News Source: Down Payment Resource

Down payment assistance, with an average benefit of $18,000, remains a bright spot for the nation's homebuyers, with more programs supporting a variety of needs, income levels and property types

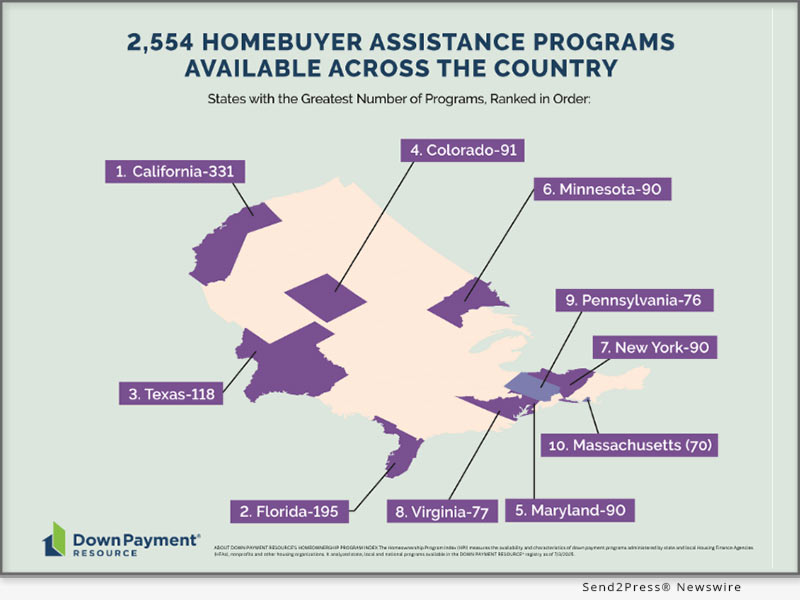

ATLANTA, Ga., July 29, 2025 (SEND2PRESS NEWSWIRE) — Down Payment Resource (DPR), the housing industry authority on homebuyer assistance program data and solutions, today released its Q2 2025 Homeownership Program Index (HPI) report. The report finds 45 new programs launched in Q2, traditionally the busiest homebuying season, bringing the total number of available programs to 2,554 — a new record — and the number of program providers to 1,340.

Image caption: Down Payment Resource’s Q2 2025 HPI Report.

Down payment assistance (DPA) can be used by lenders to lower a homebuyer’s loan-to-value (LTV) ratio by an average of 6%, helping them qualify more of their mortgage-ready buyers. In addition to down payments, many DPA programs can help with closing costs, prepaid expenses, buying down the mortgage interest rate, and even lessening mortgage insurance expenses. In some cases, buyers can combine multiple programs for even greater savings. This assistance is vital as the median home price in the U.S. increased to $369,000 in Q2 2025, from $350,275 in Q1, while the average 30-year fixed mortgage rate for the quarter was 6.82%.

“With home prices rising and interest rates still hovering close to 7%, prospective homebuyers are feeling the pinch heading into the summer, traditionally a very active homebuying season,” said Rob Chrane, founder and CEO of DPR. “Even with these market headwinds, we are heartened to find more assistance programs than ever—at least one in every U.S. county and 2,000 counties with 10 or more—helping lenders qualify eligible buyers and close more loans in this tough market.”

KEY Q2 2025 HPI REPORT FINDINGS

An examination of the existing 2,554 homebuyer assistance programs on July 3, 2025, resulted in the following key findings:

- 45 homebuyer assistance programs were added in Q2 2025, a 2% increase from Q1 2025. 967 programs (38%) are available to repeat buyers. 257 programs (10%) do not have income restrictions, increasing the number of buyers who might qualify for assistance. 31 programs support first-generation homebuyers, an increase of 7% over the last quarter.

- The number of programs supporting manufactured housing grew 4%, from 971 in Q1 2025 to 1,006 in Q2 2025. According to the Manufactured Housing Institute, manufactured homes are considered an affordable housing supply because they are significantly cheaper to purchase than site-built homes. The average cost per square foot is around $87 versus $166.

- 861 programs support the purchase of multi-family housing, a 3% increase from the previous quarter. Of these, a growing number of programs support purchasing three-unit homes (573) and four-unit homes (546). Investing in multifamily properties can generate cash flow and potentially offer buyers tax advantages.

- Below-market-rate (BMR)/resale-restricted programs increased 9%. BMR/resale-restricted programs offer housing at prices lower than the open market, with restrictions on resale to ensure affordability for future buyers, typically low-to-moderate-income households.

- 81% of DPAs are deferred payment programs, a 2% increase from the previous quarter. With a deferred payment loan, borrowers don’t make monthly payments, and the balance is typically due when they sell or refinance, or the loan matures. Many of these loans are also forgivable. 53% of DPAs offer partial or full forgiveness over time, as long as the homeowner meets certain requirements, such as maintaining primary residency.

- 1,011 programs (40%) were offered through municipalities or local program providers, a 2% increase over the previous quarter and 46% YoY increase. Programs sponsored by employers increased 8% MoM to 3% of the total—a 33% YoY increase. Housing authorities, independent governmental bodies that provide and manage affordable housing options for low-income, elderly and disabled buyers, accounted for 4% of programs, up 1% from the previous quarter.

- 198 programs offer special incentives based on the buyer’s occupation or other characteristics. Of these, 68 offer assistance for educators, 52 to Native Americans, 45 to military Veterans, and 35 to active-duty military. It’s important to note that these buyers can also qualify for many of the other 2,554 programs in the Down Payment Resource database.

- 118 programs are “multi-state,” a 31% YoY increase, meaning they are available for buyers in two states or more. Plus, the report noted a growing number of in-state programs in Hawaii, Missouri, Oklahoma, Pennsylvania and Virginia.

A more detailed analysis of the Q2 2025 HPI findings, including infographics and examples of the programs described in this release, can be found on DPR’s website at: https://downpaymentresource.com/professional-resource/45-new-programs-were-added-in-q2-2025-helping-to-make-homeownership-more-affordable-for-buyers-nationwide/.

For a complete list of homebuyer assistance programs by state, visit: https://downpaymentresource.com/wp-content/uploads/2025/07/HPI-state-by-state-data.Q22025.pdf.

Members of the media are encouraged to contact DPR for data specific to their reporting needs.

METHODOLOGY

Published quarterly, DPR’s HPI surveys the funding status, eligibility rules and benefits of U.S. homebuyer assistance programs administered by state and local housing finance agencies, municipalities, nonprofits and other housing organizations. DPR communicates with over 1,300 program providers throughout the year to track and update the country’s wide range of homeownership programs, including down payment and closing cost programs, Mortgage Credit Certificates (MCCs) and affordable first mortgages, in the DOWN PAYMENT RESOURCE® database.

About Down Payment Resource:

Down Payment Resource (DPR) is the housing industry authority on homebuyer assistance program data and solutions. With a database that tracks more than 2,500 programs and toolsets for mortgage lenders, multiple listing services (MLSs) and API users, DPR helps housing professionals connect homebuyers with the assistance they need. DPR frequently lends its expertise to nonprofits, housing finance agencies, policymakers, government-sponsored enterprises and trade organizations seeking to improve housing affordability. Its technology is used by seven of the top 25 mortgage lenders, the three largest real estate listing websites and 600,000 real estate agents. For more information, visit https://downpaymentresource.com/.

X: @DwnPmtResource #downpaymentassistance #affordabilitycrisis #housingaffordability #mortgage #housingequity #downpayment

This press release was issued on behalf of the news source (Down Payment Resource), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/45-new-assistance-programs-launched-during-q2-2025-bringing-the-total-number-of-nationwide-programs-to-a-record-breaking-2554/

Copr. © 2025 Send2Press® Newswire, Calif., USA. -- REF: S2P STORY ID: S2P128066 FCN24-3B

INFORMATION BELOW THIS PAGE, IF ANY, IS UNRELATED TO THIS PRESS RELEASE.