As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the life insurance industry, including Prudential (NYSE: PRU) and its peers.

Life insurance companies collect premiums from policyholders in exchange for providing a future death benefit or retirement income stream. Interest rates matter for the sector (and make it cyclical), with higher rates allowing insurers to reinvest their fixed-income portfolios at more attractive yields and vice versa. Additionally, favorable demographic shifts, such as an aging population, are driving strong demand for retirement products while AI and data analytics offer significant opportunities to improve underwriting accuracy and operational efficiency. Conversely, the industry faces headwinds from persistent competition from agile insurtechs that threaten traditional distribution models.

The 15 life insurance stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 4.9%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Prudential (NYSE: PRU)

Recognized by its iconic Rock of Gibraltar logo symbolizing strength and stability since 1896, Prudential Financial (NYSE: PRU) provides life insurance, annuities, retirement solutions, investment management, and other financial services to individual and institutional customers globally.

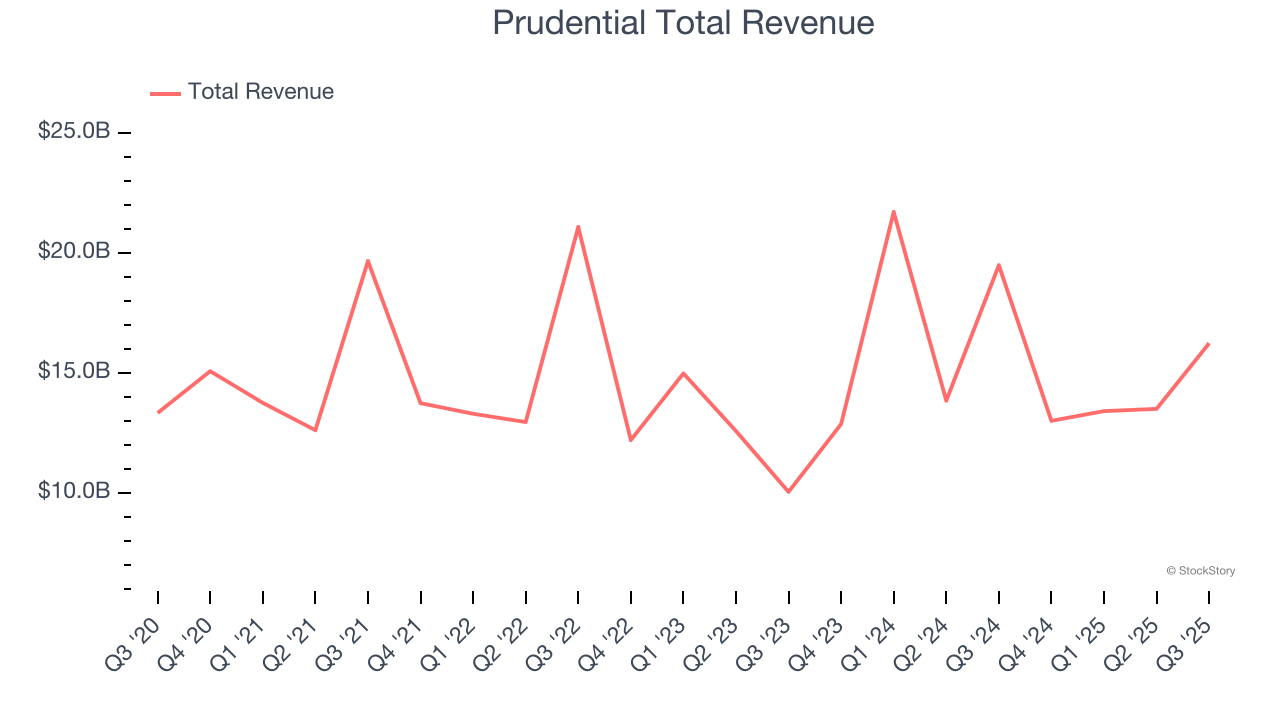

Prudential reported revenues of $16.24 billion, down 16.7% year on year. This print exceeded analysts’ expectations by 14.4%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ net premiums earned estimates and a solid beat of analysts’ revenue estimates.

Prudential delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 7.2% since reporting and currently trades at $108.50.

Is now the time to buy Prudential? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Aflac (NYSE: AFL)

Known for its iconic duck mascot that has quacked "Aflac!" in commercials since 2000, Aflac (NYSE: AFL) provides supplemental health and life insurance policies that pay cash benefits directly to policyholders for expenses not covered by their primary insurance.

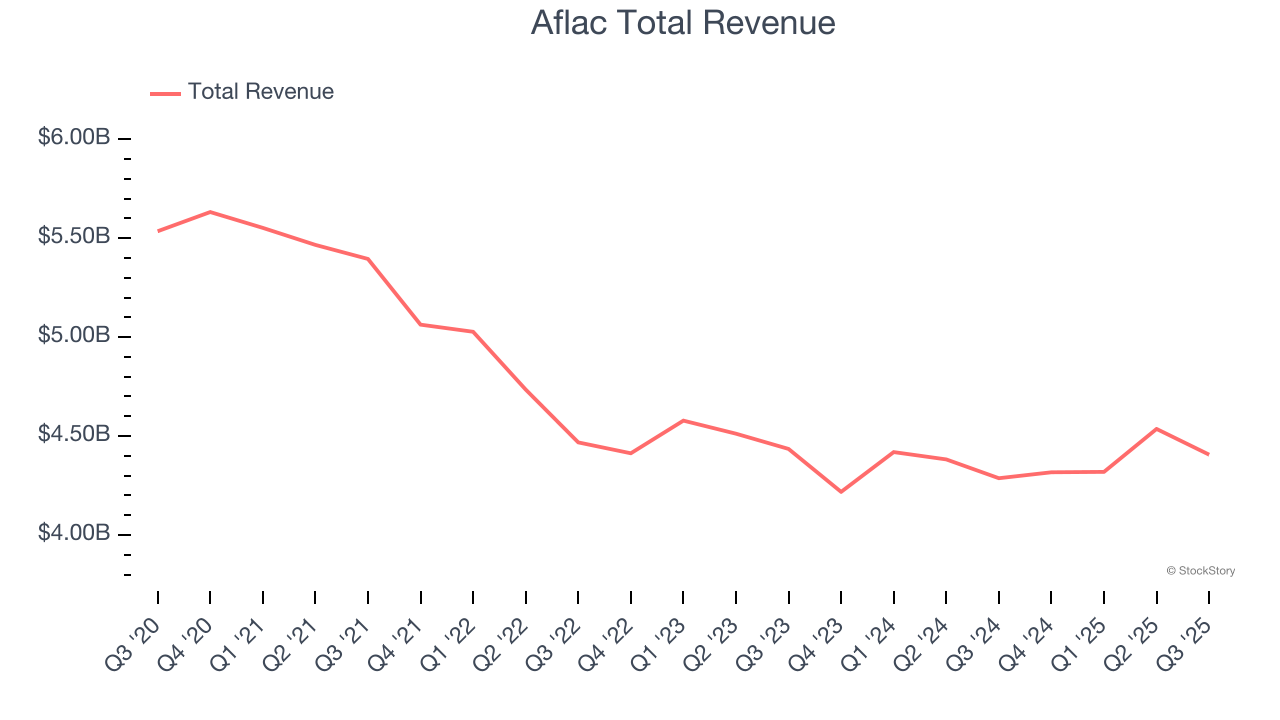

Aflac reported revenues of $4.41 billion, up 2.8% year on year, falling short of analysts’ expectations by 0.9%. However, the business still had a very strong quarter with a solid beat of analysts’ book value per share estimates and a beat of analysts’ EPS estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $108.81.

Is now the time to buy Aflac? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Brighthouse Financial (NASDAQ: BHF)

Spun off from MetLife in 2017 to focus specifically on retail financial products, Brighthouse Financial (NASDAQ: BHF) provides annuity contracts and life insurance products designed to help individuals protect wealth, generate income, and transfer assets.

Brighthouse Financial reported revenues of $2.17 billion, flat year on year, falling short of analysts’ expectations by 4%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and net premiums earned estimates.

The stock is flat since the results and currently trades at $65.33.

Read our full analysis of Brighthouse Financial’s results here.

Principal Financial Group (NASDAQ: PFG)

Founded in 1879 by a Civil War veteran seeking to provide financial security for families, Principal Financial Group (NASDAQGS:PFG) provides retirement solutions, asset management, and employee benefits to businesses, individuals, and institutional clients globally.

Principal Financial Group reported revenues of $3.90 billion, up 6.2% year on year. This print lagged analysts' expectations by 4.7%. Overall, it was a disappointing quarter as it also logged a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net premiums earned estimates.

The stock is up 6% since reporting and currently trades at $84.35.

Equitable Holdings (NYSE: EQH)

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Equitable Holdings reported revenues of $3.74 billion, flat year on year. This number topped analysts’ expectations by 3.2%. More broadly, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates.

The stock is down 9.1% since reporting and currently trades at $44.43.

Read our full, actionable report on Equitable Holdings here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.