VANCOUVER, BC, BC / ACCESS Newswire / October 14, 2025 / (TSXV:OGN)(OTCQB:OGNNF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that it has signed a purchase and sale agreement (the "Agreement") with a wholly owned subsidiary of Altitude Minerals Ltd. (ASX:ATT) ("Altitude") whereby Altitude has acquired the Firenze gold project ("Firenze" or the "Project"), located in Nevada USA.

To acquire a 100% interest in Firenze, Altitude will pay a total of US$430,000 in cash or shares, at the election of Altitude. Altitude will also grant a 3% net smelter return ("NSR") royalty of which 1% can be purchased for US$1.5 million.

Pursuant to the terms of a generative alliance (the "Alliance") between Altius Minerals Corporation ("Altius") (TSX:ALS) and Orogen (previously announced September 12, 2022), proceeds from the sale of the Project will be split evenly between the Alliance partners whereby each party will receive US$215,000 in cash and/or shares and a 1.5% NSR royalty.

Orogen CEO Paddy Nicol commented, "Firenze is an exploration-stage gold project that was made available under the National Defense Authorization Act in 2022 and was acquired by staking under the Orogen-Altius Alliance. The Project was last explored over 40 years ago and has never been drilled. Firenze is the third royalty generated under Orogen's alliance with Altius which continues to create prospective targets. We are excited to partner with Altitude and look forward to the results of their upcoming exploration program."

About the Firenze Project

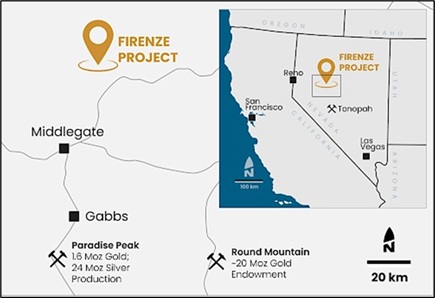

The 740-hectare Firenze property is located in central Nevada, 170 kilometres east of Reno (Figure 1). The claims are located on road accessible BLM-managed ground with no conservation designation.

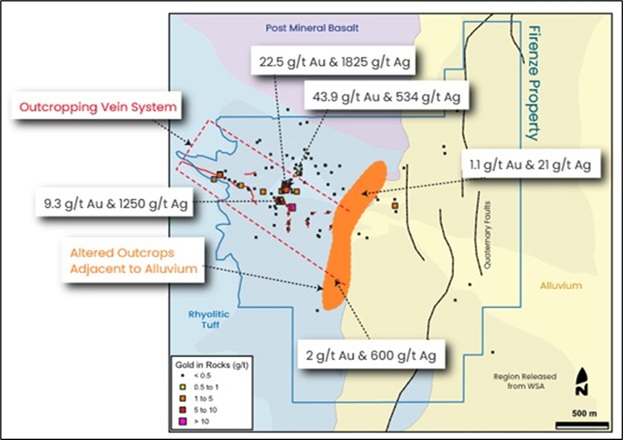

The property contains a system of up to 1.5-metre-wide precious metal rich epithermal veins outcropping over 1.5 square-kilometres (Figure 2). At surface, the veins display classic epithermal textures with banded quartz and adularia returning up to 9.3 grams per tonne ("g/t") gold and 1,250 g/t silver. Dump samples from limited artisanal production in the 1860s returned values of 44.0 g/t gold and 534 g/t silver, 22.5 g/t gold and 1825 g/t silver, and 17.7 g/t gold and 97.8 g/t silver.

Generally west-northwest trending veins are hosted within the tuff of Elevenmile Canyon, a sequence of Oligocene aged intra caldera volcaniclastics. These variably welded tuffs display localized silicification and argillization at surface associated with elevated gold and anomalous mercury, arsenic, antimony, and lead indicating the potential for disseminated gold mineralization on the property.

Precious metal grades and argillic alteration are open to the east beneath shallow, post-mineral alluvium. This covered area hosts a structurally complex fault accommodation zone that may be the focal center of the epithermal system.

Transaction Terms

Altitude will acquire a 100% interest in Firenze gold project subject to the following terms:

US$30,000 cash on signing a Letter of Intent agreement (paid);

US$100,000 in cash on signing the Agreement;

US$300,000 in cash or shares (share issuance being subject to shareholder approval only) on or before November 30, 2025; and

A 3% NSR royalty will be granted by Altitude with a 1% buydown provision for US$1.5 million.

Under the terms of the Alliance between Orogen and Altius Minerals, proceeds from the sale of Firenze will be split evenly between both parties.

Qualified Person Statement

All technical data, as disclosed in this press release, has been reviewed and approved by Laurence Pryer, Ph.D., P.Geo., Vice President of Exploration for Orogen. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

Certain technical disclosure in this release is a summary of previously released information, and the Company is relying on the interpretation provided by the relevant company. Additional information can be found on the links in the footnotes or on SEDAR+ (www.sedarplus.ca).

About Orogen Royalties Inc.

Orogen Royalties is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver Mine in Sonora, Mexico (2.0% NSR royalty) operated by First Majestic Silver Corp. The Company is well financed with several projects actively being developed by joint venture partners.

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Orogen Royalties Inc

View the original press release on ACCESS Newswire