Valued at a market cap of $42.8 billion, D.R. Horton, Inc. (DHI) is a leading homebuilding company based in Arlington, Texas. It constructs a wide range of residential homes, including single-family detached homes, townhomes, and duplexes and also provides related services such as mortgage financing, title agency services, and residential lot development. It is scheduled to announce its fiscal Q1 earnings for 2026 before the market opens on Tuesday, Jan. 20.

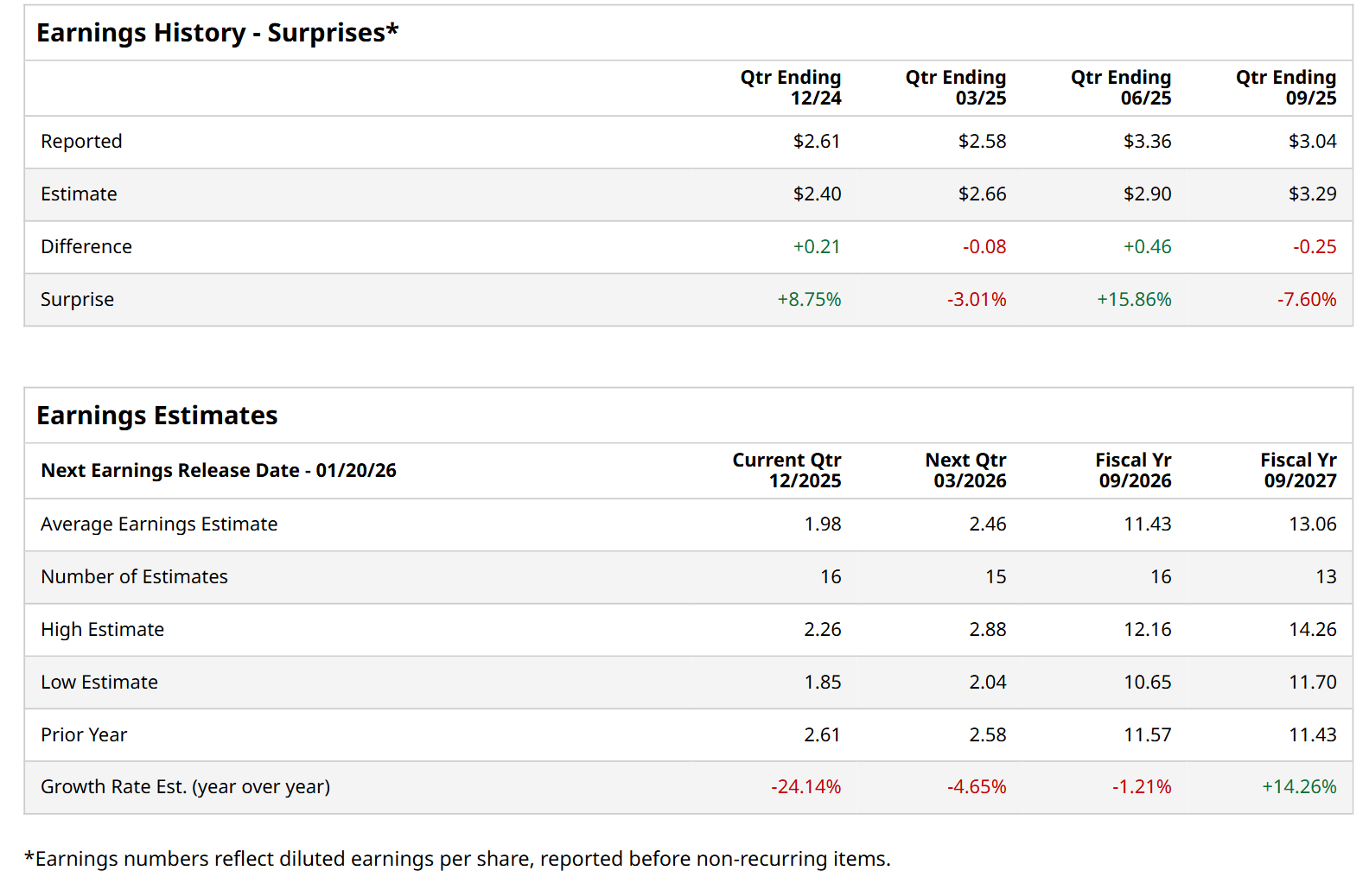

Ahead of this event, analysts expect this homebuilding company to report a profit of $1.98 per share, down 24.1% from $2.61 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. In Q4, DHI’s EPS of $3.04 fell short of the forecasted figure by 7.6%.

For fiscal 2026, ending in September, analysts expect DHI to report a profit of $11.43 per share, down 1.2% from $11.57 per share in fiscal 2025. Nonetheless, its EPS is expected to grow 14.3% year-over-year to $13.06 in fiscal 2027.

Shares of DHI have gained 7.2% over the past 52 weeks, trailing behind the S&P 500 Index's ($SPX) 16.5% return over the same time frame. However, it has outpaced the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 6.8% uptick over the same time period.

Shares of DHI surged 4.1% on Dec. 3, after BTIG initiated coverage on the company with a "Buy" rating and a $186 price target. The positive analyst view came amid a generally favorable outlook for the U.S. housing market, with forecasts pointing to gradually lower mortgage rates, better affordability as incomes rise, and limited housing supply, a combination that is expected to keep demand strong and home prices supported.

Wall Street analysts are moderately optimistic about DHI’s stock, with a "Moderate Buy" rating overall. Among 20 analysts covering the stock, seven recommend "Strong Buy," 11 indicate "Hold,” and two suggest "Strong Sell.” The mean price target for DHI is $164.27, indicating an 11.8% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Small Bank Stock Has Big Predicted Growth Ahead

- SoFi Just Launched Its Stablecoin. What Does That Mean for the SOFI Stock Bull Case?

- DoorDash Is Getting into the AI Game. Should You Buy DASH Stock Here

- Oracle May Not Be Able to Build Its Michigan Data Center After All. Should You Sell ORCL Stock Now?