As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at software development stocks, starting with GitLab (NASDAQ: GTLB).

As legendary VC investor Marc Andreessen says, "Software is eating the world", and it touches virtually every industry. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming.

The 11 software development stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

Luckily, software development stocks have performed well with share prices up 17.2% on average since the latest earnings results.

GitLab (NASDAQ: GTLB)

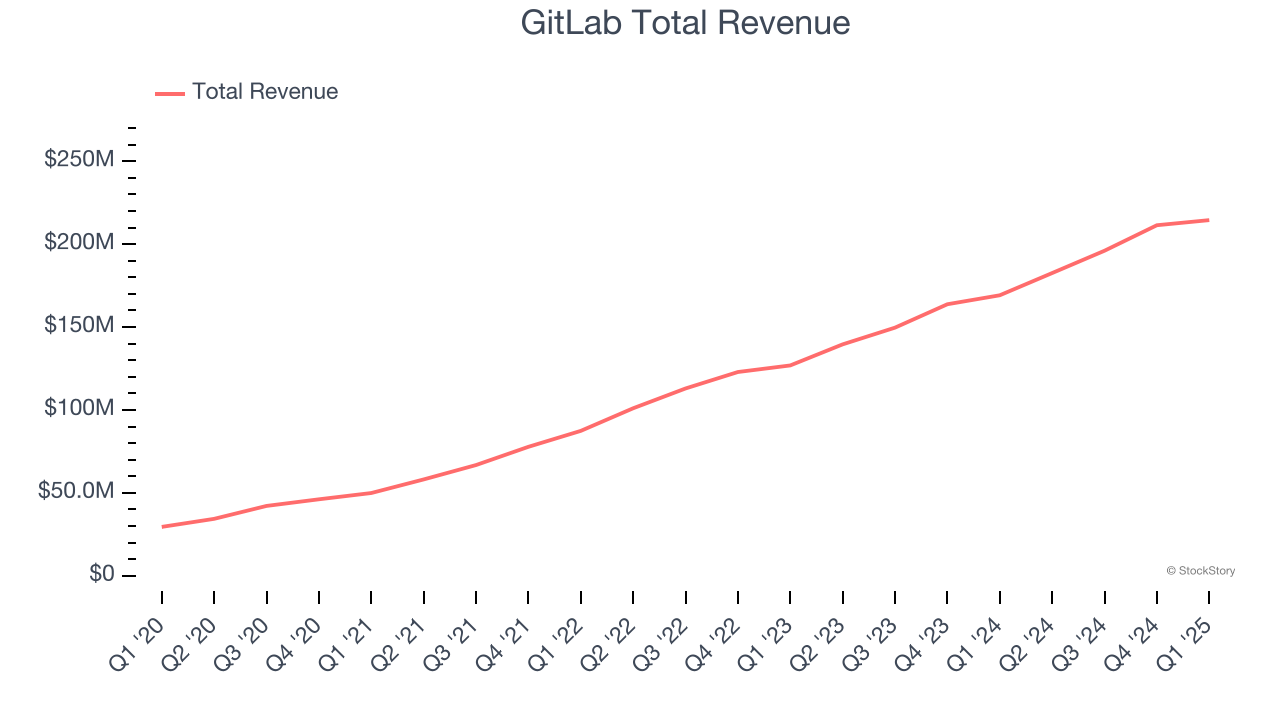

Founded as an open-source project in 2011, GitLab (NASDAQ: GTLB) is a leading software development tools platform.

GitLab reported revenues of $214.5 million, up 26.8% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

GitLab achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 6.6% since reporting and currently trades at $45.35.

Best Q1: Fastly (NYSE: FSLY)

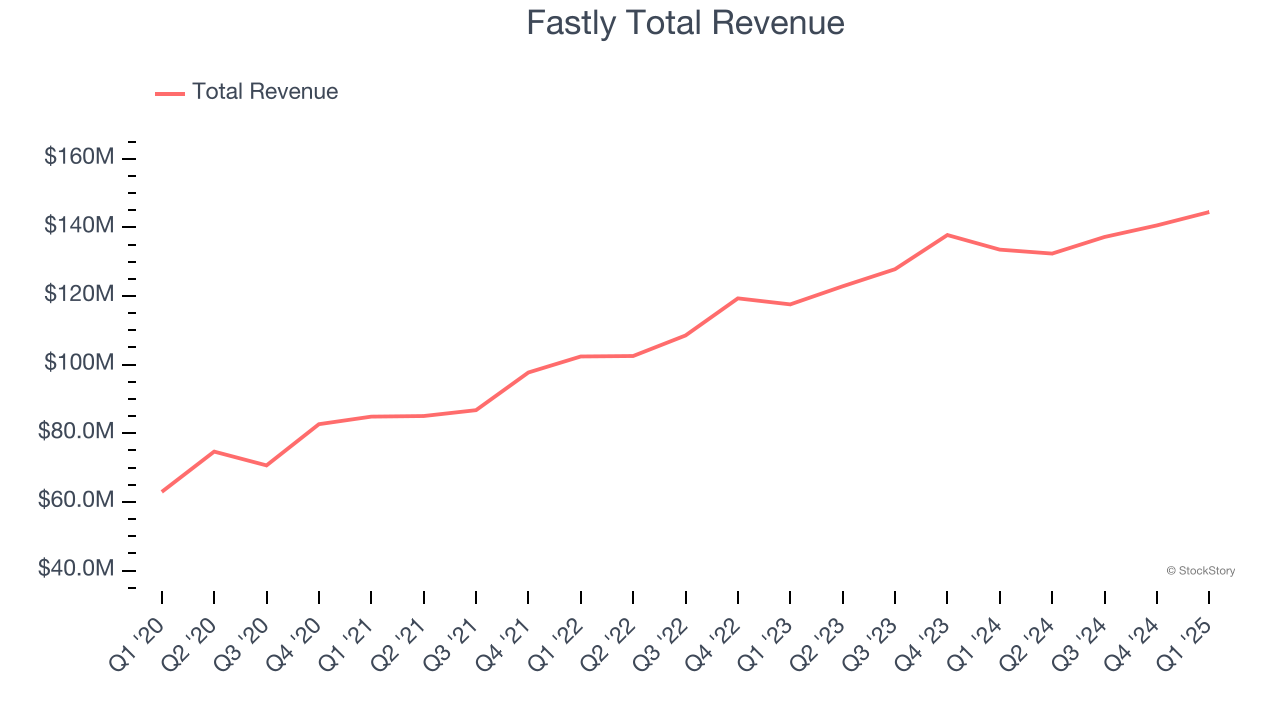

Founded in 2011, Fastly (NYSE: FSLY) provides content delivery and edge cloud computing services, enabling enterprises and developers to deliver fast, secure, and scalable digital content and experiences.

Fastly reported revenues of $144.5 million, up 8.2% year on year, outperforming analysts’ expectations by 4.8%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

Fastly achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 18.5% since reporting. It currently trades at $7.12.

Is now the time to buy Fastly? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: F5 (NASDAQ: FFIV)

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ: FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $731.1 million, up 7.3% year on year, exceeding analysts’ expectations by 1.7%. Still, it was a mixed quarter as it posted EPS guidance for next quarter missing analysts’ expectations.

Interestingly, the stock is up 14% since the results and currently trades at $302.17.

Read our full analysis of F5’s results here.

JFrog (NASDAQ: FROG)

Named after the founders' affinity for frogs, JFrog (NASDAQ: FROG) provides a software-as-a-service platform that makes developing and releasing software easier and faster, especially for large teams.

JFrog reported revenues of $122.4 million, up 22% year on year. This number surpassed analysts’ expectations by 4.4%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

The company added 33 enterprise customers paying more than $100,000 annually to reach a total of 1,051. The stock is up 18.9% since reporting and currently trades at $41.85.

Read our full, actionable report on JFrog here, it’s free.

Cloudflare (NYSE: NET)

Founded by two grad students of Harvard Business School, Cloudflare (NYSE: NET) is a software-as-a-service platform that helps improve the security, reliability, and loading times of internet applications.

Cloudflare reported revenues of $479.1 million, up 26.5% year on year. This result topped analysts’ expectations by 2.1%. More broadly, it was a mixed quarter as it also produced an impressive beat of analysts’ billings estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

The stock is up 58.5% since reporting and currently trades at $197.44.

Read our full, actionable report on Cloudflare here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.