News Source: LenderLogix

BUFFALO, N.Y., Aug. 5, 2025 (SEND2PRESS NEWSWIRE) — LenderLogix, a leading provider of mortgage point-of-sale and automation software for banks, credit unions, independent mortgage banks, and brokers, today announced the release of the Homebuyer Intelligence Report, a quarterly summary of insights into borrower behavior during the home-buying process based on data collected by the LenderLogix suite of tools. The latest report covers data collected during the pre-approval and borrower application process in the second quarter (Q2) of 2025.

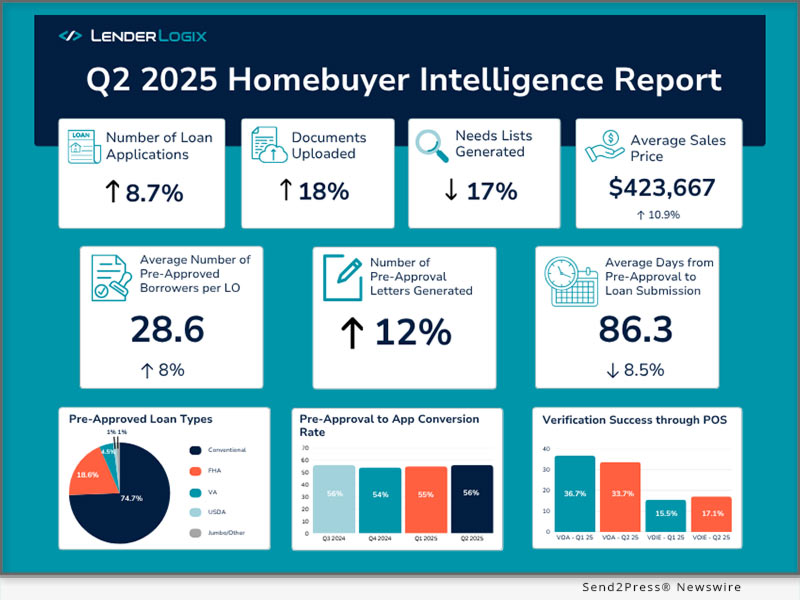

Image caption: Infographic: LenderLogix Q2 Homebuyer Intelligence Report.

Pre-Approvals

In Q2 2025, borrowers generated 11.9% more pre-approval letters through LenderLogix’s QuickQual pre-approval platform over Q1 2025. The average number of pre-approved borrowers per loan officer increased from 26.5 in Q1 2025 to 28.6 in Q2 2025.

The average pre-approval letter loan amount increased from $326,714 in Q1 to $367,305 in Q2. The average sales price also increased significantly from $381,820 to $423,667. The average down payment size shows a slight decrease from 14.4% in Q1 to 13.3%.

Conventional loans remained the most popular loan type for pre-approved borrowers in Q2, increasing marginally from 74.2% to 74.7% over the prior quarter. FHA pre-approvals decreased marginally from 19% to 18.6%. VA (4.5%) and USDA (1%) maintained their share from Q1 to Q2 2025.

“Despite the increase in sales price, we’ve seen increased prequalification numbers for conventional, FHA VA and USDA loans, demonstrating borrowers’ desire to purchase,” said LenderLogix Co-Founder and CEO Patrick O’Brien. “Lenders and real estate partners need to be vigilant to help borrowers find homes that fit their prequalification amounts.”

Borrower Conversion

Of the borrowers using QuickQual in Q1 2025, the average number of days between pre-approval and loan submission increased from 79.6 to 86.3 days in Q2. The most prolonged duration between pre-approval and application decreased by sixty-three days from 709 in Q1 to 646 in Q2. The conversion rate among borrowers from pre-approval to loan application increased slightly from 55% to 56% in Q2. Borrowers maintained an average of eight pre-approval letters before converting. In total, new applications through the LiteSpeed point-of-sale (POS) platform increased 8.7% from Q1 2025 to Q2 2025.

“Overall, borrower conversion and activity are remaining fairly steady,” said O’Brien. “Lenders must hone their marketing and outreach strategies to effectively reach the prepared borrowers in their area to remain competitive.”

Post-Application Engagement

In Q2 2025, the number of documents uploaded through LiteSpeed grew 18.3% quarter-over-quarter. The number of newly created needs lists, including both online applications and those entered by loan officers, decreased 16.7% in Q2.

Successful verification of income and employment (VOIE) through POS improved, increasing from 15.5% in Q1 to 17.1% in Q2. Verification of assets (VOA) decreased slightly from 36.7% to 33.7% over the same period.

“While we saw a dip in Needs List creation, the continued growth in document uploads and improved VOIE success rates suggest borrowers are more prepared and proactive after application,” O’Brien added. “That preparation ultimately helps lenders build cleaner, faster-moving loan files.”

Data from LenderLogix Homebuyer Intelligence Report is available to the industry free of charge. To learn more about LenderLogix, visit www.lenderlogix.com.

About LenderLogix

LenderLogix leverages the four decades of firsthand mortgage origination and real estate experience of its executive team to design customized software to meet the needs of today’s mortgage lenders. The company’s suite of products addresses the speed at which today’s real estate market moves by delivering technology solutions that create agile and informed borrowers, build strong referral partners and ultimately save lenders time and money. For more information, visit https://www.lenderlogix.com/.

This press release was issued on behalf of the news source (LenderLogix), who is solely responsible for its accuracy, by Send2Press Newswire.

To view the original story, visit: https://www.send2press.com/wire/lenderlogix-q2-2025-homebuyer-intelligence-report-shows-increased-loan-quantities-as-borrower-activity-holds-steady/

Copr. © 2025 Send2Press® Newswire, Calif., USA. -- REF: S2P STORY ID: S2P128239 FCN24-3B

INFORMATION BELOW THIS PAGE, IF ANY, IS UNRELATED TO THIS PRESS RELEASE.