IT infrastructure services provider Kyndryl (NYSE: KD) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, but sales fell by 1.3% year on year to $3.8 billion. Guidance for next quarter’s revenue was better than expected at $3.78 billion at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $0.52 per share was 2.7% above analysts’ consensus estimates.

Is now the time to buy Kyndryl? Find out by accessing our full research report, it’s free.

Kyndryl (KD) Q1 CY2025 Highlights:

- Revenue: $3.8 billion vs analyst estimates of $3.77 billion (1.3% year-on-year decline, 0.8% beat)

- Adjusted EPS: $0.52 vs analyst estimates of $0.51 (2.7% beat)

- Adjusted EBITDA: $698 million vs analyst estimates of $709.7 million (18.4% margin, 1.7% miss)

- Revenue Guidance for Q2 CY2025 is $3.78 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 4.9%, up from 1% in the same quarter last year

- Free Cash Flow was $341 million, up from -$31.33 million in the same quarter last year

- Market Capitalization: $7.74 billion

"Fiscal 2025 was another year of strong execution on our strategy. In addition to returning to constant-currency revenue growth in the fourth quarter, we strengthened our leadership in innovative mission-critical technology services. We expanded our capabilities in cloud, modernization, applications, AI and security, and we further differentiated our services with Kyndryl Bridge," said Kyndryl Chairman and Chief Executive Officer Martin Schroeter.

Company Overview

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE: KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $15.06 billion in revenue over the past 12 months, Kyndryl is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s challenging to maintain high growth rates when you’ve already captured a large portion of the addressable market. For Kyndryl to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

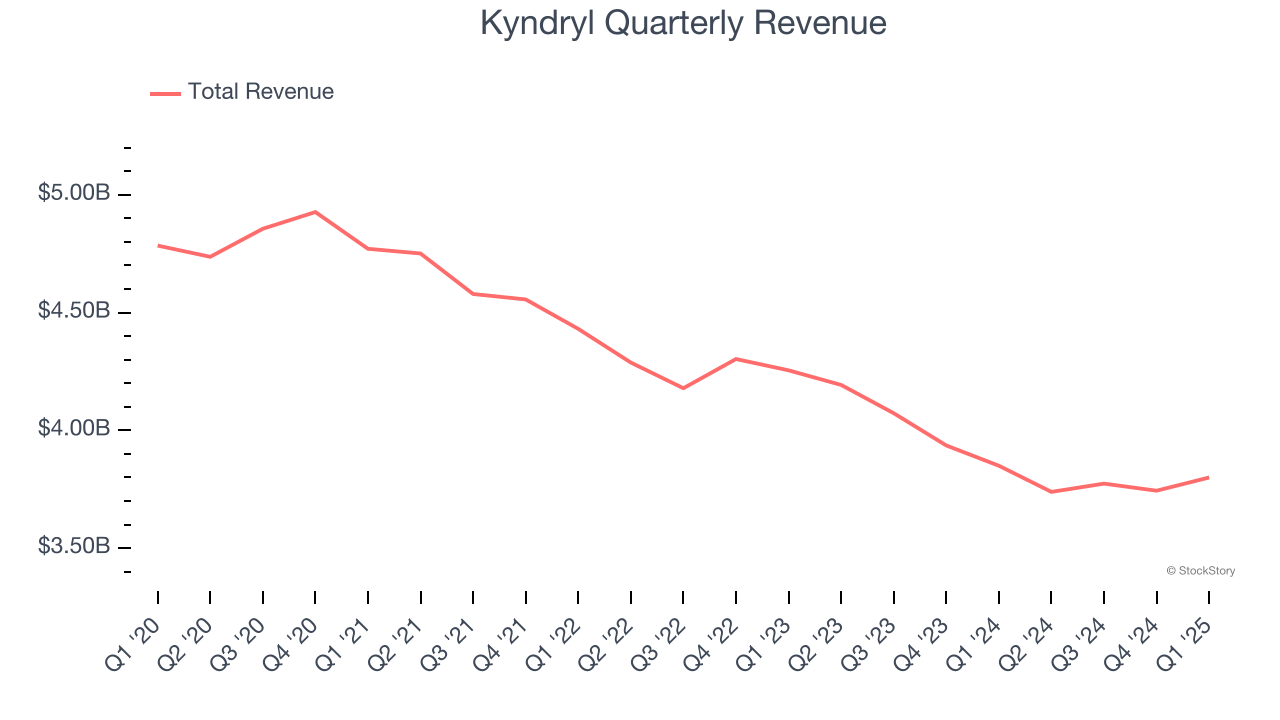

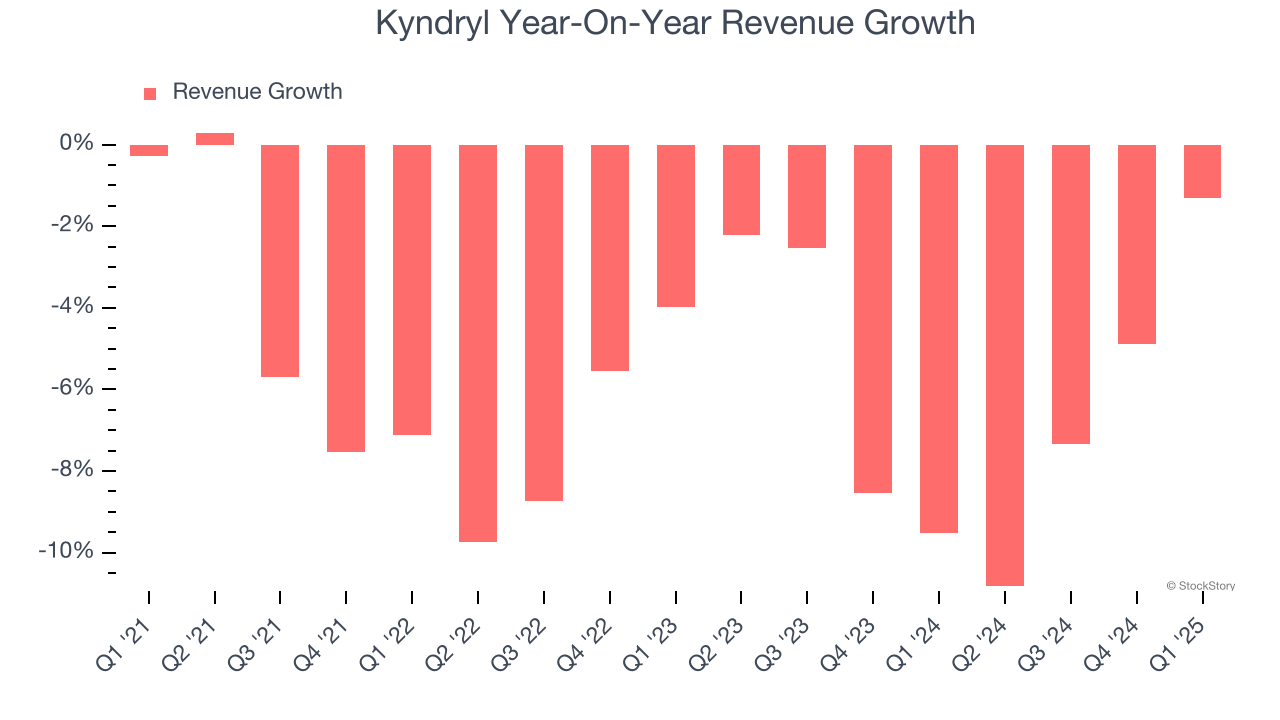

As you can see below, Kyndryl’s demand was weak over the last four years. Its sales fell by 6% annually, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Kyndryl’s annualized revenue declines of 6% over the last two years align with its four-year trend, suggesting its demand has consistently shrunk.

This quarter, Kyndryl’s revenue fell by 1.3% year on year to $3.8 billion but beat Wall Street’s estimates by 0.8%. Company management is currently guiding for a 1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

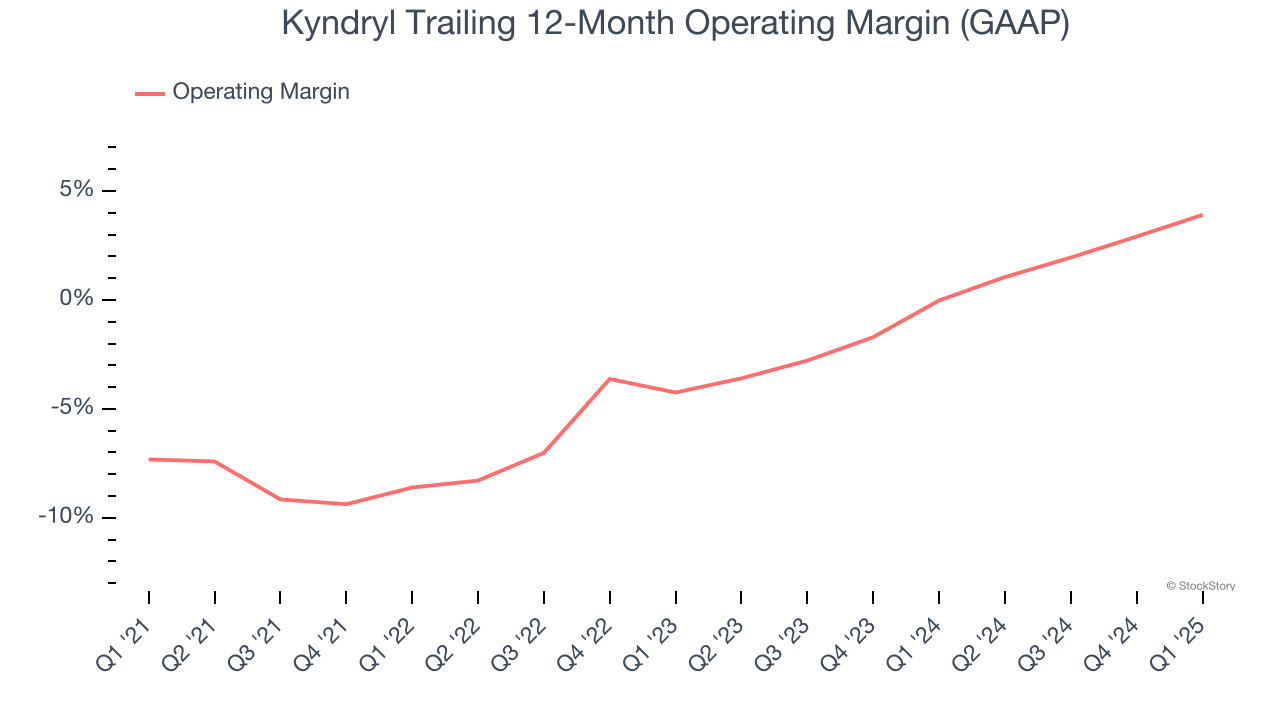

Although Kyndryl was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3.6% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Kyndryl’s operating margin rose by 11.2 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

This quarter, Kyndryl generated an operating profit margin of 4.9%, up 3.9 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

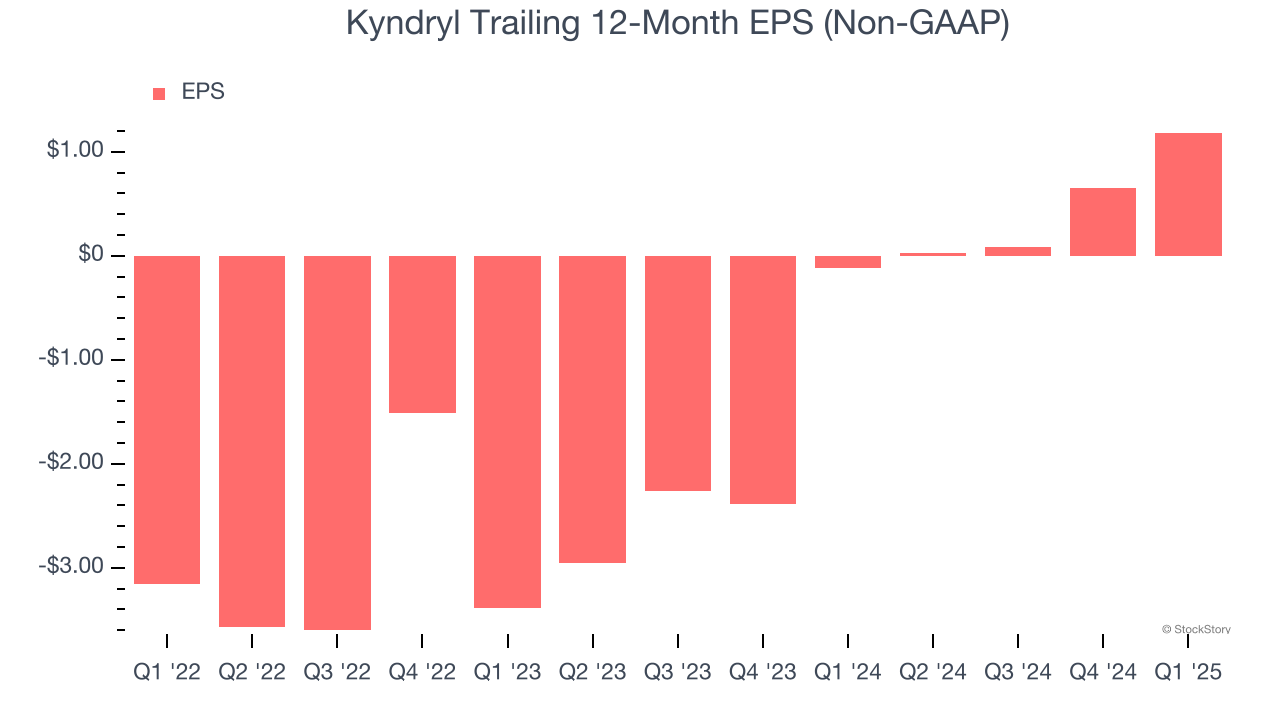

Kyndryl’s full-year EPS flipped from negative to positive over the last three years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Kyndryl reported EPS at $0.52, up from negative $0.01 in the same quarter last year. This print beat analysts’ estimates by 2.7%. Over the next 12 months, Wall Street expects Kyndryl’s full-year EPS of $1.18 to grow 75.6%.

Key Takeaways from Kyndryl’s Q1 Results

It was good to see Kyndryl beat analysts’ revenue and EPS expectations. On the other hand, its EPS missed. Overall, this print was decent. The stock remained flat at $33.01 immediately following the results.

So should you invest in Kyndryl right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.