StepStone Group has had an impressive run over the past six months as its shares have beaten the S&P 500 by 12.9%. The stock now trades at $70.63, marking a 23.7% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy STEP? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Is STEP a Good Business?

Operating as both an advisor and asset manager with over $100 billion in assets under management, StepStone Group (NASDAQ: STEP) is an investment firm that provides clients with access to private market investments across private equity, real estate, private debt, and infrastructure.

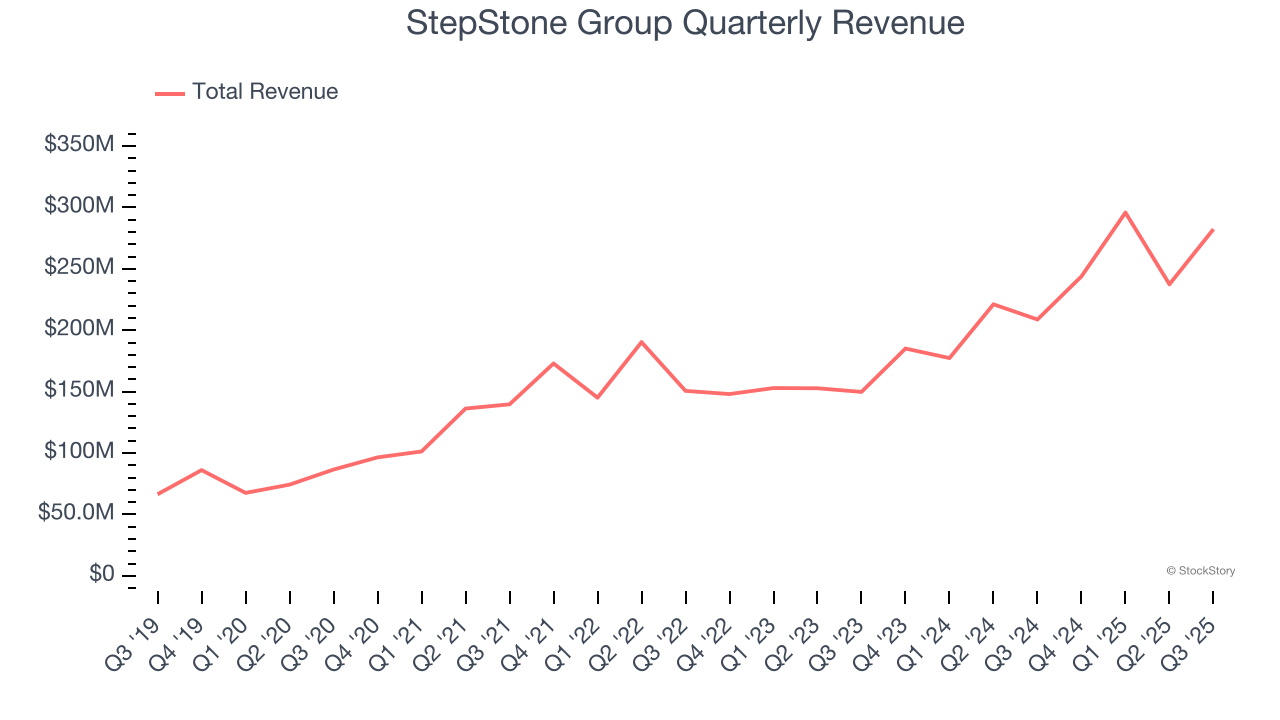

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Over the last five years, StepStone Group grew its revenue at an incredible 27.5% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

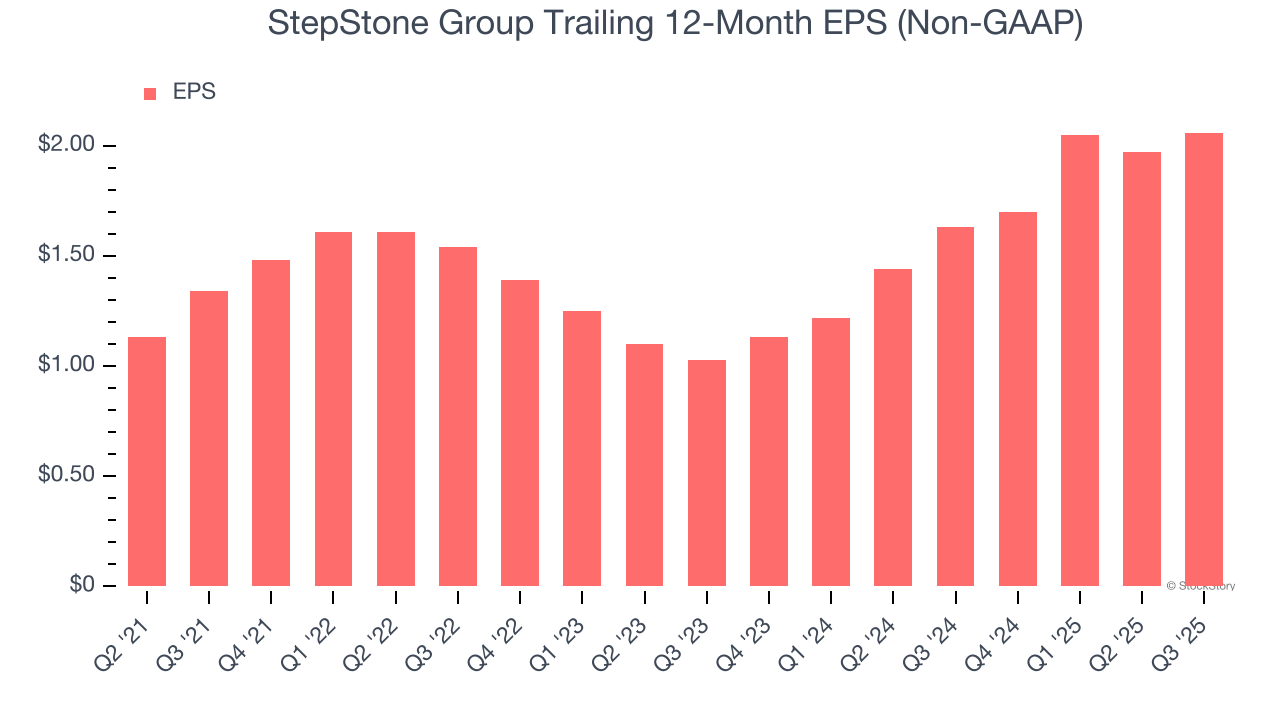

2. EPS Moving Up Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

StepStone Group’s full-year EPS grew at a decent 11.4% compounded annual growth rate over the last four years, in line with the broader financials sector.

Final Judgment

These are just a few reasons StepStone Group is a rock-solid business worth owning, and with its shares outperforming the market lately, the stock trades at 30.6× forward P/E (or $70.63 per share). Is now a good time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than StepStone Group

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.