Government consulting firm Booz Allen Hamilton (NYSE: BAH) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 8.1% year on year to $2.89 billion. Its GAAP profit of $1.42 per share was in line with analysts’ consensus estimates.

Is now the time to buy Booz Allen Hamilton? Find out by accessing our full research report, it’s free for active Edge members.

Booz Allen Hamilton (BAH) Q3 CY2025 Highlights:

- Revenue: $2.89 billion vs analyst estimates of $2.97 billion (8.1% year-on-year decline, 2.8% miss)

- EPS (GAAP): $1.42 vs analyst estimates of $1.42 (in line)

- Adjusted EBITDA: $324 million vs analyst estimates of $319.1 million (11.2% margin, 1.5% beat)

- Operating Margin: 9.8%, down from 17.4% in the same quarter last year

- Free Cash Flow Margin: 13.7%, down from 17.9% in the same quarter last year

- Market Capitalization: $12.36 billion

Company Overview

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE: BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

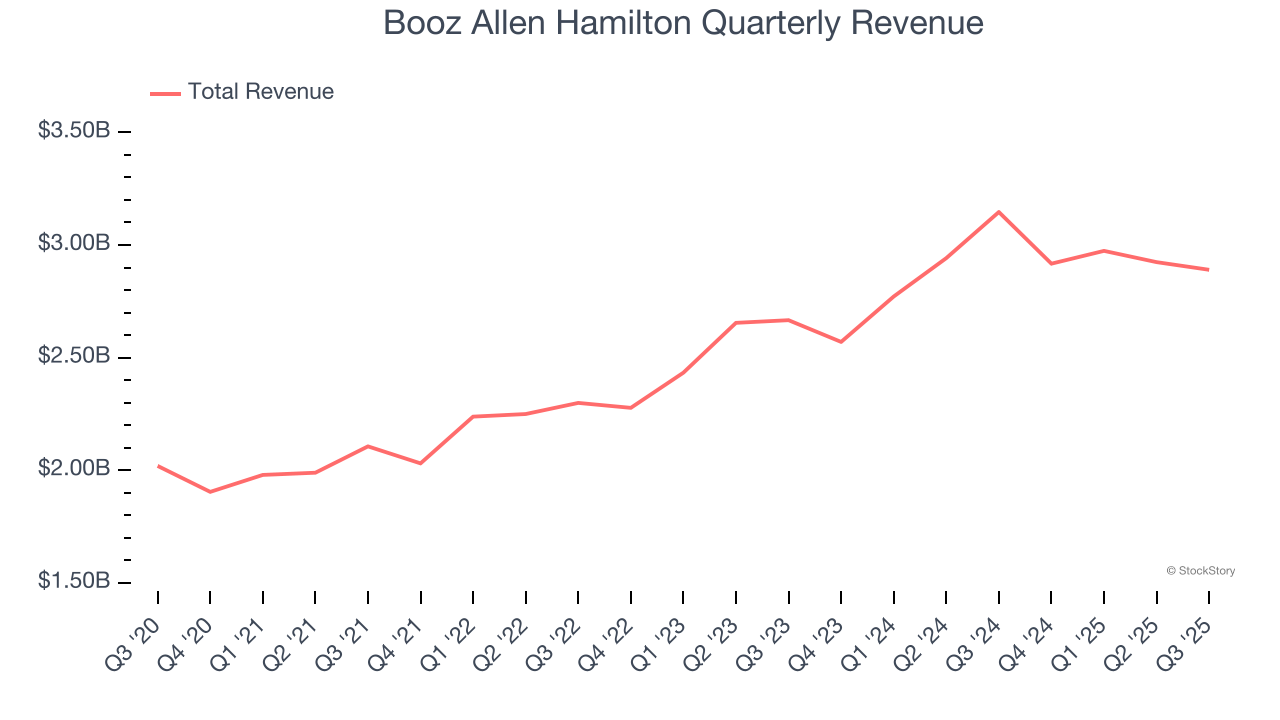

With $11.71 billion in revenue over the past 12 months, Booz Allen Hamilton is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

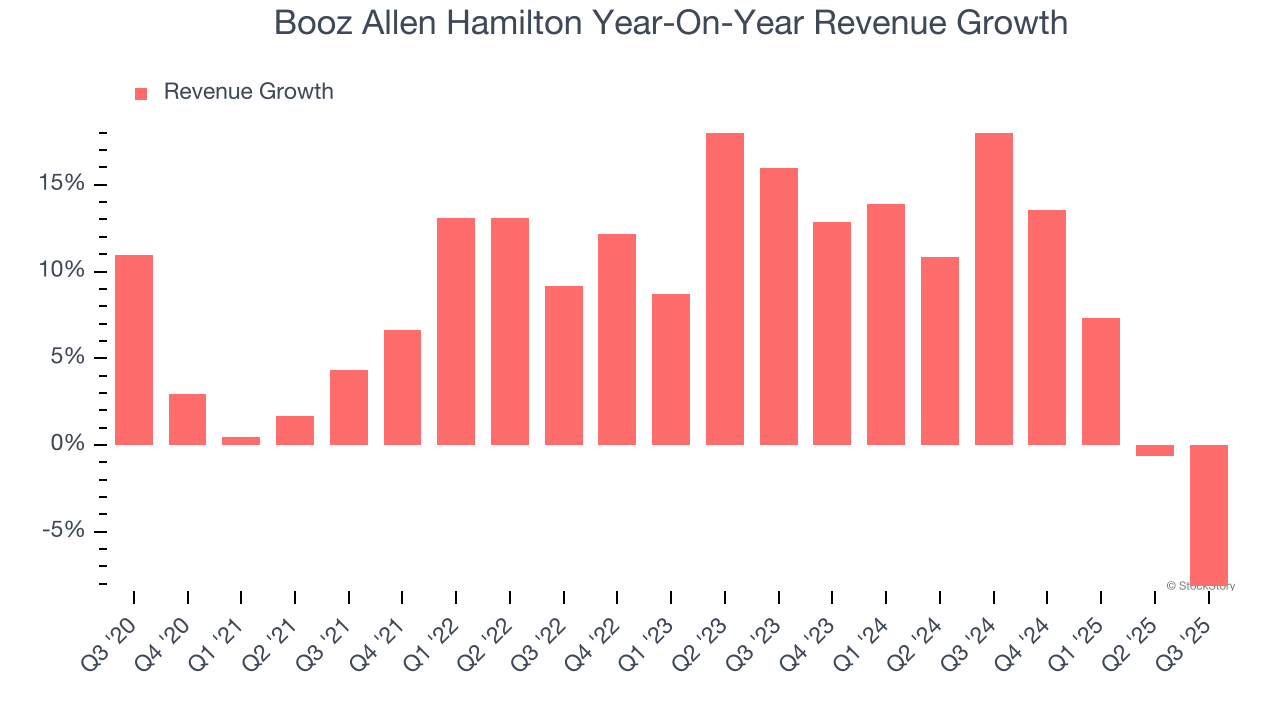

As you can see below, Booz Allen Hamilton’s 8.5% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Booz Allen Hamilton’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Booz Allen Hamilton’s annualized revenue growth of 8% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Booz Allen Hamilton missed Wall Street’s estimates and reported a rather uninspiring 8.1% year-on-year revenue decline, generating $2.89 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 5.1% over the next 12 months, a slight deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and suggests the market is forecasting success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

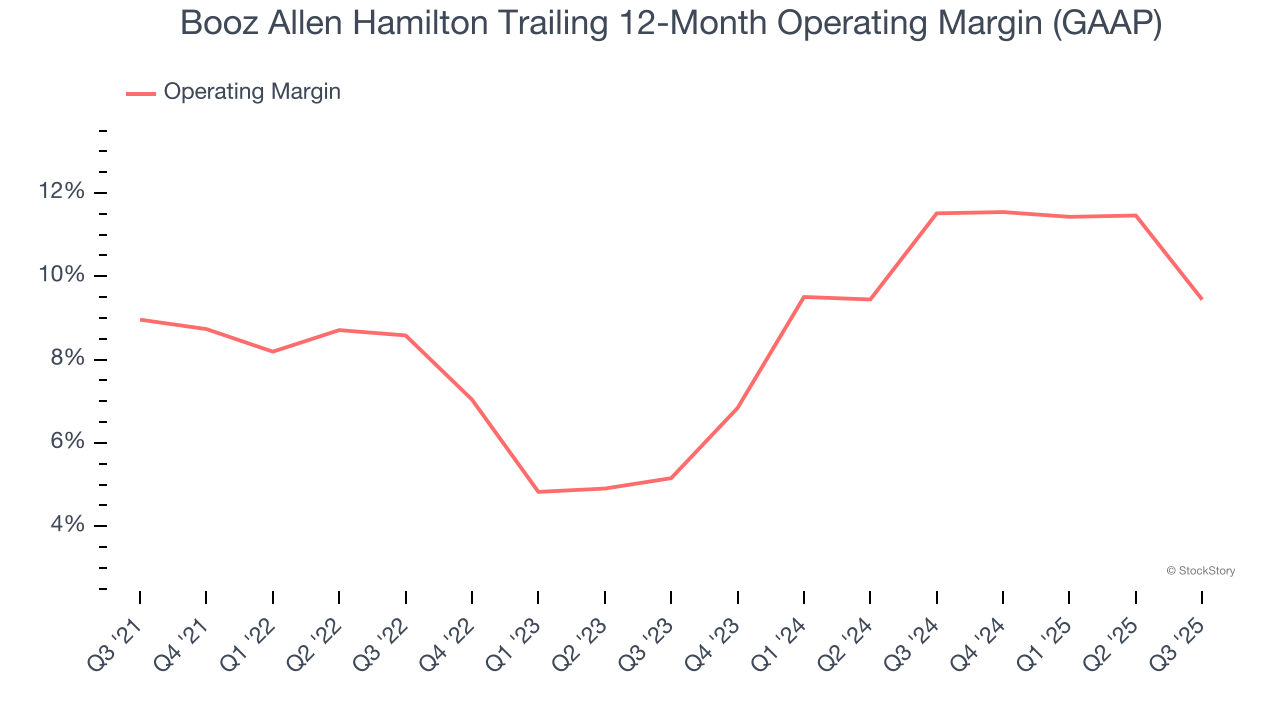

Booz Allen Hamilton’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 8.8% over the last five years. This profitability was mediocre for a business services business and caused by its suboptimal cost structure.

Analyzing the trend in its profitability, Booz Allen Hamilton’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Booz Allen Hamilton generated an operating margin profit margin of 9.8%, down 7.6 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

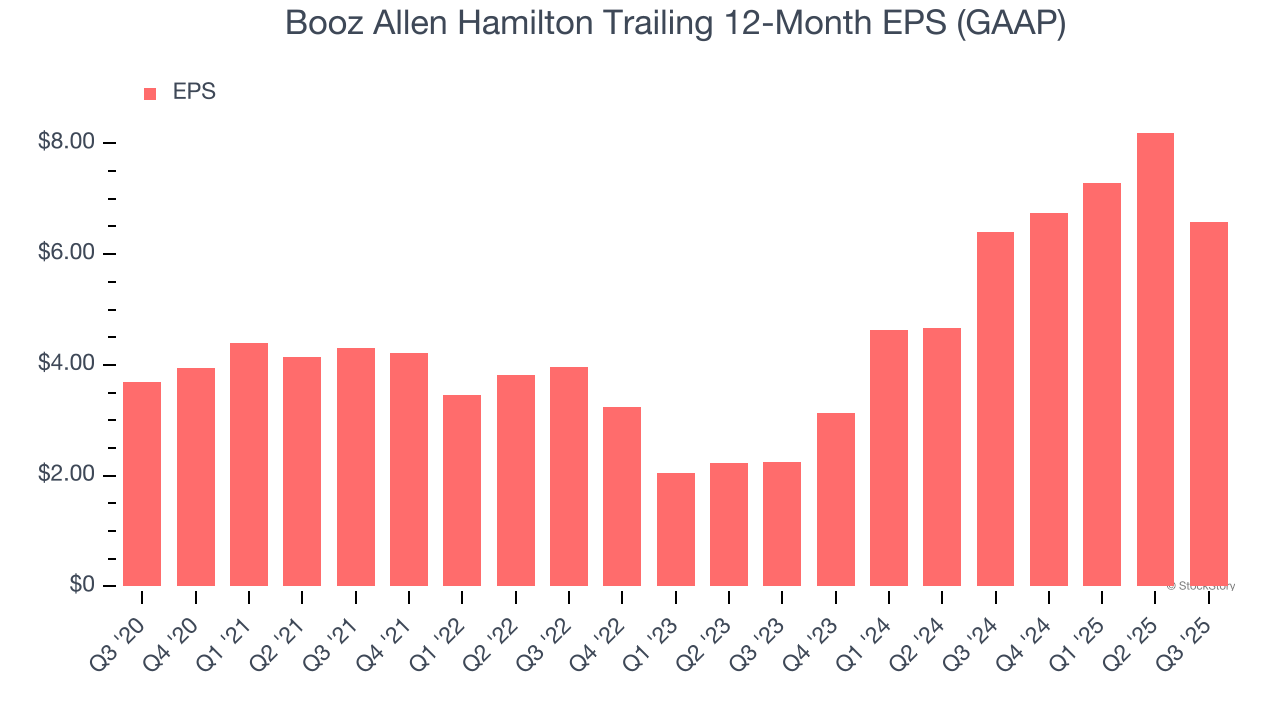

Booz Allen Hamilton’s EPS grew at a remarkable 12.3% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Booz Allen Hamilton, its two-year annual EPS growth of 71.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Booz Allen Hamilton reported EPS of $1.42, down from $3.03 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Booz Allen Hamilton’s full-year EPS of $6.59 to shrink by 3.5%.

Key Takeaways from Booz Allen Hamilton’s Q3 Results

We struggled to find many positives in these results. Overall, this quarter could have been better. The stock traded down 8.5% to $91.81 immediately following the results.

The latest quarter from Booz Allen Hamilton’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.