W.W. Grainger currently trades at $959.70 per share and has shown little upside over the past six months, posting a small loss of 4%. The stock also fell short of the S&P 500’s 23.2% gain during that period.

Given the weaker price action, is now a good time to buy GWW? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Does GWW Stock Spark Debate?

Founded as a supplier of motors, W.W. Grainger (NYSE: GWW) provides maintenance, repair, and operating (MRO) supplies and services to businesses and institutions.

Two Positive Attributes:

1. Outstanding Long-Term EPS Growth

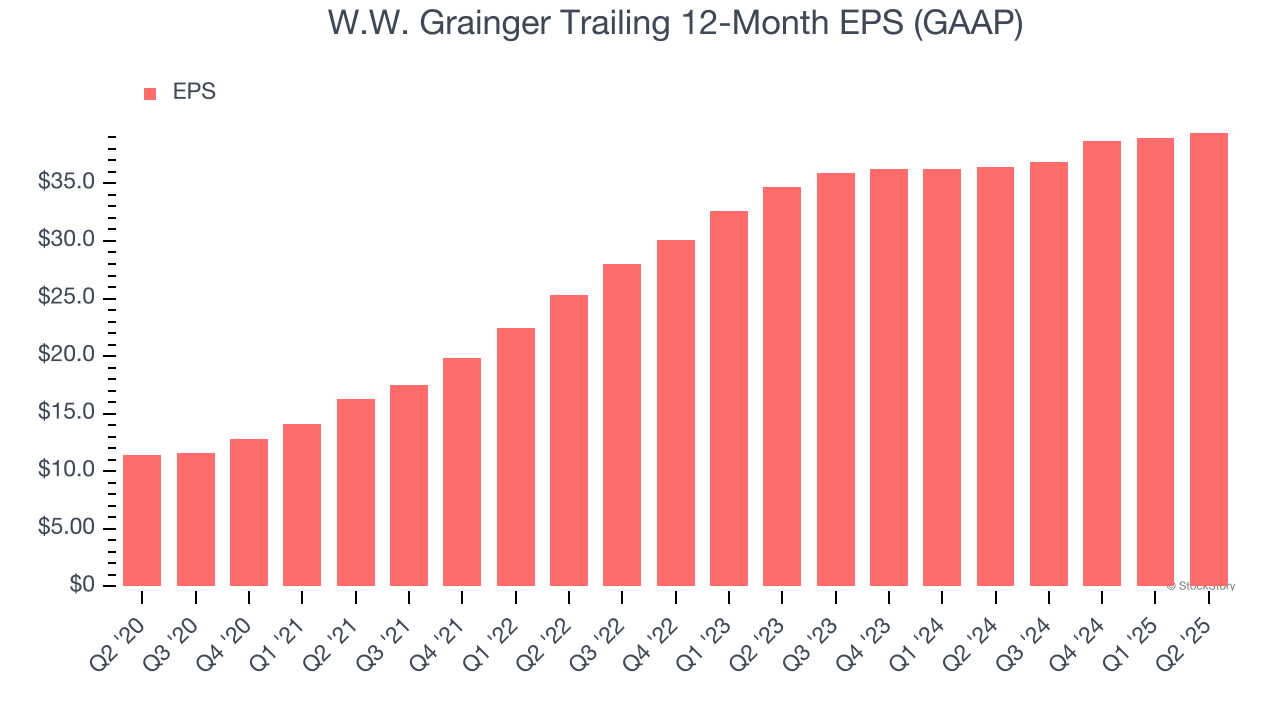

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

W.W. Grainger’s EPS grew at an astounding 28.1% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. Stellar ROIC Showcases Lucrative Growth Opportunities

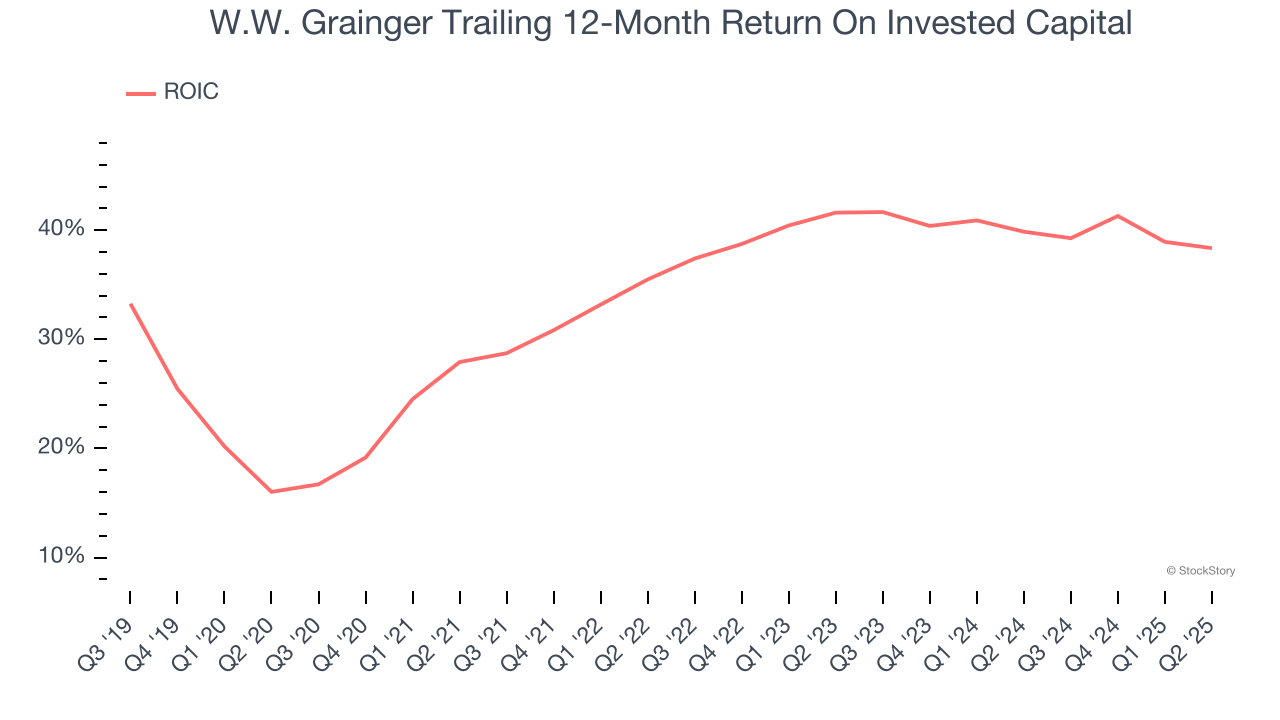

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

W.W. Grainger’s five-year average ROIC was 36.6%, placing it among the best industrials companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

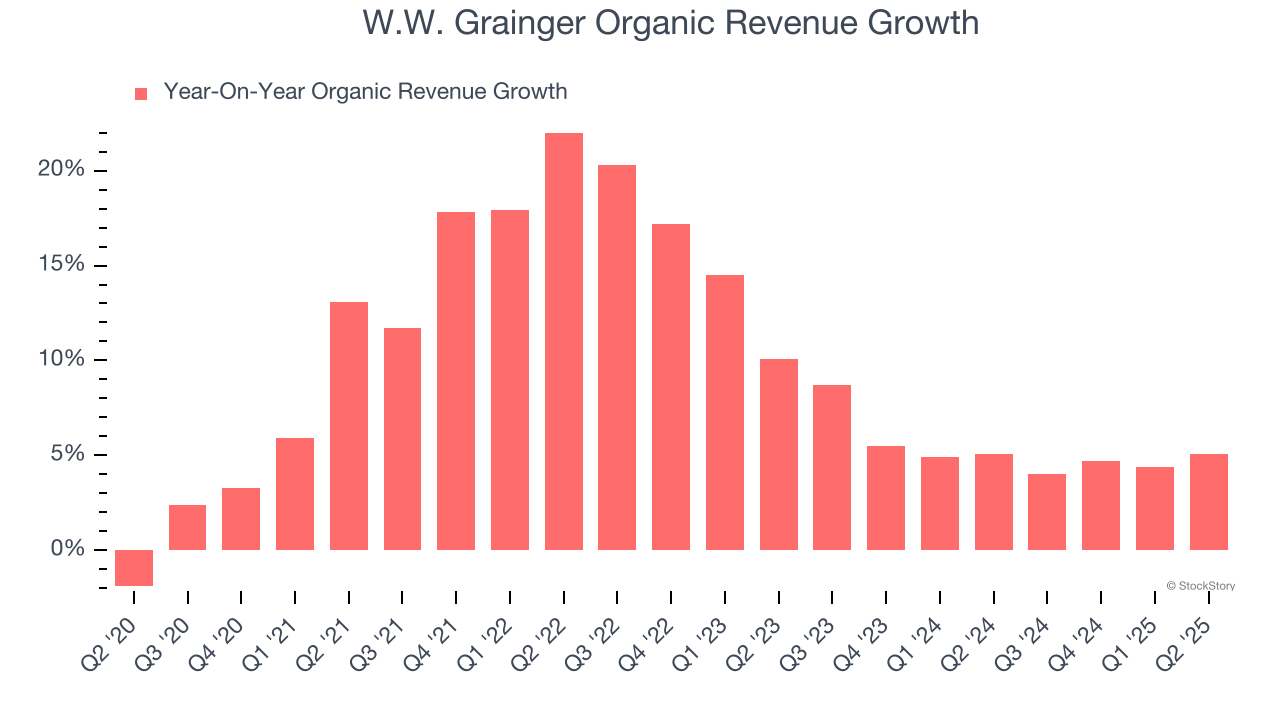

In addition to reported revenue, organic revenue is a useful data point for analyzing Maintenance and Repair Distributors companies. This metric gives visibility into W.W. Grainger’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, W.W. Grainger’s organic revenue averaged 5.3% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

W.W. Grainger’s positive characteristics outweigh the negatives. With its shares underperforming the market lately, the stock trades at 23.2× forward P/E (or $959.70 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.