Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at KLA Corporation (NASDAQ: KLAC) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 25.2% since the latest earnings results.

KLA Corporation (NASDAQ: KLAC)

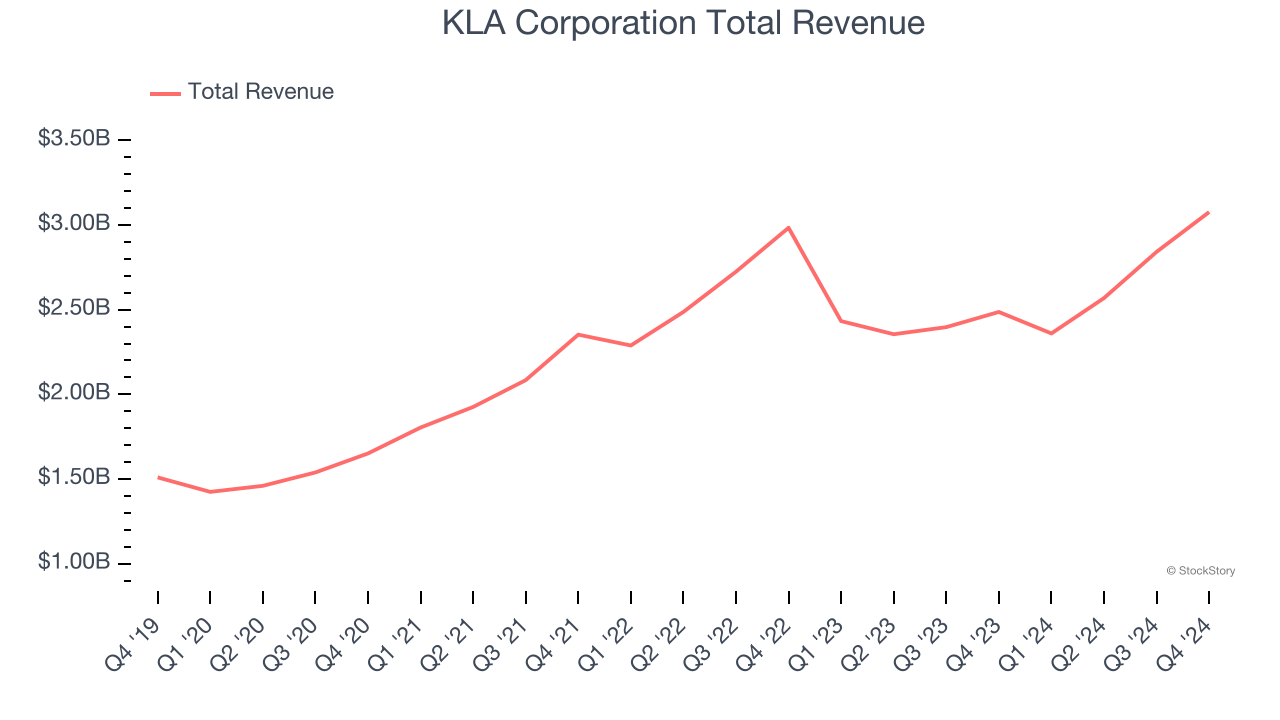

Formed by the 1997 merger of the two leading semiconductor yield management companies, KLA Corporation (NASDAQ: KLAC) is the leading supplier of equipment used to measure and inspect semiconductor chips.

KLA Corporation reported revenues of $3.08 billion, up 23.7% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was a very strong quarter for the company with a significant improvement in its inventory levels and a solid beat of analysts’ adjusted operating income estimates.

"KLA's December quarter results were above the midpoint of our guidance ranges despite navigating through the business impact of new U.S. government export controls released late in the quarter. These results supported a strong finish to calendar 2024 for KLA highlighted by relative revenue growth outperformance and strong profitability," said Rick Wallace, president and CEO, KLA Corporation.

The stock is down 9.9% since reporting and currently trades at $669.96.

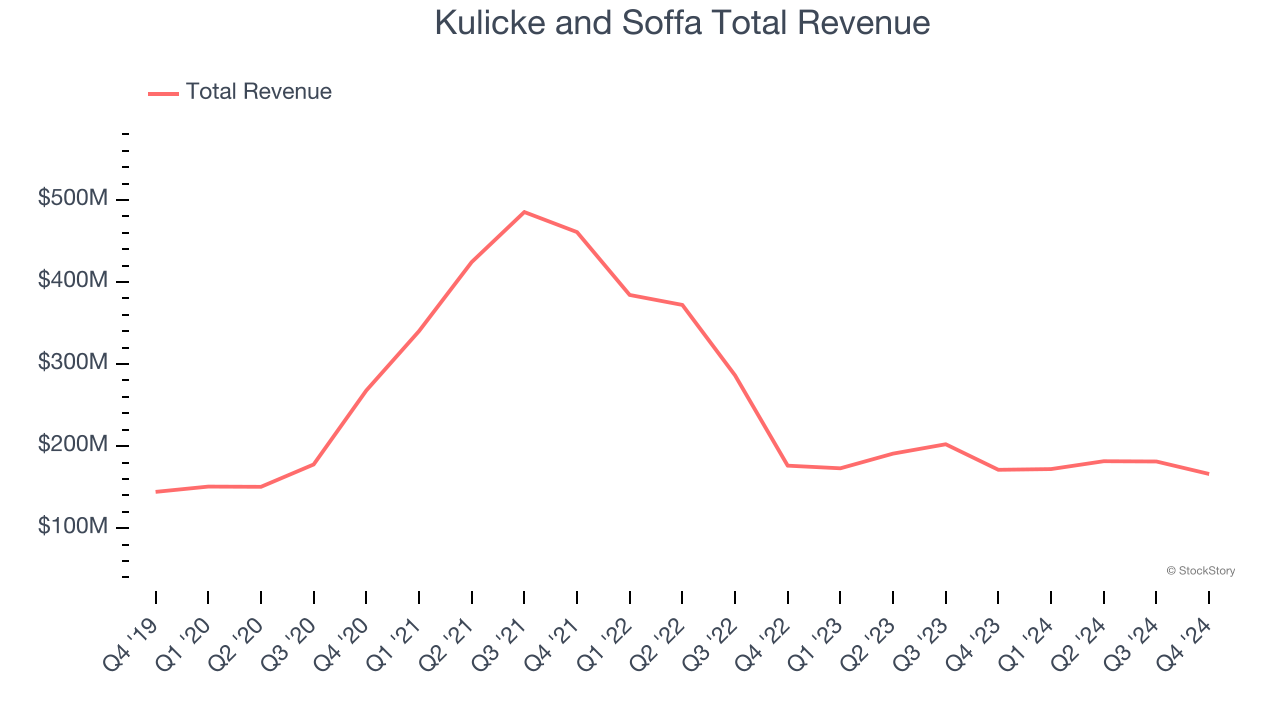

Best Q4: Kulicke and Soffa (NASDAQ: KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $166.1 million, down 3% year on year, outperforming analysts’ expectations by 0.7%. The business had a very strong quarter with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

The stock is down 34.6% since reporting. It currently trades at $28.39.

Is now the time to buy Kulicke and Soffa? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: FormFactor (NASDAQ: FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $189.5 million, up 12.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 33.8% since the results and currently trades at $27.22.

Read our full analysis of FormFactor’s results here.

Semtech (NASDAQ: SMTC)

A public company since the late 1960s, Semtech (NASDAQ: SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

Semtech reported revenues of $251 million, up 30.1% year on year. This print was in line with analysts’ expectations. It was a strong quarter as it also logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 15.2% since reporting and currently trades at $27.66.

Read our full, actionable report on Semtech here, it’s free.

Teradyne (NASDAQ: TER)

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ: TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

Teradyne reported revenues of $752.9 million, up 12.3% year on year. This result surpassed analysts’ expectations by 1.4%. Zooming out, it was a mixed quarter as it also produced an impressive beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 39.1% since reporting and currently trades at $74.32.

Read our full, actionable report on Teradyne here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.