Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Alphabet (NASDAQ: GOOGL) and the best and worst performers in the consumer internet industry.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Luckily, consumer internet stocks have performed well with share prices up 12.6% on average since the latest earnings results.

Alphabet (NASDAQ: GOOGL)

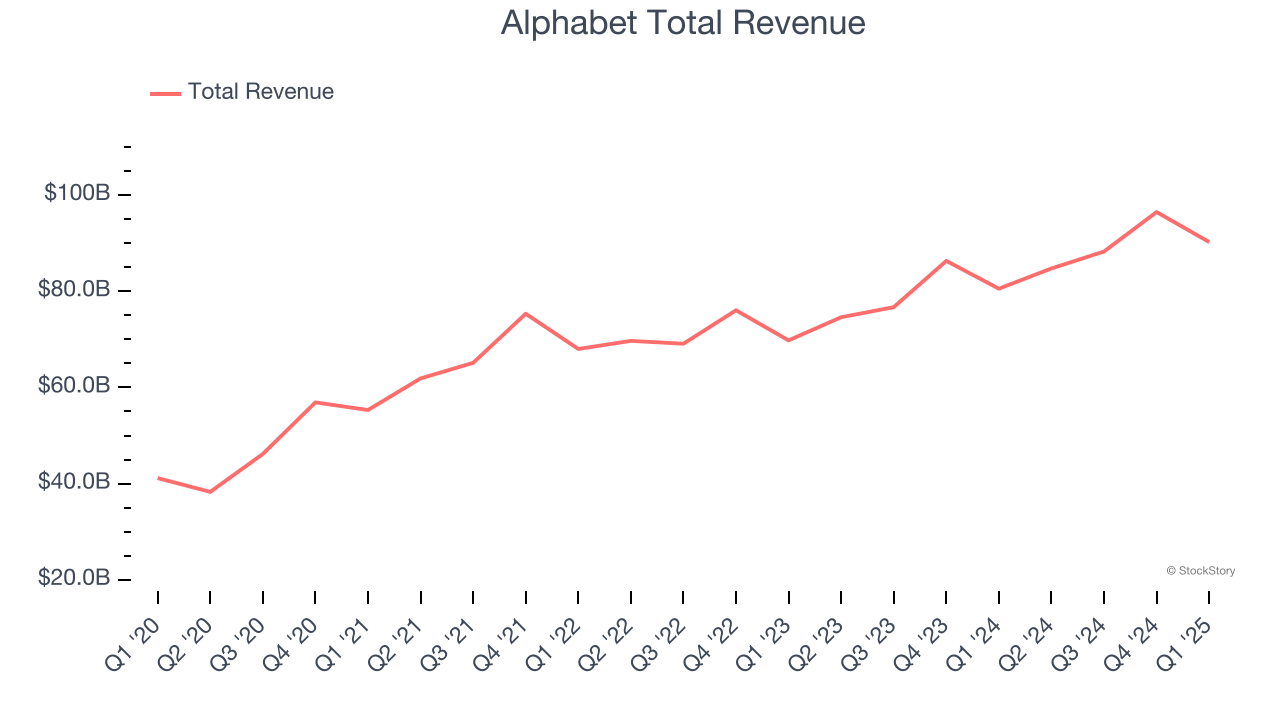

Started by Stanford students Larry Page and Sergey Brin in a Menlo Park garage, Alphabet (NASDAQ: GOOGL) is the parent company of the eponymous Google Search engine, Google Cloud Platform, and YouTube.

Alphabet reported revenues of $90.23 billion, up 12% year on year. This print exceeded analysts’ expectations by 1.2%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ operating income estimates.

Interestingly, the stock is up 10% since reporting and currently trades at $174.97.

We think Alphabet is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q1: Carvana (NYSE: CVNA)

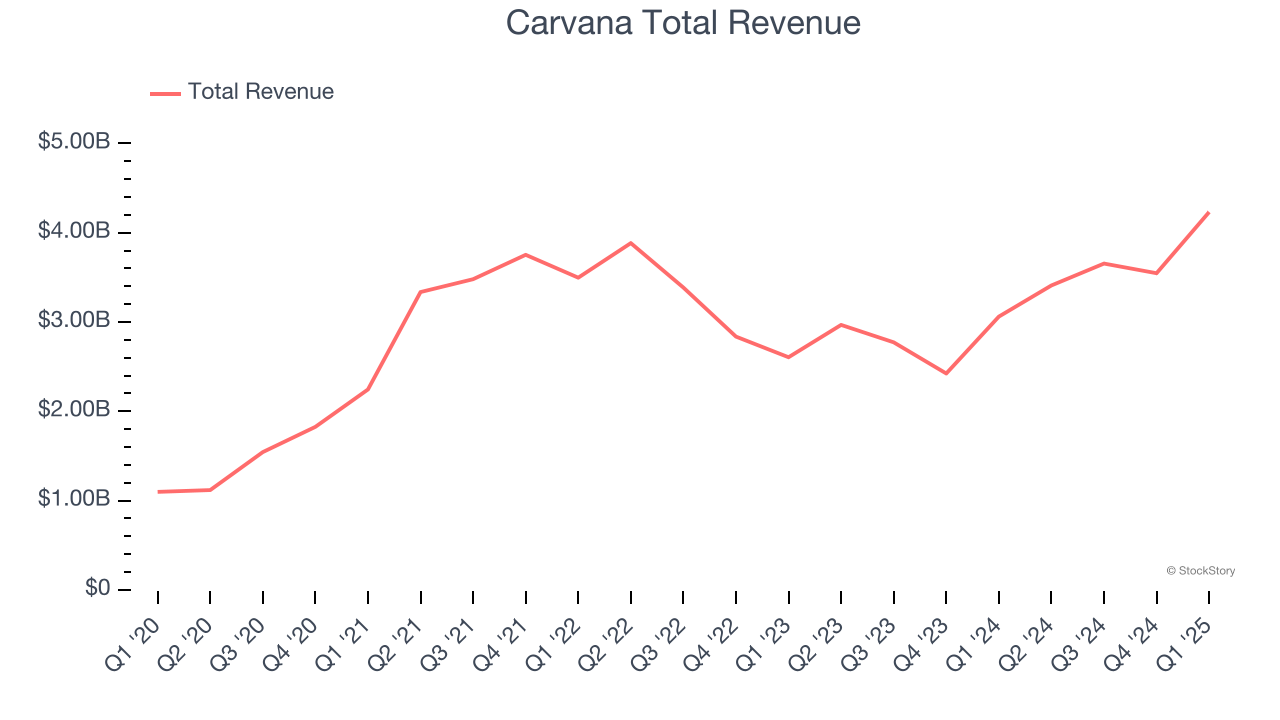

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.23 billion, up 38.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 26.4% since reporting. It currently trades at $326.90.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $160 million, up 11.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 23.3% since the results and currently trades at $5.60.

Read our full analysis of The RealReal’s results here.

Airbnb (NASDAQ: ABNB)

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $2.27 billion, up 6.1% year on year. This print topped analysts’ expectations by 0.6%. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates.

The company reported 143.1 million nights booked, up 7.9% year on year. The stock is up 5.2% since reporting and currently trades at $130.51.

Read our full, actionable report on Airbnb here, it’s free.

Booking (NASDAQ: BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

Booking reported revenues of $4.76 billion, up 7.9% year on year. This result surpassed analysts’ expectations by 3.6%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and solid growth in its bookings.

The company reported 319 million nights booked, up 7.4% year on year. The stock is up 12% since reporting and currently trades at $5,505.

Read our full, actionable report on Booking here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.