Meta Platforms (META) stock is once again in the limelight after the company reported good earnings results, taking its shares close to record highs. Although Wall Street has generally reacted well to the accelerating revenue growth of Meta Platforms and its aggressive artificial intelligence (AI) plans, at least one major investment firm is cautioning investors not to get overly bullish on the tech giant’s shares. In a recent interview, Needham senior analyst Laura Martin said Meta Platforms is “priced for perfection” but could potentially decline 10% to 15% if growth targets are not met.

META stock has risen 7% in the past month due to Meta's aggressive AI plans for its advertisements and management's positive outlook on the business. However, the current high optimism surrounding Meta Platforms shares has led investors to price its growth potential at an unforgiving level. With a massive capital expenditure cycle in place, the market is no longer rewarding good enough execution.

The warning comes at a time when the valuations of other major tech stocks are once again facing challenges due to increasing spending plans and a lower tolerance for margin pressure.

About Meta Platforms Stock

Meta Platforms operates the world's largest social media platform through its Facebook, Instagram, WhatsApp, and Messenger services, along with its Reality Labs segment dedicated to virtual and augmented reality technologies. With its headquarters in Menlo Park, California, Meta Platforms has a current market capitalization of around $1.8 trillion, making it one of the most valuable companies in the world.

Over the last 52 weeks, the stock has traded between a low of $479.80 and a high of $796.25. This is a reflection of its strong earnings momentum and the volatility of the stock related to the investing cycles of artificial intelligence. META stock is currently trading at $697 and has outperformed the S&P 500 Index ($SPX). Investors have clearly rewarded the company for the acceleration of its growth after the efficiency reset of 2022 to 2023.

From the perspective of valuation, the stock currently trades at 24 times trailing earnings and 24 times forward earnings. The price-to-sales (P/S) ratio is above 9 times as well. These numbers are at the upper end of the stock's historical range, further supporting the idea that the good news is already priced into META.

Meta Beats on Earnings, But Spending Jumps

Meta Platforms' fourth-quarter and full-year 2025 results were undoubtedly strong. Revenue for Q4 was up 24% year-over-year (YOY) and came in at almost $60 billion. This was due to an 18% increase in ad impressions and a 6% increase in average ad price during the period. For the full year, revenue was up 22% YOY and came in at more than $200 billion, reflecting a robust digital advertising environment.

However, the story is not so rosy when looking at expenses. Fourth-quarter expenses went up by 40% YOY while full-year expenses went up by 24% YOY. This is a reflection of the significant investments Meta is making in AI infrastructure and technical talent. The company spent $72.2 billion in capital expenditures in 2025 and is projecting a significant increase in capex in 2026 to between $115 billion and $135 billion. This projected increase in capex is related to the upcoming rollout of Meta's Superintelligence Labs.

Guidance provided by Meta's CFO is for revenue growth of 30% or more in Q1 2026 in constant currencies. This rate marks a significant acceleration from prior quarters. While that acceleration is great, it leaves little room for disappointment. The problem that concerns Needham is that much of the expense is irreversible in the near term. This means that Meta Platforms' margins could compress rapidly if the growth slows.

Analysts Split on Valuation Risk

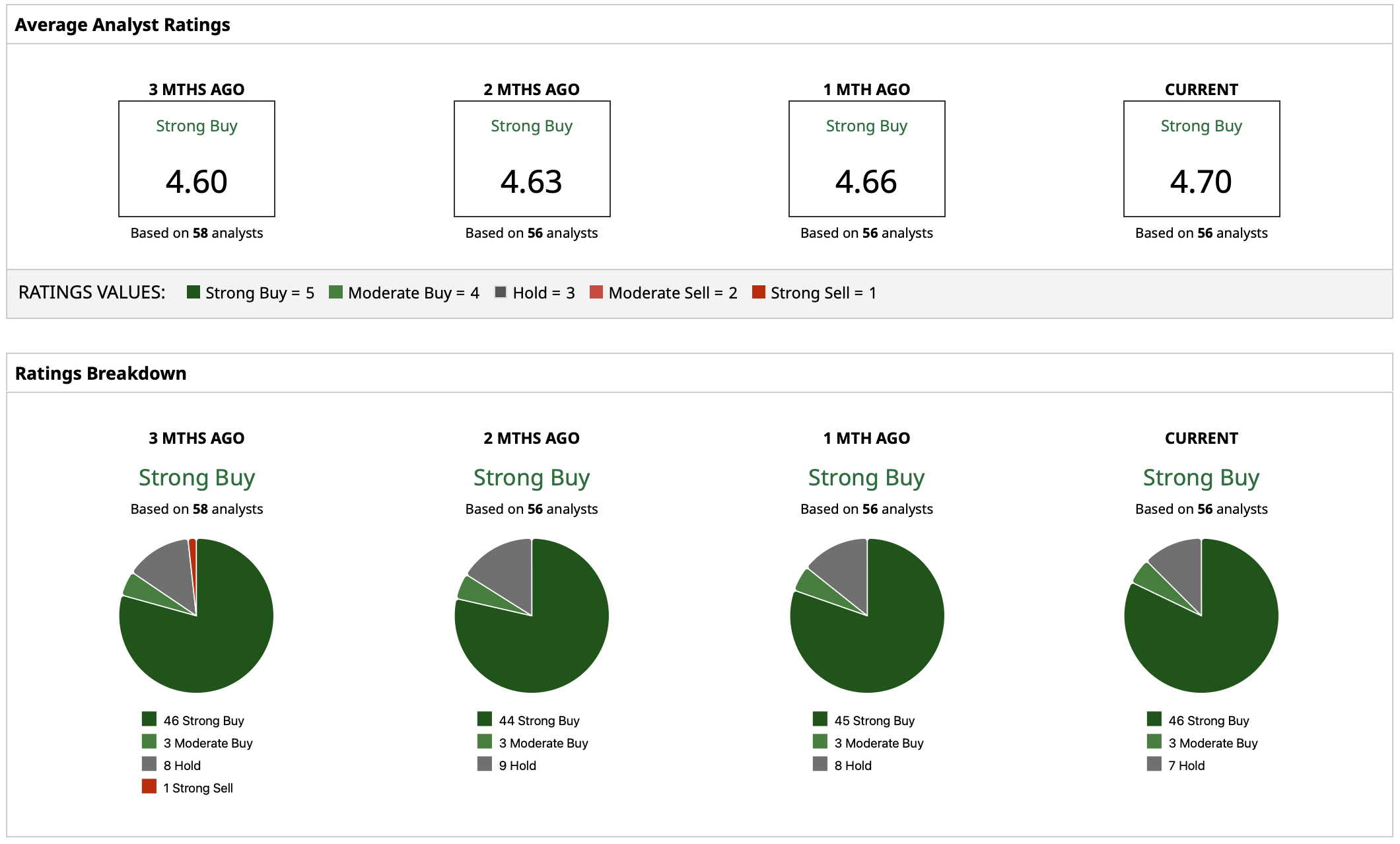

Analysts assign a “Strong Buy” consensus rating on META stock with a mean price target at $855.88, indicating a potential increase of 23% from the current price. The high price target for META is $1,144 while the lowest target price is $700, showing a wide range of price targets.

Analyst Laura Martin’s bearish view on the company’s shares is noteworthy, as it focuses less on Meta’s competitive position and more on the timing of the firm's performance. Martin believes that being in front of a capex cycle has historically implied higher downside risk, particularly as returns on invested capital have declined. Needham estimates that Meta's operating margins may decline from 40% in 2025 to the low 30% range in 2026, a significant reset given the company’s premium valuation.

However, Martin was more positive on the ad-tech space as a whole. The analyst highlighted strong results seen by digital advertising companies in the fourth quarter, seeing positive read-throughs for companies like Alphabet (GOOGL), The Trade Desk (TTD), and Magnite (MGNI), even if there's weakness for Meta shares.

On the date of publication, Yiannis Zourmpanos had a position in: META . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why This Analyst Says Any Dip in Tesla Stock Is Worth Buying

- A Potential Sentiment Mismatch Makes Rocket Lab (RKLB) Stock Options an Enticing Proposition

- MicroStrategy Stock Is Down Nearly 70% from Its Record Highs. How Should You Play MSTR Here?

- ‘It Seems Like China Listens to Everything I Say’: Elon Musk Says China Is Out-Executing the U.S. on Energy By Using His Playbook