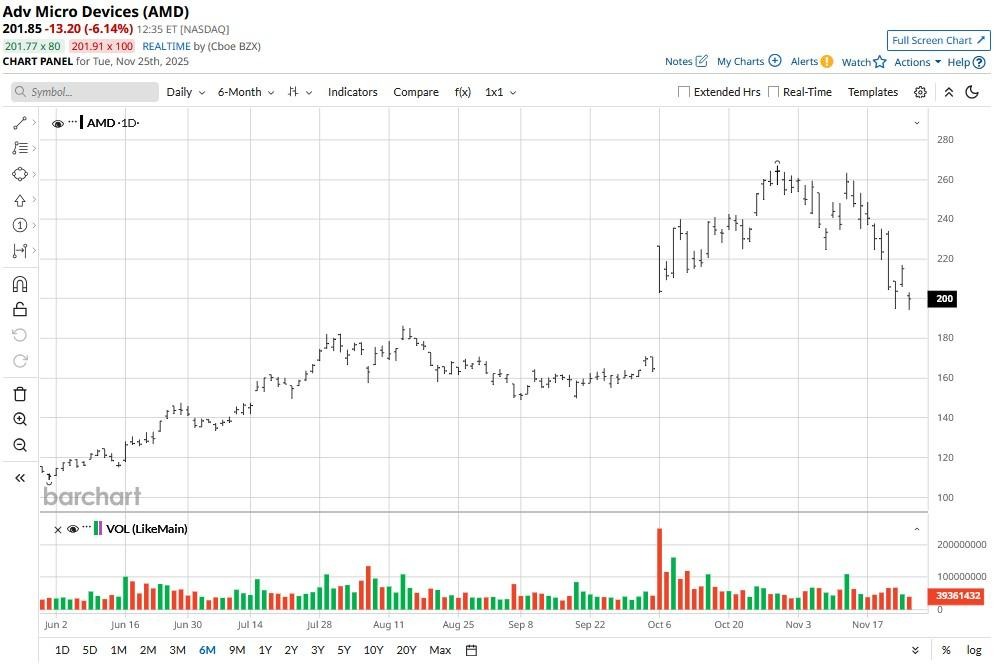

Advanced Micro Devices (AMD) shares crashed as much as 10% on Tuesday morning following reports that Meta Platforms (META) plans on switching to Alphabet’s (GOOGL) artificial intelligence (AI) chips.

According to “The Information,” the company behind Instagram will start renting Google’s tensor processing units (TPUs) next year.

These chips will then go into full deployment and begin powering Meta’s data centers in 2027, it added. Following today’s decline, AMD stock is down more than 25% versus its year-to-date high.

Why Would a Meta-Google Deal Hurt AMD Stock?

A potential deal between Meta and Google would prove majorly negative for AMD shares as it would sideline the company from one of the largest potential buyers of AI chips.

Investors had hoped that META would eventually want to diversify its supply chain away from Nvidia (NVDA), and that would drive it straight to Advanced Micro Devices.

But the giant is reportedly considering moving to Google’s chips instead – effectively eliminating that expected growth catalyst.

All in all, with hyperscalers driving most of the AI hardware demand, losing Meta as a client hurts AMD’s revenue visibility and competitive positioning heading into 2026.

Higher HBM Cost Could Weigh on AMD Shares

AMD stock has been a lucrative investment over the past seven months, but headwinds that go far beyond Meta’s potential chips deal with Google warrant treading with caution.

These include higher HBM costs and supply chain constraints that may hurt the firm’s gross margin next year. At writing, the multinational’s margin sits at a whopping 52%.

Moreover, Advanced Micro Devices is currently going for a forward price-earnings (P/E) ratio of about 65x, which makes it significantly more expensive than NVDA shares at less than 41x only.

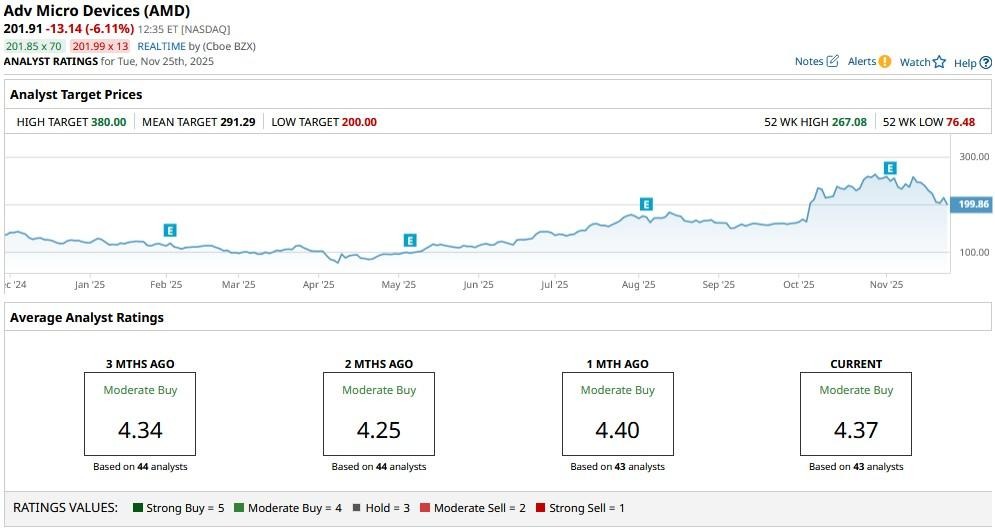

AMD Remains in Favor With Wall Street Analysts

Despite these fundamental and technical risks, however, Wall Street remains bullish as ever on the AMD stock.

The consensus rating on AMD shares remains at “Moderate Buy” with the mean target of roughly $291 signaling potential upside of more than 45% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Microsoft Partners Up with Nvidia and Anthropic, Should You Buy, Sell, or Hold MSFT Stock?

- Nvidia Stock Is Selling Off on Google-Meta Deal. Should You Buy the NVDA Dip Today?

- Nvidia Just ‘Dropped the Mic’ But Its Stock Dropped Too. How Should You Play NVDA Here?

- Get Out of Your Cave and Out onto the Field, Says Wedbush. The AI Game for NVDA Stock Is Still a ‘Field of Dreams.’