Let’s dig into the relative performance of Viatris (NASDAQ: VTRS) and its peers as we unravel the now-completed Q4 generic pharmaceuticals earnings season.

The generic pharmaceutical industry operates on a volume-driven, low-cost business model, producing bioequivalent versions of branded drugs once their patents expire. These companies benefit from consistent demand for affordable medications, as they are critical to reducing healthcare costs. Generics typically face lower R&D expenses and shorter regulatory approval timelines compared to branded drug makers, enabling cost efficiencies. However, the industry is highly competitive, with intense pricing pressures, thin margins, and frequent legal challenges from branded pharmaceutical companies over patent disputes. Looking ahead, the industry is supported by tailwinds such as the role of AI in streamlining drug development (reverse engineering complex formulations) and manufacturing efficiency (optimize processes and remove inefficiencies). Governments and insurers' focus on reducing drug costs can also boost generics' adoption. However, headwinds include escalating pricing pressure from large buyers like pharmacy chains and healthcare distributors as well as evolving regulatory hurdles.

The 4 generic pharmaceuticals stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 2.2%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.2% since the latest earnings results.

Weakest Q4: Viatris (NASDAQ: VTRS)

Created through the 2020 merger of Mylan and Pfizer's Upjohn division, Viatris (NASDAQ: VTRS) is a healthcare company that develops, manufactures, and distributes branded and generic medicines across more than 165 countries worldwide.

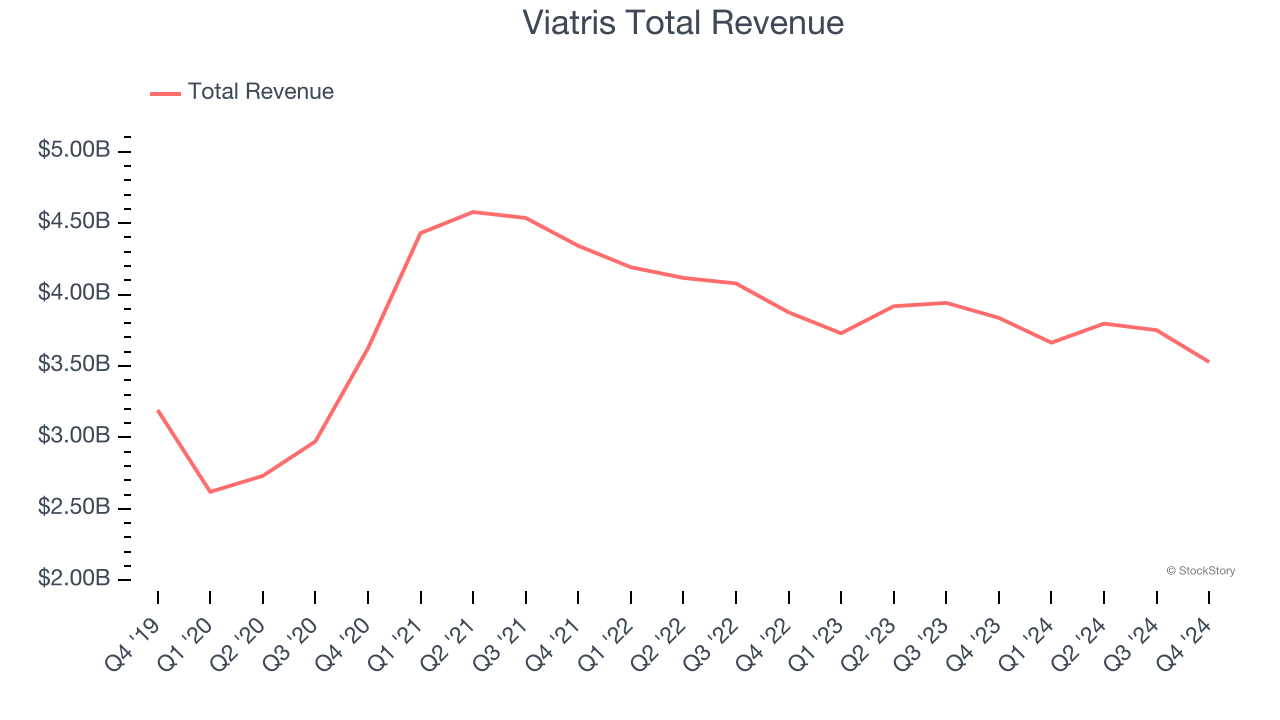

Viatris reported revenues of $3.53 billion, down 8.1% year on year. This print fell short of analysts’ expectations by 1.8%. Overall, it was a disappointing quarter for the company with full-year revenue guidance missing analysts’ expectations.

Viatris delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 27.7% since reporting and currently trades at $8.12.

Read our full report on Viatris here, it’s free.

Best Q4: ANI Pharmaceuticals (NASDAQ: ANIP)

With a diverse portfolio of 116 pharmaceutical products and a growing rare disease platform, ANI Pharmaceuticals (NASDAQ: ANIP) develops, manufactures, and markets branded and generic prescription pharmaceuticals, with a focus on rare disease treatments.

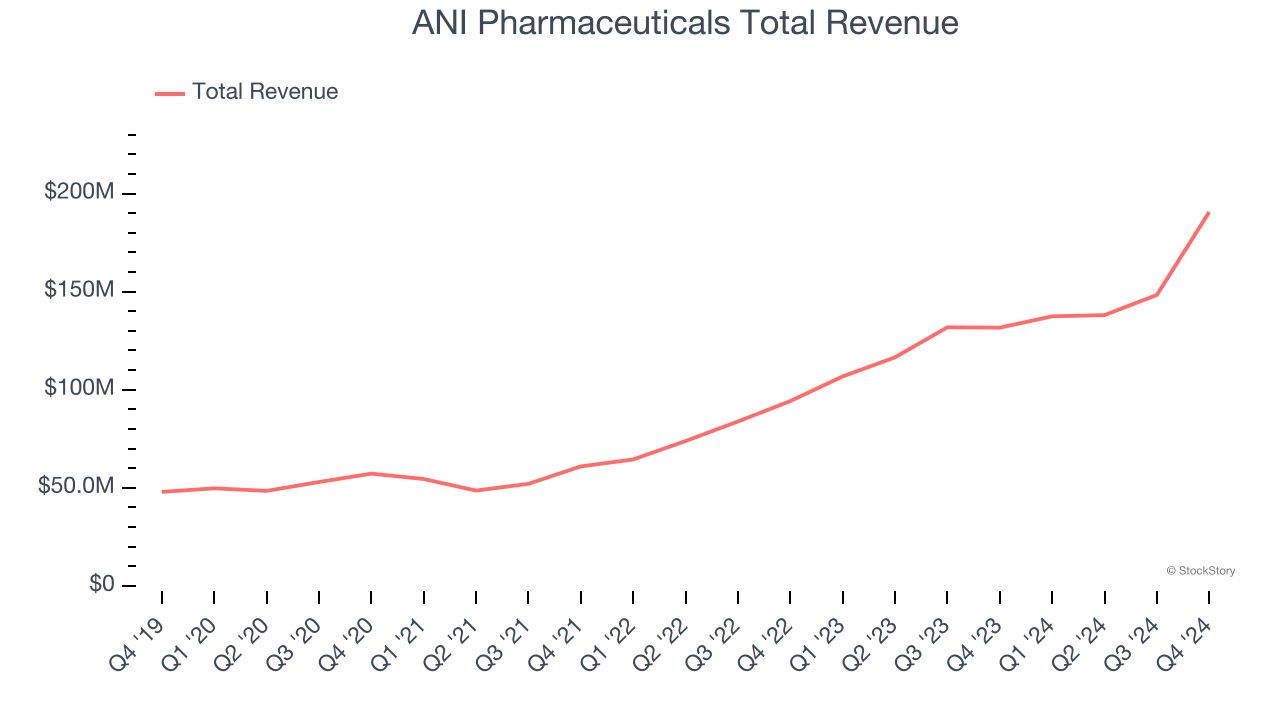

ANI Pharmaceuticals reported revenues of $190.6 million, up 44.8% year on year, outperforming analysts’ expectations by 8.5%. The business had a stunning quarter with an impressive beat of analysts’ full-year EPS guidance estimates and full-year revenue guidance exceeding analysts’ expectations.

ANI Pharmaceuticals delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 27.9% since reporting. It currently trades at $69.82.

Is now the time to buy ANI Pharmaceuticals? Access our full analysis of the earnings results here, it’s free.

Amphastar Pharmaceuticals (NASDAQ: AMPH)

Founded in 1996 and known for its expertise in complex drug formulations, Amphastar Pharmaceuticals (NASDAQ: AMPH) develops and manufactures technically challenging injectable and inhalation medications, including both generic and proprietary pharmaceutical products.

Amphastar Pharmaceuticals reported revenues of $186.5 million, up 2.9% year on year, falling short of analysts’ expectations by 1.4%. It was a softer quarter as it posted a miss of analysts’ EPS estimates.

As expected, the stock is down 25.8% since the results and currently trades at $23.33.

Read our full analysis of Amphastar Pharmaceuticals’s results here.

Amneal (NASDAQ: AMRX)

Founded in 2002 and growing into one of America's largest generic drug producers, Amneal Pharmaceuticals (NASDAQ: AMRX) develops, manufactures, and distributes generic medicines, specialty branded drugs, biosimilars, and injectable products for the U.S. healthcare market.

Amneal reported revenues of $730.5 million, up 18.4% year on year. This result surpassed analysts’ expectations by 3.4%. Aside from that, it was a mixed quarter as it also produced full-year revenue guidance exceeding analysts’ expectations.

The stock is down 15% since reporting and currently trades at $7.12.

Read our full, actionable report on Amneal here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.