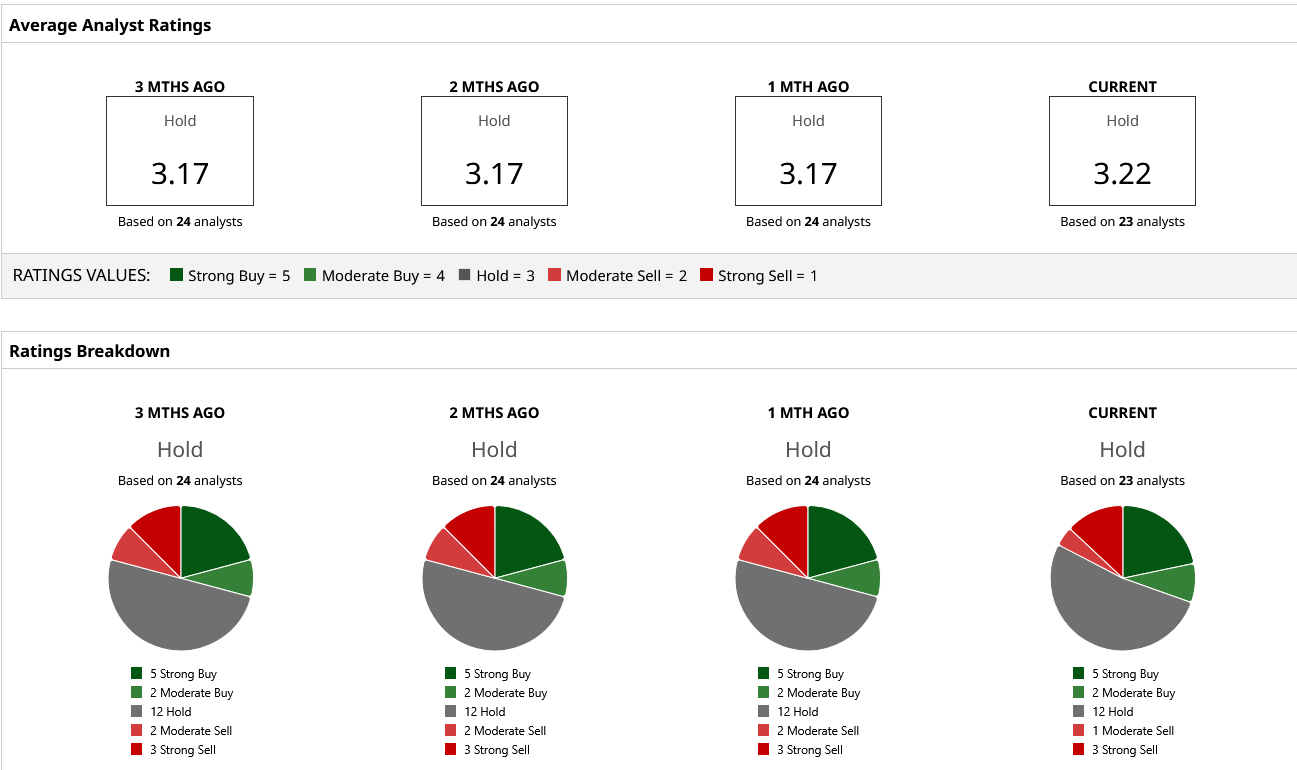

Wall Street is quite neutral about SOFI at this point. Analysts following the stock have a “Hold” rating consensus and a price target of $27.69, which is quite close to the stock's current price. Analyst targets show a great variance in value, from a high point at $38 to a low point at $12. The wide range of targets reflects that it is not just the growth rate and profitability that are being compared, but also what type of growth and profitability SoFi can potentially deliver and how that affects valuation multiples going forward.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart