Mortgage REIT AGNC Investment (NASDAQ: AGNC) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 122% year on year to $836 million. Its GAAP profit of $0.72 per share was 31.5% above analysts’ consensus estimates.

Is now the time to buy AGNC Investment? Find out by accessing our full research report, it’s free for active Edge members.

AGNC Investment (AGNC) Q3 CY2025 Highlights:

- Net Interest Income: $148 million vs analyst estimates of $468.5 million (68.4% miss)

- Revenue: $836 million vs analyst estimates of $587.6 million (122% year-on-year growth, 42.3% beat)

- EPS (GAAP): $0.72 vs analyst estimates of $0.55 (31.5% beat)

- Tangible Book Value per Share: $8.28 vs analyst estimates of $8.04 (6.8% year-on-year decline, 3% beat)

- Market Capitalization: $10.41 billion

Company Overview

Born during the 2008 financial crisis when mortgage markets were in turmoil, AGNC Investment (NASDAQ: AGNC) is a real estate investment trust that primarily invests in mortgage-backed securities guaranteed by U.S. government agencies or enterprises.

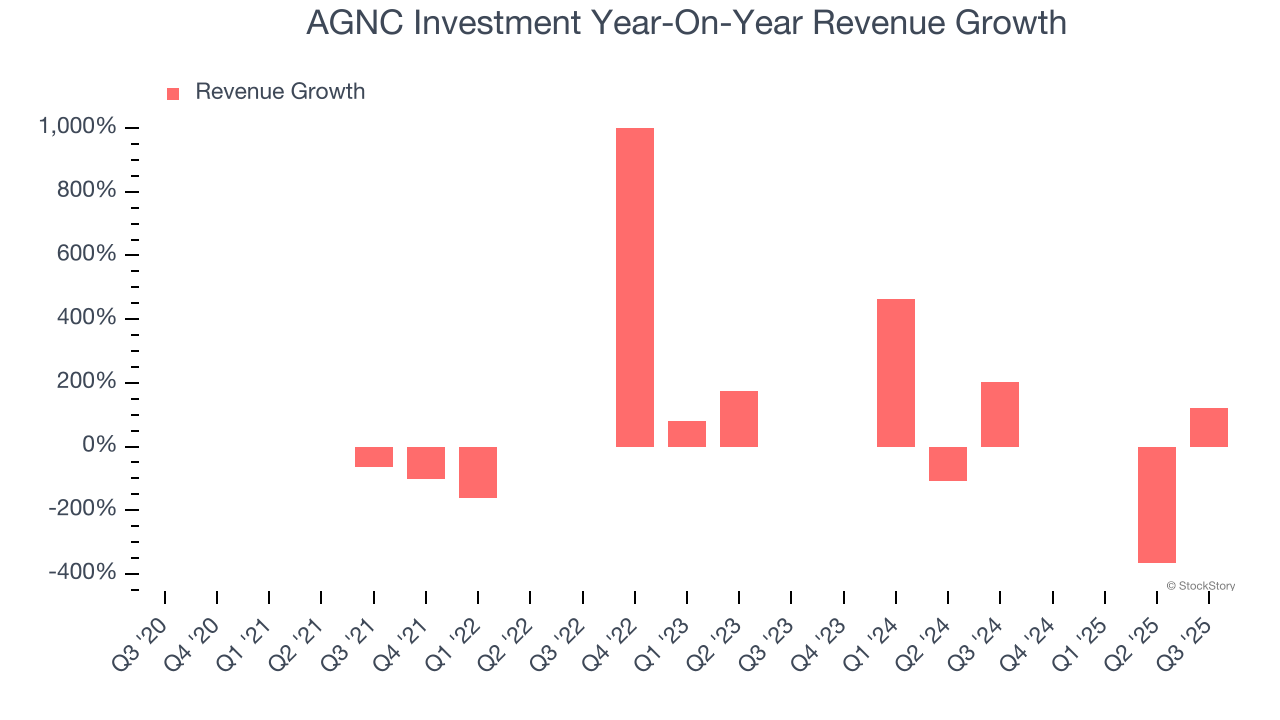

Sales Growth

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. AGNC Investment struggled to consistently generate demand over the last five years as its revenue dropped at a 51.9% annual rate. This wasn’t a great result and suggests it’s a lower quality business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. AGNC Investment’s recent performance shows its demand remained suppressed as its revenue has declined by 78.2% annually over the last two years.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, AGNC Investment reported magnificent year-on-year revenue growth of 122%, and its $836 million of revenue beat Wall Street’s estimates by 42.3%.

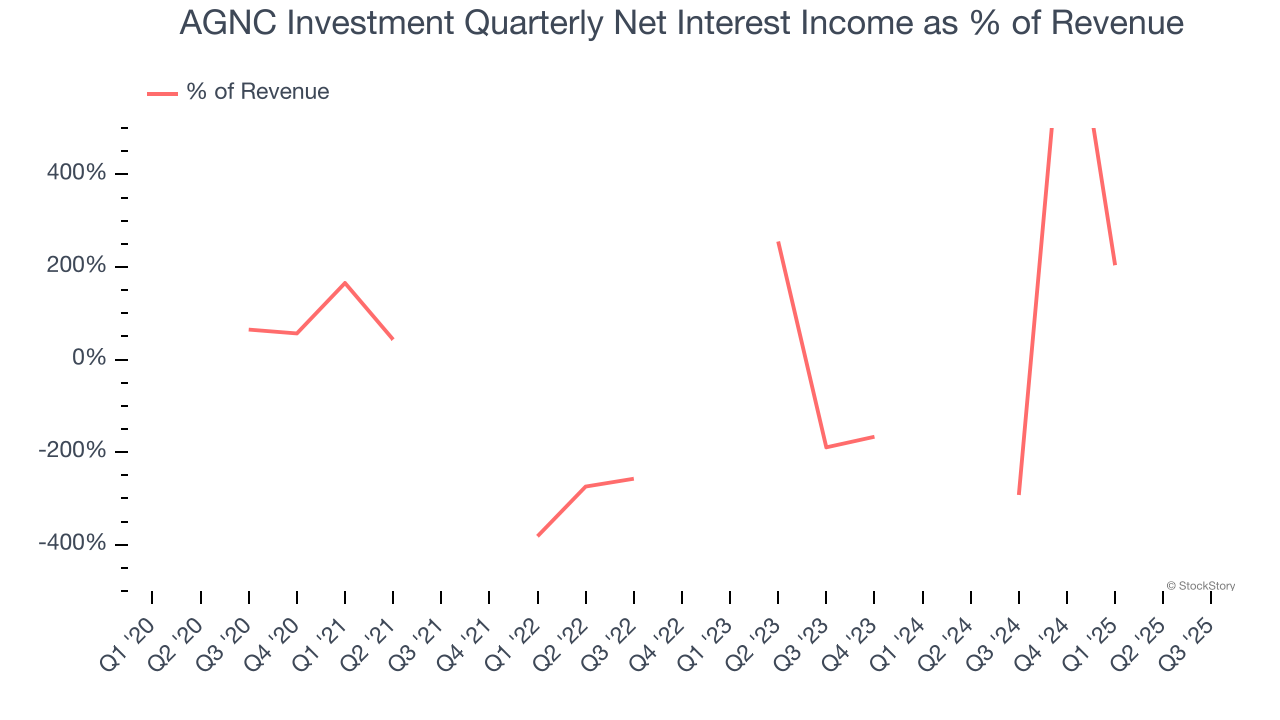

Net interest income made up -429% of the company’s total revenue during the last five years, meaning AGNC Investment is well diversified and has a variety of income streams driving its overall growth. Nevertheless, net interest income is critical to analyze for banks because they’re considered a higher-quality, more recurring revenue source by investors.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

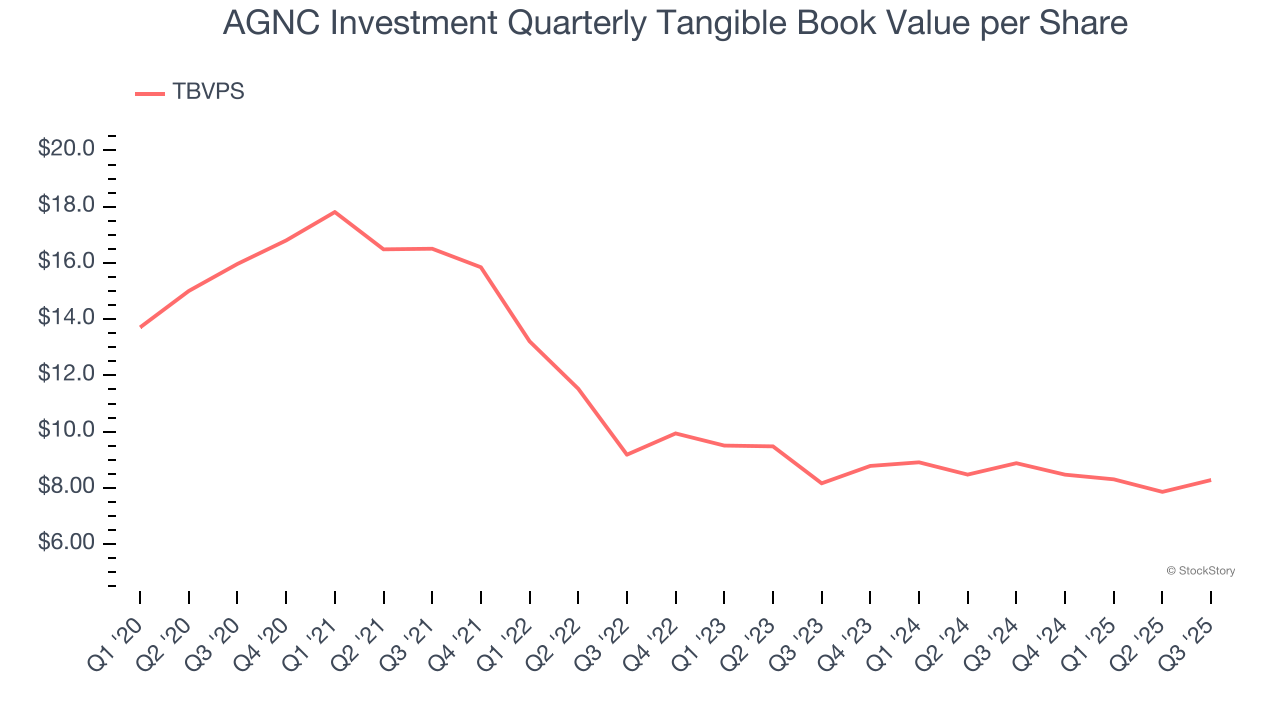

Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. On the other hand, EPS is often distorted by mergers and flexible loan loss accounting. TBVPS provides clearer performance insights.

AGNC Investment’s TBVPS declined at a 12.3% annual clip over the last five years. TBVPS has stabilized recently as it was flat over the last two years at about $8.28 per share.

Over the next 12 months, Consensus estimates call for AGNC Investment’s TBVPS to shrink by 2.9% to $8.04, a sour projection.

Key Takeaways from AGNC Investment’s Q3 Results

It was good to see AGNC Investment beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its net interest income missed. Overall, we think this was a mixed quarter. The stock remained flat at $10.07 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.