Brokers profit when clients lose — Afterprime 2.0 ends that conflict with the world’s first Pay-to-Trade model on an aligned execution model.

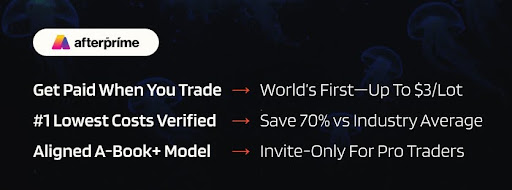

Sydney, Australia, October 1st, 2025- Afterprime, a next-generation FX and CFD broker, today announced the launch of Afterprime 2.0, a direct challenge to legacy brokerage practices. With the industry’s first Pay-to-Trade model, Afterprime compensates traders for trading flow — while independent verification from ForexBenchmark ranks it as the #1 lowest-cost broker globally.

For decades, retail trading has been dominated by B-book models — where brokers profit when their clients lose, dressed up with gimmicks like bonuses, inflated spreads, affiliates and paid-for awards. Afterprime 2.0 flips that equation, eliminating the conflict of interest. Unlike legacy brokers, Afterprime does not profit from client losses. Its success grows only when client flow is sustainable and profitable.

“For too long, retail brokerage has been shaped by models where brokers win at the expense of their clients,” said Jeremy Kinstlinger, CEO & Co-Founder of Afterprime. “Afterprime 2.0 shows there’s a better path — one built on verified lowest costs, aligned execution, and a model that rewards traders for the flow they generate. It’s a new standard for fairness and transparency in the industry.”

Independent data from ForexBenchmark confirms that Afterprime’s all-in costs are 40–70% lower than leading competitors. This cost leadership, combined with Flow Rewards, creates a structural edge for professional traders.

Elan Bension, Co-Founder of Afterprime, commented: “Independent verification is critical in an industry where claims are often difficult to substantiate. By submitting our pricing to third-party audits, we’ve provided objective proof of our cost leadership. The introduction of Flow Rewards builds on that foundation, creating a structure where incentives are transparent and fully aligned with long-term client success.”

How it works

Instead of adding commissions to spreads, Afterprime credits traders for trading flow on zero commission trading. Orders are passed to top-tier liquidity providers and monetized at scale, with rewards shared back directly to clients. The result: a broker incentivized to foster profitable, long-term trading, not churn or client blow-ups.

Invite-only access

To protect execution quality, Afterprime 2.0 is invite-only. Traders are admitted through qualification, referrals, or the waitlist. Its active Discord community plays a central role — where traders share feedback, propose features, and hold Afterprime accountable in real time.

The bigger picture

By combining verified lowest costs, Pay-to-Trade rewards, and community-driven accountability, Afterprime 2.0 represents a reset of retail brokerage. Much like Robinhood’s move to zero commissions, Afterprime pushes further — beyond zero cost, to a model where traders are paid for the value of their flow.

“This isn’t just a product launch,” said Jeremy Kinstlinger, CEO & Co-Founder of Afterprime. “It’s a defining moment. Legacy brokers can stick with outdated, conflicted models — we’re building a cleaner, fairer, and fully aligned future for serious traders.”

About Afterprime

Afterprime is a next-generation FX and CFD broker built to end the conflicts of legacy B-book models. Operating on an aligned execution model, it never profits from client losses.

Independent verification from ForexBenchmark (2025) ranks Afterprime #1 globally for lowest all-in trading costs across 40+ FX pairs. With an invite-only model and an active Discord community, Afterprime combines Pay-to-Trade rewards, verified lowest costs, and institutional-grade execution to create a brokerage fully aligned with trader success.

Afterprime represents the next evolution of retail trading — where trust is earned through data, incentives are transparent, and traders finally operate on the same terms as institutions.